DEF 14A: Definitive proxy statements

Published on April 12, 2006

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

COMMONWEALTH BIOTECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

COMMONWEALTH BIOTECHNOLOGIES, INC.

601 Biotech Drive, Richmond, Virginia 23235

PROXY STATEMENT AND NOTICE OF

2006 ANNUAL MEETING OF SHAREHOLDERS

| To the shareholders of |

April 12, 2006 | |

| Commonwealth Biotechnologies, Inc. |

Richmond, Virginia |

To our shareholders:

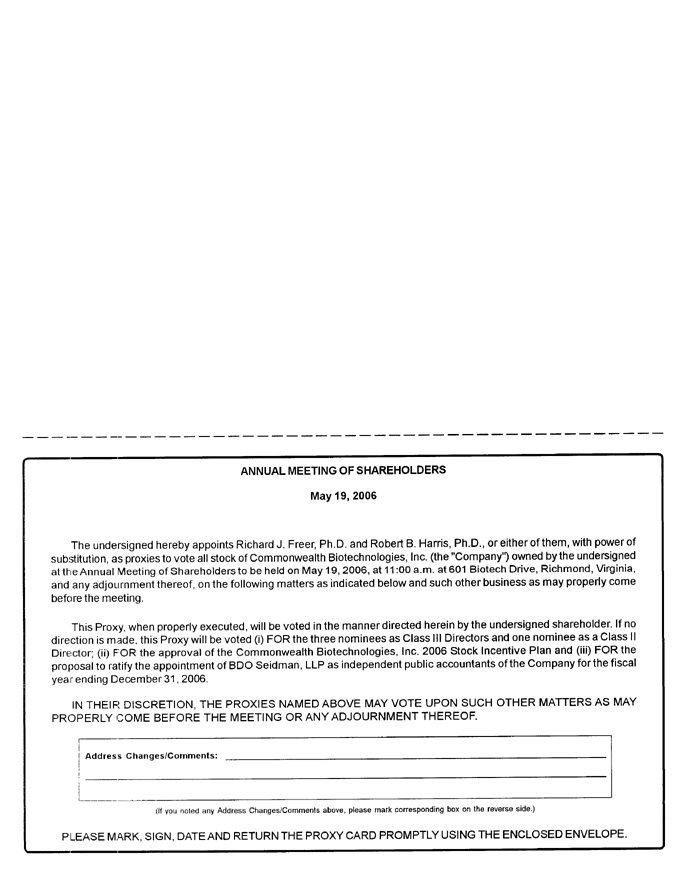

It is my pleasure to invite you to attend our 2006 Annual Meeting of Shareholders on Friday, May 19, 2006, at 11:00 a.m., Eastern Time. The meeting will be held at 601 Biotech Drive, Richmond, Virginia 23235.

The matters to be acted upon at the meeting are described in the Notice of 2006 Annual Meeting of Shareholders and Proxy Statement. At the meeting, we will also report on the Companys performance and operations during the fiscal year ended December 31, 2005 and respond to shareholder questions.

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING OF SHAREHOLDERS, WE URGE YOU TO VOTE AND SUBMIT YOUR PROXY BY TELEPHONE, THE INTERNET OR BY MAIL. IF YOU ARE A REGISTERED SHAREHOLDER AND ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON. IF YOU HOLD YOUR SHARES THROUGH A BANK OR BROKER AND WANT TO VOTE YOUR SHARES IN PERSON AT THE MEETING, PLEASE CONTACT YOUR BANK OR BROKER TO OBTAIN A LEGAL PROXY. THANK YOU FOR YOUR SUPPORT.

| By order of the Board of Directors, |

| /s/ Thomas R. Reynolds |

| Thomas R. Reynolds Secretary |

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

COMMONWEALTH BIOTECHNOLOGIES, INC.

| TIME: |

11:00 a.m., Eastern Time, on Friday, May 19, 2006 | |

| PLACE: |

Commonwealth Biotechnologies, Inc. | |

| 601 Biotech Drive | ||

| Richmond, Virginia 23235 | ||

ITEMS OF BUSINESS:

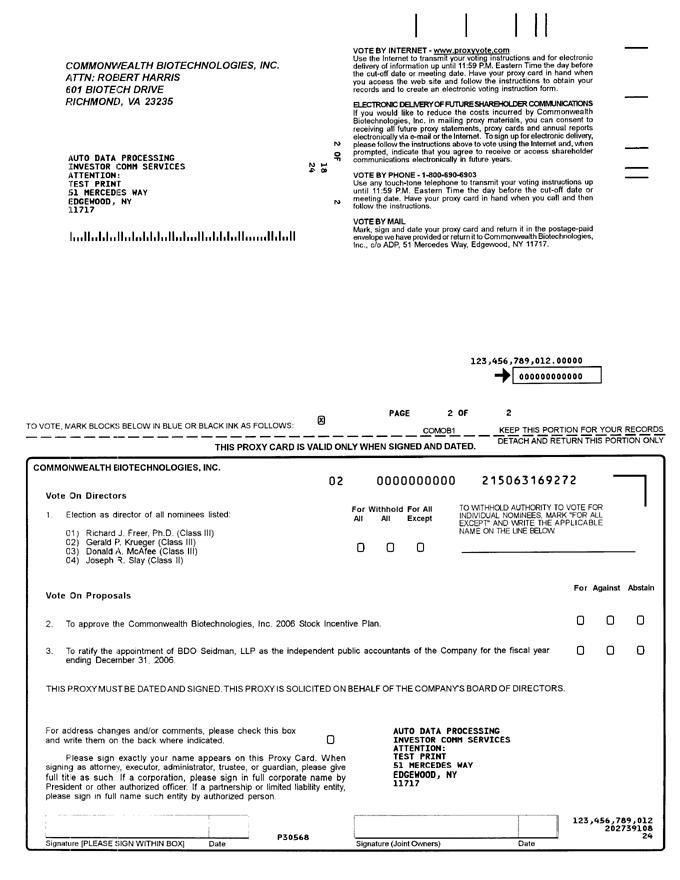

(1) To elect (a) three Class III members of the Board of Directors, each to serve a term expiring at the Annual Meeting of Shareholders in 2009 or until his successor is duly elected and qualified and (b) one Class II member of the Board of Directors to serve a term expiring at the Annual Meeting of Shareholders in 2008, or until his successor is duly elected and qualified;

(2) To approve the Commonwealth Biotechnologies, Inc. 2006 Stock Incentive Plan;

(3) To ratify the appointment of BDO Seidman, LLP as the Companys independent registered public accounting firm for the fiscal year ending December 31, 2006; and

(4) To transact any other business properly coming before the meeting.

| WHO MAY VOTE: | You may vote if you were a shareholder of record on March 17, 2006. | |

| ANNUAL REPORT: | A copy of our 2005 Annual Report is enclosed. | |

| DATE OF MAILING: | This Notice and the Proxy Statement are first being mailed to shareholders on or about April 12, 2006. | |

| By order of the Board of Directors, |

| /s/ Thomas R. Reynolds |

| Thomas R. Reynolds Secretary |

ABOUT THE 2006 ANNUAL MEETING OF SHAREHOLDERS

What am I voting on?

You will be voting on the following:

1. The election of (a) three Class III members of the Board of Directors, each to serve a term expiring of the Annual Meeting of Shareholders in 2009 or until each such directors successor is duly elected and qualified and (b) one Class II member of the Board of Directors to serve a term expiring at the Annual Meeting of Shareholders in 2008 or until his successor is duly elected and qualified;

2. The approval of the Commonwealth Biotechnologies, Inc. 2006 Stock Incentive Plan;

3. The ratification of the appointment of BDO Seidman, LLP as the Companys independent registered public accounting firm for the fiscal year ending December 31, 2006; and

4. The transaction any other business properly coming before the meeting.

Who is entitled to vote?

You may vote if you owned shares of the Companys common stock as of the close of business on March 17, 2006. Each share of common stock is entitled to one vote. As of March 17, 2006, we had 3,306,184 shares of common stock outstanding.

How do I vote before the meeting?

If you are a registered shareholder, meaning that you hold your shares in certificate form, you have three voting options:

1. Over the Internet, which we encourage if you have Internet access, at the address shown on your proxy card;

2. By phone, by calling 1-800-690-6903 using any touch-tone telephone to transmit your voting instructions; or

3. By mail, by completing, signing and returning the enclosed proxy card.

If you hold your shares through an account with a bank or broker, your ability to vote by the Internet depends on their voting procedures. Please follow the directions that your bank or broker provides.

2

May I vote at the meeting?

You may vote your shares at the meeting if you attend in person. If you hold your shares through an account with a bank or broker, you must obtain a legal proxy from the bank or broker in order to vote at the meeting. A legal proxy is an authorization from your bank or broker to vote the shares it holds in its name for your benefit on the records of the Companys transfer agent. Even if you plan to attend the meeting, we encourage you to vote your shares by proxy. You may vote by proxy through the Internet, by telephone or by mail.

Can I change my mind after I return my proxy?

You may change your vote at any time before the polls close at the conclusion of voting at the meeting. You may do this by (1) signing another proxy card with a later date and returning it to us before the meeting, (2) voting again over the Internet prior to 11:59 p.m., Eastern Time, on May 18, 2006, (3) voting again via the telephone prior to 11:59 p.m., Eastern Time, on May 18, 2006, or (4) voting at the meeting if you are a registered shareholder or have obtained a legal proxy from your bank or broker.

What if I return my proxy card but do not provide voting instructions?

Proxies that are signed and returned but do not contain instructions will be voted (1) FOR the election of the three nominees for Class III directors and the one nominee for Class II director, each as named herein, (2) FOR approval of the Companys 2006 Stock Incentive Plan, (3) FOR the ratification of BDO Seidman, LLP as the Companys independent registered public accounting firm for the fiscal year ended December 31, 2006, and (4) in accordance with the best judgment of the named proxies on any other matters properly brought before the meeting.

What does it mean if I receive more than one proxy card or instruction form?

It indicates that your shares are registered differently and are in more than one account. To ensure that all shares are voted, please either vote each account by telephone or on the Internet, or sign and return all proxy cards. We encourage you to register all your accounts in the same name and address. Those holding shares through a bank or broker should contact your bank or broker and request consolidation.

Will my shares be voted if I do not provide my proxy or instruction form?

If you are a registered shareholder and do not provide a proxy, you must attend the meeting in order to vote your shares. If you hold shares through an account with a bank or broker, your shares may be voted even if you do not provide voting instructions on your instruction form. Brokerage firms have the authority to vote shares for which their customers do not provide voting instructions on certain routine matters. The election of directors and the ratification of BDO Seidman, LLP as the Companys independent registered public accounting firm for the fiscal year ended December 31, 2006 are considered routine matters for which brokerage firms may vote without specific instructions. The other proposal to be voted on at the

3

meeting is not considered routine under applicable rules. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. Shares that a broker is not authorized to vote are counted as broker non-votes.

How can I attend the meeting?

The meeting is open to all holders of the Companys common stock as of March 17, 2006.

May shareholders ask questions at the meeting?

Yes. Representatives of the Company will answer questions of general interest at the end of the meeting.

How many votes must be present to hold the meeting?

Your shares are counted as present at the meeting if you attend the meeting and vote in person or if you properly return a proxy by Internet, telephone or mail. In order for us to conduct our meeting, a majority of our outstanding shares of common stock as of March 17, 2006 must be present in person or by proxy. This is referred to as a quorum. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the meeting.

How many votes are needed to approve the Companys proposals?

The nominees receiving the highest number of For votes will be elected as directors. This number is called a plurality. Shares not voted will have no impact on the election of directors. The proxy given will be voted For each of the nominees for director unless a properly executed proxy card is marked Withhold as to a particular nominee or nominees for director.

With respect to the approval of the Companys 2006 Stock Incentive Plan, broker non-votes will not be voted but an abstention will have the effect of a vote Against this proposal. Approval of the Companys 2006 Stock Incentive Plan requires that a majority of the votes cast at the meeting be voted For the proposal and that the holders of a majority of the shares entitled to vote cast a vote, whether For, Against or Abstain.

The ratification of the appointment of BDO Seidman, LLP as the Companys independent registered public accounting firm for the fiscal year ended December 31, 2006 requires that a majority of the votes cast at the meeting be voted For the proposal. A properly executed proxy card marked Abstain with respect to this proposal will not be voted.

4

BOARD OF DIRECTORS INFORMATION

What if a nominee is unwilling or unable to serve?

Each of the nominees listed in the Proxy Statement has agreed to serve as a director, if elected. If for some unforeseen reason a nominee becomes unwilling or unable to serve, proxies will be voted for a substitute nominee selected by the Board of Directors.

How are directors compensated?

All non-employee directors will receive an annual retainer fee (Retainer Fee) and a fee for each of the five regularly scheduled Board meetings attended per year (collectively, the Directors Fee). Employee directors will not be eligible to receive the Retainer Fee or the Directors Fee. The Retainer Fee and Directors Fee for the upcoming year will be set at the last Board meeting during a calendar year. In addition to the Directors Fee, all non-employee directors will receive reimbursement for travel and other related expenses incurred in attending Board meetings and committee meetings. For 2006, the Board set the Retainer Fee to be $7,500 and the Directors Fee to be $1,000 for each Board meeting attended.

How does the Board determine which directors are independent?

The Board of Directors reviews the independence of each director yearly. During this review, the Board of Directors considers transactions and relationships between each director (and his or her immediate family and affiliates) and the Company and its management to determine whether any such relationships or transactions are inconsistent with a determination that the director is independent in light of applicable law, listing standards and the Companys director independence standards. Based on this review, the Board affirmatively determined that all of the directors nominated for election at the meeting are independent of management, with the exception of Dr. Freer who is considered an inside director because of his employment as Chairman and COO of the Company and is therefore not considered an independent director. The Company believes that is meets the independence standards adopted by the Securities and Exchange Commission and the Nasdaq Capital Market.

What role does the Nominating Committee play in selecting nominees to the Board of Directors?

Two of the primary purposes of the Boards Nominating Committee are to (i) develop and implement policies and procedures that are intended to ensure that the Board of Directors will be appropriately constituted and organized to meet its fiduciary obligations to the Company and its shareholders and (ii) identify individuals qualified to become members of the Board of Directors and to recommend to the Board of Directors the director nominees for the annual meeting of shareholders. The Nominating Committee is also responsible for considering candidates for membership on the Board of Directors submitted by eligible shareholders. The Nominating Committees charter, as well as other committee charters, is available on the Companys website at www.cbi-biotech.com and in print upon request.

5

Are the members of the Nominating Committee independent?

Yes. All members of the Nominating Committee have been determined to be independent by the Board of Directors.

How does the Nominating Committee identify and evaluate nominees for director?

The Nominating Committee considers candidates for nomination to the Board of Directors from a number of sources. Current members of the Board of Directors are considered for re-election unless they have notified the Company that they do not wish to stand for re-election. The Nominating Committee also considers candidates recommended by current members of the Board of Directors, members of management or eligible shareholders. From time to time the Board may engage a firm to assist in identifying potential candidates, although the Company did not engage such a firm to identify any of the nominees for director proposed for election at the meeting.

The Nominating Committee evaluates all candidates for director, regardless of the person or firm recommending such candidate, on the basis of the length and quality of their business experience, the applicability of such candidates experience to the Company and its business, the skills and perspectives such candidate would bring to the Board of Directors and the personality or fit of such candidate with existing members of the Board of Directors and management.

What are the Nominating Committees policies and procedures for considering director considering director candidates recommended by shareholders?

The Nominating Committee will consider all candidates recommended by eligible shareholders. An eligible shareholder is a shareholder (or group of shareholders) who owns at least 5% of the Companys outstanding shares and who has held such shares for at least one year as of the date of the recommendation. A shareholder wishing to recommend a candidate must submit the following documents to the Secretary of the Company at Commonwealth Biotechnologies, Inc., 601 Biotech Drive, Richmond, Virginia 23235:

| | a recommendation that identifies the name and address of the shareholder and the person to be nominated; |

| | documentation establishing that the shareholder making the recommendation is an eligible shareholder; |

| | the written consent of the candidate to serve as a director of the Company, if elected; |

| | a description of all arrangements between the shareholders and such nominee pursuant to which the nomination is to be made; and |

| | such other information regarding the nominee as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC. |

6

Upon timely receipt of the required documents, the Companys Secretary will determine if the shareholder submitting the recommendation is an eligible shareholder based on such documents. If the shareholder is not an eligible shareholder, the Nominating Committee may, but is not obligated to, evaluate the candidate and consider such candidate for nomination to the Board of Directors.

If the candidate is to be evaluated by the Nominating Committee, the Secretary will request a detailed resume, an autobiographical statement explaining the candidates interest in serving as a director of the Company, a completed statement regarding conflicts of interest, and a waiver of liability for background check from the candidate.

What are the minimum qualifications required to serve on the Companys Board of Directors?

All members of the Board of Directors must possess the following minimum qualifications as determined by the Nominating Committee:

| | A director must demonstrate integrity, accountability, informed judgment, financial literacy, creativity and vision; |

| | A director must be prepared to represent the best interests of all Company shareholders, and not just one particular constituency; |

| | A director must have a record of professional accomplishment in his or her chosen field; and |

| | A director must be prepared and able to participate fully in Board activities, including membership on committees. |

What other considerations does the Nominating Committee consider?

The Nominating Committee believes it is important to have directors from various backgrounds and professions in order to ensure that the Board of Directors has a wealth of experiences to inform its decisions. Consistent with this philosophy, in addition to the minimum standards set forth above, business and managerial experience and an understanding of financial statements and financial matters are very important.

7

How may shareholders communicate with the members of the Board of Directors?

Shareholders and others who are interested in communicating directly with members of the Board of Directors, including communication of concerns relating to accounting, internal accounting controls or audit matters, or fraud or unethical behavior, may do so by writing to the directors at the following address:

Name of Director or Directors

Commonwealth Biotechnologies, Inc.

601 Biotech Drive

Richmond, Virginia 23235

Does the Company have a Code of Conduct?

The Company has adopted a Code of Conduct, which is applicable to all directors, officers and associates of the Company, including the principal executive officer and the principal financial and accounting officer. The complete text of the Code of Conduct is available on the Companys web site at www.cbi-biotech.com and is also available in print upon request. The Company intends to post any amendments to or waivers from its Code of Conduct (to the extent applicable to the Companys principal executive officer and principal financial and accounting officer) at this location on its web site.

How often did the Board meet in fiscal 2005?

The Board of Directors met five times during fiscal 2005. The number of times that each Committee of the Board of Directors met is shown on pages 9-12. Each incumbent director attended at least 75% of the meetings of the Board of Directors and of the standing committees of which he or she was a member during fiscal 2005. Although the Company has not adopted a formal policy regarding Board of Directors attendance at annual meetings of shareholders, three directors attended the 2005 Annual Meeting of Shareholders.

8

What are the committees of the Board?

During fiscal 2005, the Board of Directors had standing Audit, Nominating, Compensation and Strategic Planning Committees. The members of each of the Committees as of December 31, 2005, their principal functions and the number of meetings held during the fiscal year ended December 31, 2005 are shown below:

Compensation Committee

The members of the Compensation Committee are:

Donald A. McAfee, Ph.D., Chairman

Samuel P. Sears, Jr.

James D. Causey

The Compensation Committee held five meetings during the fiscal year ended December 31, 2005. The Compensation Committees principal responsibilities include:

| | Making recommendations to the Board of Directors concerning executive management organization matters generally; |

| | In the area of compensation and benefits, making recommendations to the Board of Directors concerning employees who are also directors of the Company, consult with the CEO on matters relating to other executive officers, and make recommendations to the Board of Directors concerning policies and procedures relating to executive officers; provided, however, that, the Committee shall have full decision-making powers with respect to compensation for executive officers to the extent such compensation is intended to be performance-based compensation within the meaning of Section 162(m) of the Internal Revenue Code; |

| | Making recommendations to the Board of Directors regarding all contracts of the Company with any officer for remuneration and benefits after termination of regular employment of such officer; |

| | Making recommendations to the Board of Directors concerning policy matters relating to employee benefits and employee benefit plans, including incentive compensation plans and equity based plans; and |

| | Administering the Companys formal incentive compensation programs, including equity based plans. |

Audit Committee

The members of the Audit Committee are:

Samuel P. Sears, Jr., Chairman

James D. Causey

Joseph R. Slay

Gerald P. Krueger

The Audit Committee held five meetings during the fiscal year ended December 31, 2005. The primary responsibility of the Audit Committee is to assist the Board of Directors in monitoring the integrity of the Companys financial statements and the independence of its external auditors. The Company believes that each of the members of the Audit Committee is independent, and Mr. Sears qualifies as an audit committee financial expert in accordance

9

with applicable Nasdaq Capital Market listing standards. In carrying out its responsibility, the Audit Committee undertakes to:

| | Review and recommend to the directors the independent auditors to be selected to audit the financial statement of the Company; |

| | Meet with the independent auditors and management of the Company to review the scope of the proposed audit for the current year and the audit procedures to be utilized, and at the conclusion thereof review such audit, including any comments or recommendations of the independent auditors; |

| | Review with the independent auditors and financial and accounting personnel, the adequacy and effectiveness of the accounting and financial controls of the Company. The Committee elicits recommendations for the improvement of such internal control procedures or particular areas where new or more detailed controls or procedures are desirable. The Committee emphasizes the adequacy of such internal controls to expose any payments, transactions, or procedures that might be doomed illegal or otherwise improper; |

| | Review the internal accounting function of the Company, the proposed audit plans for the coming year and the coordination of such plans with the Companys independent auditors; |

| | Review the financial statements contained in the annual report to shareholders with management and the independent auditors to determine that the independent auditors are satisfied with the disclosure and contents of the financial statements to be presented to the shareholders; |

| | Provide sufficient opportunity for the independent auditors to meet with the members of the Committee without members of management present. Among the items discussed in these meetings are the independent auditors evaluation of the Companys financial, accounting, and auditing personnel, and the cooperation that the independent auditors received during the course of the audit; |

| | Review accounting and financial human resources and succession planning within the Company; |

| | Submit the minutes of all meetings of the Audit Committee to, or discuss the matters discussed at each committee meeting with, the Board of Directors; and |

| | Investigate any matter brought to its attention within the scope of its duties, with the power to retain outside counsel for this purpose, if, in its judgment, that is appropriate. |

The Audit Committee has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls and auditing matters, including procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

10

Nominating Committee

The members of the Nominating Committee are:

Thomas R. Reynolds, Chairman

Gerald P. Krueger

Donald A. McAfee, Ph.D.

Joseph R. Slay

The Nominating Committee had five meetings during the fiscal year ended December 31, 2005. All members of the Nominating Committee are independent, as such term is defined by the Nasdaq Capital Market listing standards, with the exception of Mr. Reynolds. The Nominating Committee undertakes to:

| | Identify individuals qualified to become members of the Board of Directors and to make recommendations to the Board of Directors with respect to candidates for nomination for election at the next annual meeting of shareholders or at such other times when candidates surface and, in connection therewith, consider suggestions submitted by shareholders of the Company; |

| | Determine and make recommendations to the Board of Directors with respect to the criteria to be used for selecting new members of the Board of Directors; |

| | Oversee the process of evaluation of the performance of the Companys Board of Directors and committees; |

| | Make recommendations to the Board of Directors concerning the membership of committees of the Board and the chairpersons of the respective committees; |

| | Make recommendations to the Board of Directors with respect to the remuneration paid and benefits provided to members of the Board in connection with their service on the Board or on its committees; and |

| | Evaluate Board and committee tenure policies as well as policies covering the retirement or resignation of incumbent directors. |

11

Strategic Planning Committee

The members of the Strategic Planning Committee are:

Robert B. Harris, Ph.D., Chairman

Donald A. McAfee, Ph.D.

Thomas R. Reynolds

The Strategic Planning Committee met five times during the fiscal year ended December 31, 2005. The Strategic Planning Committee is responsible for developing, modifying, and monitoring the implementation of the Companys long-term strategic plan.

The Board of Directors has determined to provide a process by which shareholders may communicate with the Board as a whole, a Board committee or individual director. Shareholders wishing to communicate with the Board as a whole, a Board committee or an individual member may do so by sending a written communication addressed to the Board of Directors of the Company or to the committee or to an individual director, c/o Secretary, Commonwealth Biotechnologies, Inc., 601 Biotech Drive, Richmond, Virginia 23235. All communications will be compiled by the Secretary of the Company and submitted to the Board of Directors or the addressee not later than the next regular Board meeting.

PROPOSAL ONE

ELECTION OF DIRECTORS AND DIRECTOR BIOGRAPHIES

(ITEM 1 ON THE PROXY CARD)

Nominees for election as Class III members of the Board of Directors to serve three year terms expiring in 2009:

RICHARD J. FREER, PH.D.

Chairman of the Board, Chief Operating Officer, Director and Founder

Age - 63

Director since 1992

Since founding the Company in 1992, Dr. Freer has served as the Chairman of the Board and a director of the Company. He assumed the role of Chief Operating Officer in 2002. From 1975 until 1997, Dr. Freer was employed in the Department of Pharmacology and Toxicology at Virginia Commonwealth University (VCU), first as an Associate Professor and then a full Professor. In addition, from 1988 through 1995, Dr. Freer was first Director and then Chair of the Biomedical Engineering Program. From 1996 through 1997, Dr. Freer served as Professor in VCUs Department of Biochemistry and Molecular Biophysics. Dr. Freer received a bachelors degree in Biology from Marist College and a doctorate degree in Pharmacology from Columbia University.

12

GERALD P. KRUEGER

Director

Age 62

Director since 2004

Since 1999, Dr. Krueger has served as the Principal Research Scientist and Ergonomist at the Wexford Group International in Vienna, Virginia where he is director of Wexfords Human Factors Engineering, Ergonomics, and Medical Research Program. He provides a wide variety of scientific advisory services to organizations in the Department of Defense and the Department of Transportation. For the Undersecretary of Defense for Laboratories and Basic Science, Dr. Krueger led a project to elicit exemplary practices in management of large industrial and government research labs for applicability to Department of Defense laboratories. He directed Wexfords business management consulting effort in advising staff officers of the U.S. Army Medical Research and Materiel Command, Fort Detrick, Maryland on alternative schemes for prioritization of medical research programs. Recently, Dr. Kruger led a Human Systems Integration (HIS) team for the Defense Information Systems Agency Teleport Satellite Communications upgrade program. He also served as a principal consultant on three National Academy of Sciences Transportation Research Board (TRB) Synthesis studies on commercial driver safety issues. His current TRB Synthesis work is evaluating Health and Wellness Programs for commercial truck and bus operator. Dr. Krueger has his Ph.D. in experimental and engineering psychology from the Johns Hopkins University. He had a highly successful 25-year Army career in occupational and preventive medicine research, is a graduate of the Army War College, and is an adjunct associate professor of military psychology at the Uniformed Services University of the Health Sciences in Bethesda, Maryland.

DONALD A. MCAFEE, PH.D.

Director

Age 65

Director since 2001

Since 2004, Dr. McAfee has served as Vice President of New Product Development for Cardiome Pharma Corp., a Vancouver-based drug discovery and development company. In addition, since 2004, Dr. McAfee has also served as a consultant for McAfee Scientific, a drug development consulting firm. In 1994, he co-founded Aderis Pharmaceuticals, Inc. (formerly Discovery Therapeutics, Inc.), a clinical stage pharmaceutical company, where he served as Chief Technical Officer and Director. Before organizing Discovery Therapeutics, Dr. McAfee served for eight years as Vice President, Research, at Whitby Research, Inc., Richmond, Virginia (formerly Nelson Research and Development, Irvine, California), managing drug discovery programs. Prior to entering industry, Dr. McAfee served as Chairman of the Division of Neurosciences at the Beckman Research Institute (City of Hope), Duarte, California, and held faculty appointments at the Yale University School of Medicine and the University of Miami School of Medicine. Dr. McAfee earned his Ph.D. in Physiology at the University of Oregon School of Medicine, and has authored more than 100 articles and book chapters in neuroscience and pharmacology. He is currently an adjunct professor at the Medical College of Virginia and a Director of the Virginia Biotech Association, an industry advocacy group.

13

Nominee for election as a Class II member of the Board of Directors to serve a two year term expiring in 2008:

JOSEPH R. SLAY

Nominee for Director

Age 56

Director since 2005

Since November 1992, Mr. Slay has served as President of Slay Public Relations, a Richmond, Virginia-based public relations firm. Since November 1994, Mr. Slay has served as a Partner of the Martin Agency, a Richmond, Virginia-based advertising firm. Mr. Slay has lectured on business communication issues in New York, Los Angeles, Chicago and Washington, D.C. He is an accredited member of the Public Relations Society of America. In 1995, he was the recipient of the groups Thomas Jefferson Citation for Public Relations. In 2000, Mr. Slay was inducted into the VCU Communications Hall of Fame. Mr. Slay received a bachelors degree in History from Washington & Lee University. Since graduation, Mr. Slay has taken several graduate courses in Divinity from Edinburgh University and Business from VCU.

Class I members of the Board of Directors whose terms continue to 2007:

THOMAS R. REYNOLDS

Executive Vice President for Science and Technology, Secretary, Director and Founder

Age 44

Director since 1992

Thomas R. Reynolds currently serves the Company as Executive Vice President for Science and Technology and a director. He assumed the role of the Companys Secretary in 1998. Since the founding of the Company in 1992, Mr. Reynolds has served as Vice President and Senior Vice President. From 1987 until 1997, Mr. Reynolds served as Manager of the Nucleic Acids Core Laboratory at the Massey Cancer Center in the Department of Microbiology and Immunology at Virginia Commonwealth University. Mr. Reynolds received a Bachelors degree in Biology from the Pennsylvania State University.

JAMES D. CAUSEY

Director

Age 53

Director since 2004

Since 2004, Mr. Causey has served as Vice President of Trader Publishing Company, a nationwide network of classified publications. From 2003 until 2004, Mr. Causey served as a consultant in the publishing industry. From 1999 to 2003, Mr. Causey served as the chief executive officer of Sabot Publishing, a Richmond, Virginia based publisher of leading special interest publications. Mr. Causey received a masters degree in business from the University of Maryland.

14

Class II members of the Board of Directors whose terms continue to 2008:

ROBERT B. HARRIS, PH.D.

President, Chief Executive Officer, Director and Founder

Age 54

Director since 1992

Since founding the Company in 1992, Dr. Harris has served as the President and a director of the Company. He also assumed the position of Chief Executive Officer in 2002. Until 1997, Dr. Harris was employed in the Department of Biochemistry and Molecular Biophysics at VCU, first as an Assistant, then Associate and finally a full Professor. Dr. Harris received a joint bachelors degree in Chemistry and Biology from the University of Rochester, and a masters degree and a doctorate degree in Biochemistry/Biophysical Chemistry from New York University.

SAMUEL P. SEARS, JR.

Director

Age 63

Director since 2001

Since March 1999, Mr. Sears has been in private practice as an attorney and has been providing business consulting services. From December 1998 through February 1999, Mr. Sears served as Vice Chairman of American Prescription Providers, Inc., a specialty pharmacy network offering prescriptions and nutriceuticals to patients with chronic diseases. From 1995 through May 1998, Mr. Sears was Chief Executive Officer and Chairman to Star Scientific, Inc., a tobacco company focusing on demonstrating the commercial viability of potentially less harmful tobacco products. Mr. Sears is a graduate of Harvard College and Boston College Law School.

WE RECOMMEND THAT YOU VOTE FOR THE ELECTION OF EACH OF THESE NOMINEES TO THE BOARD OF DIRECTORS.

15

PROPOSAL TWO

APPROVAL OF THE COMMONWEALTH BIOTECHNOLOGIES, INC.

2006 STOCK INCENTIVE PLAN

(ITEM 2 ON THE PROXY CARD)

What am I voting on?

The Board of Directors adopted The Commonwealth Biotechnologies, Inc. 2006 Stock Incentive Plan (the 2006 Plan) on November 18, 2005, subject to approval by the shareholders of the Company.

The Board of Directors believes that the 2006 Plan will advance the long-term success of the Company by encouraging stock ownership among key employees and members of the Board who are not employees (Nonemployee Directors).

How is the 2006 Plan administered?

The 2006 Plan is administered by the Compensation Committee of the Board of Directors (the Committee). Awards made to Nonemployee Directors will be approved by the Board. The 2006 Plan provides the Committee flexibility to design compensatory awards that are responsive to the Companys needs. Subject to the terms of the 2006 Plan, the Committee has the discretion to determine the terms of each award. The Committee may delegate to one or more officers of the Company the authority to grant awards to participants who are not directors or executive officers of the Company. The Committee must fix the total number of shares that may be subject to grants made under this delegation.

What kind of awards may be granted?

Awards under the 2006 Plan may be in the form of stock options or shares of restricted or incentive stock.

Who is eligible to receive awards?

Employees of the Company and Nonemployee Directors may be selected by the Committee to receive awards under the 2006 Plan. The benefits or amounts that may be received by or allocated to participants under the 2006 Plan will be determined at the discretion of the Committee and are not presently determinable.

16

How many shares are available for issuance under the 2006 Plan?

The maximum number of shares as to which stock awards may be granted under the 2006 Plan is 300,000 shares. The fair market value of a share of the Companys common stock on April 4, 2006 was $3.59, as reported on the Nasdaq Capital Market.

Are there limits on grants to individual participants or other grant limits?

Yes. No participant may receive awards during any one calendar year representing more than 50,000 shares of common stock. This limit is subject to adjustment by the Committee as provided in the 2006 Plan for stock splits, stock dividends, recapitalizations and other similar transactions or events.

Upon what terms may options be awarded?

Options may be either incentive stock options or nonqualified stock options, provided that only employees may be granted incentive stock options. The option may specify that the option price is payable (i) in cash, (ii) by the transfer to the Company of unrestricted stock, (iii) with any other legal consideration the Committee may deem appropriate or (iv) any combination of the foregoing. No stock option may be exercised more than 10 years from the date of grant. Each grant may specify a period of continuous employment or service with the Company or any subsidiary that is necessary before the stock option or any portion thereof will become exercisable and may provide for the earlier exercise of the option in the event of a change in control of the Company or similar event.

Upon what terms may restricted stock be awarded?

An award of restricted stock involves the immediate transfer by the Company to a participant of ownership of a specific number of shares of common stock in return for the performance of services. The participant is entitled immediately to voting, dividend and other ownership rights in such shares, subject to the discretion of the Committee. The transfer may be made without additional consideration from the participant. The Committee may specify performance objectives that must be achieved for the restrictions to lapse. Restricted stock must be subject to a substantial risk of forfeiture within the meaning of Code Section 83 for a period to be determined by the Committee on the grant date and any grant or sale may provide for the earlier termination of such risk of forfeiture in the event of a change of control of the Company or similar event.

Upon what terms may incentive stock be awarded?

An award of incentive stock granted under the 2006 Plan represents the right to receive a specific number of shares at the end of a specified deferral period. Any grant of deferred shares may be further conditioned upon the attainment of performance objectives. The grant may provide for the early termination of the deferral period in the event of a change in control of the Company or similar event. During the deferral period, the participant is not entitled to vote or receive dividends on the shares subject to the aware, but the Compensation Committee may

17

provide for the payment of dividend equivalents on a current or deferred basis. The grant of deferred shares may be made without any consideration from the participant other than the performance of future services.

Are awards made under the 2006 Plan transferable?

Except as provided below, no award under the 2006 Plan may be transferred by a participant other than by will or the laws of descent and distribution, and stock options and stock appreciation rights may be exercised during the participants lifetime only by the participant or, in the event of the participants legal incapacity, the guardian or legal representative acting on behalf of the participant. The Committee may expressly provide in an award agreement (other than an incentive stock option) that the participant may transfer the award to a spouse or lineal descendant, a trust for the exclusive benefit of such family members, a partnership or other entity in which all the beneficial owners are such family members, or any other entity affiliated with the participant that the Committee may approve.

When does the 2006 Plan terminate?

The 2006 Plan will terminate on the tenth anniversary of the date it is approved by shareholders, and no award will be granted under the plan after that date.

How can the 2006 Plan be amended?

The 2006 Plan may be amended by the Board of Directors, but without further approval by the shareholders of the Company no such amendment may increase the limitations set forth in the 2006 Plan on the number of shares that may be issued under the 2006 Plan or any of the limitations on awards to individual participants. The Board may condition any amendment on the approval of the shareholders if such approval is necessary or deemed advisable with respect to the applicable listing or other requirements of a national securities exchange or other applicable laws, policies or regulations.

What are the tax consequences of the 2006 Plan?

The following is a brief summary of certain of the federal income tax consequences of certain transactions under the 2006 Plan. This summary is not intended to be exhaustive and does not describe state or local tax consequences.

In general, an optionee will not recognize income at the time a nonqualified stock option is granted. At the time of exercise, the optionee will recognize ordinary income in an amount equal to the difference between the option price paid for the shares and the fair market value of the shares on the date of exercise. At the time of sale of shares acquired pursuant to the exercise of a nonqualified stock option, any appreciation (or depreciation) in the value of the shares after the date of exercise generally will be treated as capital gain (or loss).

18

An optionee generally will not recognize income upon the grant or exercise of an incentive stock option. If shares issued to an optionee upon the exercise of an incentive stock option are not disposed of in a disqualifying disposition within two years after the date of grant or within one year after the transfer of the shares to the optionee, then upon the sale of the shares any amount realized in excess of the option price generally will be taxed to the optionee as long-term capital gain and any loss sustained will be a long-term capital loss. If shares acquired upon the exercise of an incentive stock option are disposed of prior to the expiration of either holding period described above, the optionee generally will recognize ordinary income in the year of disposition in an amount equal to any excess of the fair market value of the shares at the time of exercise (or, if less, the amount realized on the disposition of the shares) over the option price paid for the shares. Any further gain (or loss) realized by the optionee generally will be taxed as short-term or long-term capital gain (or loss) depending on the holding period.

Subject to certain exceptions for death or disability, if an optionee exercises an incentive stock option more than three months after termination of employment, the exercise of the option will be taxed as the exercise of a nonqualified stock option. In addition, if an optionee is subject to federal alternative minimum tax, the exercise of an incentive stock option will be treated essentially the same as a nonqualified stock option for purposes of the alternative minimum tax.

A recipient of restricted stock generally will be subject to tax at ordinary income rates on the fair market value of the restricted stock (reduced by any amount paid by the recipient) at such time as the shares are no longer subject to a risk of forfeiture or restrictions on transfer for purposes of Code Section 83. However, a recipient who so elects under Code Section 83(b) within 30 days of the date of transfer of the restricted stock will recognize ordinary income on the date of transfer of the shares equal to the excess of the fair market value of the restricted stock (determined without regard to the risk of forfeiture or restrictions on transfer) over any purchase price paid for the shares. If a Section 83(b) election has not been made, any dividends received with respect to restricted stock that are subject at that time to a risk of forfeiture or restrictions on transfer generally will be treated as compensation that is taxable as ordinary income to the recipient.

To the extent that a participant recognizes ordinary income in the circumstances described above, the Company or subsidiary for which the participant performs services will be entitled to a corresponding deduction, provided that, among other things, the income meets the test of reasonableness, is an ordinary and necessary business expense, is not an excess parachute payment within the meaning of Code Section 280G and is not disallowed by the $1,000,000 limitation on certain executive compensation under Section 162(m) of the Internal Revenue Code.

Where can I get a copy of the 2006 Plan?

This summary is not a complete description of all provisions of the 2006 Plan. A copy of the 2006 Plan is attached hereto as Exhibit A.

WE RECOMMEND THAT YOU VOTE FOR THE ADOPTION OF THIS PROPOSAL.

19

PROPOSAL THREE

RATIFICATION OF THE APPOINTMENT OF BDO SEIDMAN, LLP

(ITEM 3 ON THE PROXY CARD)

What am I voting on?

A proposal to ratify the appointment of BDO Seidman, LLP as the Companys fiscal 2006 independent registered public accounting firm. The Audit Committee of the Board of Directors has appointed BDO Seidman, LLP to serve as the Companys fiscal 2006 independent registered public accounting firm. Although the Companys governing documents do not require the submission of this matter to shareholders, the Board of Directors considers it desirable that the appointment of BDO Seidman, LLP be ratified by shareholders.

What services does BDO Seidman, LLP provide?

Audit services provided by BDO Seidman, LLP for fiscal 2005 included the examination of the consolidated financial statements of the Company; audit of the Companys internal control over financial reporting and services related to periodic filings made with the SEC. In addition, BDO Seidman, LLP provided certain services relating to the Companys quarterly reports.

Will a representative of BDO Seidman, LLP be present at the meeting?

One or more representatives of BDO Seidman, LLP will be present at the meeting. The representatives will have an opportunity to make a statement if they desire and will be available to respond to questions from shareholders.

What if this proposal is not approved?

If the appointment of BDO Seidman, LLP is not ratified, the Audit Committee of the Board of Directors will reconsider the appointment.

WE RECOMMEND THAT YOU VOTE FOR THE RATIFICATION OF BDO

SEIDMAN, LLP AS THE COMPANYS FISCAL 2006 INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM.

20

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid to or earned by (i) our Chief Executive Officer, and (ii) the Companys three other most highly compensated executive officers (collectively, the Named Executive Officers) during each of the Companys last three fiscal years:

| Long-Term Compensation | ||||||||||||||

| Name and Principal Position |

Year | Salary ($) (1) | Bonus ($) | Other Annual Compensation ($) |

Restricted Stock Awards ($) |

Securities Underlying Options (#) |

||||||||

| Richard J. Freer, Ph.D., |

2005 | 205,000 | 18,869 | 13,000 | (2) | 53,943 | (3) | | ||||||

| Chairman and COO |

2004 | 181,500 | | 9,600 | (2) | 45,000 | (4) | 10,000 | ||||||

| 2003 | 181,500 | | 9,600 | (2) | 11,029 | |||||||||

| Robert B. Harris, Ph.D., |

2005 | 205,000 | 18,869 | 13,000 | (2) | 3,943 | (5) | 30,000 | ||||||

| President and CEO |

2004 | 181,500 | | 9,600 | (2) | | | |||||||

| 2003 | 181,500 | | 9,600 | (2) | 30,000 | (3) | 10,000 | |||||||

| Thomas R. Reynolds, |

2005 | 190,000 | 8,579 | 13,000 | (2) | 3,943 | (5) | 30,000 | ||||||

| Secretary and Senior Vice President |

2004 | 165,000 | | 9,600 | (2) | | | |||||||

| 2003 | 165,000 | | 9,600 | (2) | 25,000 | (3) | 10,000 | |||||||

| James H. Brennan, |

2005 | 120,178 | 2,173 | 13,000 | (2) | | 30,000 | |||||||

| Controller |

2004 | 114,640 | | 9,600 | (2) | | | |||||||

| 2003 | 104,640 | | 9,600 | (2) | 4,167 | (3) | 6,000 | |||||||

| (1) | Does not include certain perquisites and other personal benefits, the amounts of which are not shown because the aggregate amount of such compensation during the year did not exceed the lesser of $50,000 or 10% of total salary and bonus reported for such executive officer. |

| (2) | Represents travel expenses paid by the Company. |

| (3) | Includes 50,000 restricted shares granted pursuant to the amended employment agreement between the executive and the Company. The Company granted such securities in connection with the termination of an executive severance package previously held by the executive. This number also includes 3,943 restricted shares granted to Dr. Freer as a portion of his annual bonus. |

| (4) | In 2003, the Company granted either (i) options to purchase shares of Common Stock or (ii) shares of restricted stock in satisfaction of accrued, but unpaid salary. The value of the restricted stock so issued, as of the original date of grant, is reflected in the table. The restricted shares issued to Dr. Freer vested on April 6, 2003. The restricted shares issued to Dr. Harris and Messrs. Reynolds and Brennan vested on April 16, 2004. |

| (5) | Represents restricted shares granted to the executive as a portion of his annual bonus. |

21

The following tables set forth information regarding options to purchase shares of the Companys common stock granted to and exercised by the Companys Named Executive Officers during fiscal 2005. The Company has no outstanding stock appreciation rights.

OPTION GRANTS IN LAST FISCAL YEAR

Individual Grants

| Name |

Number of Options Granted |

% of Total Options Fiscal Year |

Exercise Price ($/Share) |

Expiration Date |

||||

| Richard J. Freer, Ph.D., Chairman and COO |

7,885 | 4.7 | 4.80 | 12/30/2015 | ||||

| Robert B. Harris, Ph.D., President and CEO |

10,000 | 6.00 | 1/3/2015 | |||||

| 20,000 | 5.35 | 2/3/2015 | ||||||

| 30,000 | 17.7 | |||||||

| Thomas R. Reynolds, Secretary and Senior Vice President |

10,000 | 6.00 | 1/3/2015 | |||||

| 20,000 | 5.19 | 2/9/2005 | ||||||

| 30,000 | 17.7 | |||||||

| James H. Brennan, Controller |

5,000 | 3.0 | 4.81 | 12/15/2015 |

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR END OPTION VALUES

| Number

of Year End (#) Exercisable / |

Value of Unexercised Exercisable

/ |

|||||||

| Name |

Shares Acquired on Exercise (#) |

Value Realized ($) |

||||||

| Richard J. Freer, Ph.D., Chairman and COO |

| |

132,755 / 0 |

86,203 / 0 |

||||

| Robert B. Harris, Ph.D., President and CEO |

| |

110,513 / 0 |

26,989 / 0 |

||||

| Thomas R. Reynolds, Secretary and Senior Vice President |

| |

76,609 / 0 |

24,777 / 0 |

||||

| James H. Brennan, Controller |

| |

75,080 / 75,080 |

57,204 / 0 |

| (1) | Calculated based on the closing price of $4.80 per share as reported on the Nasdaq Capital Market on December 30, 2005. |

22

EQUITY COMPENSATION PLAN INFORMATION

| Plan Category |

Number of securities to be outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under |

||||

| Equity compensation plans approved by security holders |

986,919 | $ | 5.60 | 287,309 | |||

| Equity compensation plans not approved by security holders |

0 | 0 | 0 | ||||

| Total |

986,919 | $ | 5.60 | 287,309 | |||

MANAGEMENT BUSINESS HISTORY OF EXECUTIVE OFFICERS

For information as to the business history of Dr. Freer, Dr. Harris and Mr. Reynolds, see the section Proposal One: Election of Directors elsewhere in this Proxy Statement.

JAMES H. BRENNAN

Vice President, Financial Operations

Age 54

Mr. Brennan became the Companys Vice President, Financial Operations in January 2006. From December 1997 until January 2006, he served as the Companys Controller. From 1996 to 1997, Mr. Brennan served as the Controller of Star Tobacco, a tobacco product manufacturer. From 1995, Mr. Brennan was the Controller for Herald Pharmacal, a manufacturer of skin care products. Mr. Brennan received a bachelors degree in Political Science from Mount St. Marys College and a masters degree in Business Administration from Averett College.

23

EMPLOYMENT AGREEMENTS WITH THE COMPANYS

NAMED EXECUTIVE OFFICERS

Richard J. Freer, Ph.D.

As of June 27, 2005, the Company entered into an amended employment agreement with Dr. Freer pursuant to which Dr. Freer will serve the Company as Chairman of the Board and Chief Operating Officer. This agreement expires on December 31, 2009. The employment agreement provides Dr. Freer with:

| | a base salary of at least $205,000, with any amount above such minimum level to be determined by the Board of Directors; |

| | a grant, to take effect on January 1, 2007, of incentive stock options to purchase 30,000 shares of the Companys common stock; |

| | an annual bonus to be based upon financial performance criteria determined by the Board of Directors. Assuming full satisfaction of such financial performance criteria, the maximum cash bonus payable shall not be less than $25,000 per year; |

| | a number of annual incentive stock option and restricted stock grants to be based upon financial performance criteria determined by the Board of Directors. Assuming full satisfaction of such financial performance criteria, Dr. Freer is eligible to receive incentive stock options to purchase an aggregate of 10,000 shares of common stock and 5,000 shares of restricted common stock on a yearly basis. Such options and restricted shares shall vest in three equal yearly installments beginning on the date that is one year following the date of grant; |

| | a grant of 50,000 shares of restricted common stock on June 27, 2005 and a grant of 50,000 shares of restricted common stock on January 1, 2006, with such shares vesting in quarterly installments of 10,000 shares beginning on January 1, 2010; and |

| | participation in any and all employee benefit plans. |

Under the employment agreement, upon Dr. Freers death, the Company shall pay Dr. Freers beneficiary an amount equal to (i) one months salary, and (ii) a cash, option and restricted stock bonus with respect to that portion of the Companys fiscal year completed prior to Dr. Freers death. In addition, upon Dr. Freers death, all unvested, restricted shares of the Companys common stock held by Dr. Freer shall immediately vest.

The Company may terminate Dr. Freers employment at any time for Cause, as such term is defined in the employment agreement, without incurring any continuing obligations to Dr. Freer.

If the Company terminates Dr. Freers employment for any reason other than for Cause or if Dr. Freer terminates his employment for Good Reason, as such term is defined in the

24

employment agreement, Dr. Freer is entitled to (a) a lump cash sum equal to the aggregate amount of salary due to Dr. Freer up through December 31, 2009 and (b) medical, dental and life insurance benefits until December 31, 2009.

To the extent a Change-of-Control, as such term is defined in the employment agreement, occurs during the term of the agreement, Dr. Freer, at his sole option, may deem such event to be a termination of employment without Cause. As a result, Dr. Freer would be entitled to receive the benefits noted above. In addition, all unvested options and shares of restricted stock held by Dr. Freer will immediately vest. In connection with the execution of this agreement, the Company and Dr. Freer terminated that certain Executive Severance Agreement, dated June 27, 1997.

To the extent Dr. Freer becomes Disabled, as such term is defined in the employment agreement, during the term of the agreement, the Company shall continue pay him his full salary and benefits until he shall become eligible for disability income under the Companys disability plan. While receiving disability income payments, the Company shall pay Dr. Freer the difference between such payments and his salary (without bonus), and he shall continue to participate in the Companys benefit plans until December 31, 2009.

The agreement contains a non-competition provision, which prohibits Dr. Freer from competing with the Company or soliciting its employees under certain circumstances. A court may, however, determine that this non-competition provision is unenforceable or only partially enforceable.

Robert B. Harris, Ph.D.

As of January 1, 2005, the Company entered into an amended employment agreement with Dr. Harris pursuant to which Dr. Harris will serve the Company as President and Chief Executive Officer. This agreement expires on December 31, 2007. The employment agreement provides Dr. Harris with:

| | a base salary of at least $205,000, with any amount above such minimum level to be determined by the Board of Directors; |

| | a grant of incentive stock options to purchase 30,000 shares of the Companys common stock on January 1, 2005; |

| | an annual bonus to be based upon financial performance criteria determined by the Board of Directors. Assuming full satisfaction of such financial performance criteria, the maximum cash bonus payable shall not be less than $25,000 per year; |

| | a number of annual incentive stock option and restricted stock grants to be based upon financial performance criteria determined by the Board of Directors. Assuming full satisfaction of such financial performance criteria, Dr. Harris is eligible to receive incentive stock options to purchase an aggregate of 10,000 shares of common stock and 5,000 shares of |

25

| restricted common stock on a yearly basis. Such options and restricted shares shall vest in three equal yearly installments beginning on the date that is one year following the date of grant; and |

| | participation in any and all employee benefit plans. |

Under the employment agreement, upon Dr. Harris death, the Company shall pay Dr. Harris beneficiary an amount equal to (a) one months salary, and (b) a cash, option and restricted stock bonus with respect to that portion of the Companys fiscal year completed prior to Dr. Harris death.

The Company may terminate Dr. Harris employment at any time for Cause, as such term is defined in the employment agreement, without incurring any continuing obligations to Dr. Harris.

If the Company terminates Dr. Harris employment for any reason other than for Cause or if Dr. Harris terminates his employment for Good Reason, as such term is defined in the employment agreement, Dr. Harris is entitled to (a) receive salary and benefits for a period of twelve months following the date of termination and (b) medical, dental and life insurance benefits until December 31, 2007.

To the extent that the Company has not offered to renew this agreement or enter into another employment arrangement with substantially similar or better terms for Dr. Harris on or before the date that is one year prior to the expiration date of this agreement, Dr. Harris may declare the Company in default, and terminate this agreement for Good Reason. As such, Dr. Harris would be entitled to the benefits noted above for such a termination.

To the extent a Change-of-Control, as such term is defined in the employment agreement, occurs during the term of the agreement, Dr. Harris, at his sole option, may deem such event to be a termination of employment without Cause. As a result, Dr. Harris would be entitled to receive the benefits noted above. In addition, all unvested options and shares of restricted stock held by Dr. Harris will immediately vest. In connection with the execution of this agreement, the Company and Dr. Harris terminated that certain Executive Severance Agreement, dated June 27, 1997.

To the extent Dr. Harris becomes Disabled, as such term is defined in the employment agreement, during the term of the agreement, the Company shall continue pay him his full salary and benefits until he shall become eligible for disability income under the Companys disability plan. While receiving disability income payments, the Company shall pay Dr. Harris the difference between such payments and his salary (without bonus), and he shall continue to participate in the Companys benefit plans until December 31, 2007.

The agreement contains a non-competition provision, which prohibits Dr. Harris from competing with the Company or soliciting its employees under certain circumstances. A court may, however, determine that this non-competition provision is unenforceable or only partially enforceable.

26

Thomas R. Reynolds

As of January 1, 2005, the Company entered into an amended employment agreement with Mr. Reynolds pursuant to which Mr. Reynolds will serve the Company as Executive Vice President for Science and Technology. This agreement expires on December 31, 2007. The employment agreement provides Mr. Reynolds with:

| | a base salary of at least $190,000, with any amount above such minimum level to be determined by the Board of Directors; |

| | a grant of incentive stock options to purchase 30,000 shares of the Companys common stock on January 1, 2005; |

| | an annual bonus to be based upon financial performance criteria determined by the Board of Directors. Assuming full satisfaction of such financial performance criteria, the maximum cash bonus payable shall not be less than $25,000 per year; |

| | a number of annual incentive stock option and restricted stock grants to be based upon financial performance criteria determined by the Board of Directors. Assuming full satisfaction of such financial performance criteria, Mr. Reynolds is eligible to receive incentive stock options to purchase an aggregate of 5,000 shares of common stock and 5,000 shares of restricted common stock on a yearly basis. Such options and restricted shares shall vest in three equal yearly installments beginning on the date that is one year following the date of grant; and |

| | participation in any and all employee benefit plans. |

Under the employment agreement, upon Mr. Reynolds death, the Company shall pay Mr. Reynolds beneficiary an amount equal to (a) one months salary, and (b) a cash, option and restricted stock bonus with respect to that portion of the Companys fiscal year completed prior to Mr. Reynolds death.

The Company may terminate Mr. Reynolds employment at any time for Cause, as such term is defined in the employment agreement, without incurring any continuing obligations to Mr. Reynolds.

If the Company terminates Mr. Reynolds employment for any reason other than for Cause or if Mr. Reynolds terminates his employment for Good Reason, as such term is defined in the employment agreement, Mr. Reynolds is entitled to (a) receive salary and benefits for a period of twelve months following the date of termination and (b) medical, dental and life insurance benefits until December 31, 2007.

To the extent that the Company has not offered to renew this agreement or enter into another employment arrangement with substantially similar or better terms for Mr. Reynolds on or before the date that is one year prior to the expiration date of this agreement, Mr. Reynolds may declare the Company in default, and terminate this agreement for Good Reason. As such, Mr. Reynolds would be entitled to the benefits noted above for such a termination.

27

To the extent a Change-of-Control, as such term is defined in the employment agreement, occurs during the term of the agreement, Mr. Reynolds, at his sole option, may deem such event to be a termination of employment without Cause. As a result, Mr. Reynolds would be entitled to receive the benefits noted above. In addition, all unvested options and shares of restricted stock held by Mr. Reynolds will immediately vest. In connection with the execution of this agreement, the Company and Mr. Reynolds terminated that certain Executive Severance Agreement, dated June 27, 1997.

To the extent Mr. Reynolds becomes Disabled, as such term is defined in the employment agreement, during the term of the agreement, the Company shall continue pay him his full salary and benefits until he shall become eligible for disability income under the Companys disability plan. While receiving disability income payments under such plan, the Company shall pay Mr. Reynolds the difference between such payments and his salary (without bonus), and he shall continue to participate in the Companys benefit plans until December 31, 2007.

The agreement contains a non-competition provision, which prohibits Mr. Reynolds from competing with the Company or soliciting its employees under certain circumstances. A court may, however, determine that this non-competition provision is unenforceable or only partially enforceable.

James H. Brennan

As of January 1, 2005, the Company entered into a First Amended and Restated Employment Agreement with Mr. Brennan. The agreement has a term of one year and will be extended for successive one-year terms unless either Mr. Brennan or the Company shall give notice to the other of an election not to extend the term of the employment agreement. The employment agreement provides a base salary of $120,175 per year, which amount is adjustable by the Company from time to time. Mr. Brennan is also entitled to participate in the Companys employee benefit plans. Pursuant to the agreement, Mr. Brennan is eligible to receive annual stock incentive awards to be determined by the Compensation Committee.

Pursuant to the employment agreement, Mr. Brennan is entitled to receive an annual cash bonus to be based upon financial performance criteria determined by the Board of Directors. Assuming full satisfaction of such financial performance criteria, the maximum cash bonus payable shall not be less than $25,000. To the extent Mr. Brennan becomes disabled during the term of the agreement, the Company shall continue to pay his full salary until he becomes eligible under the Companys disability income plan. The agreement contains a non-competition provision which prohibits Mr. Brennan from competing with the Company or soliciting its employees under certain circumstances. A court may, however, determine that this non-competition provision is unenforceable or only partially enforceable.

As of April 10, 2000, the Company entered into a severance agreement with Mr. Brennan. This agreement has a term of one year and will be extended for successive one-year periods, unless either Mr. Brennan or the Company shall give notice to the other of an

28

election not to extend the term of the severance agreement. If Mr. Brennans employment is terminated (with certain exceptions) within 60 months following a Change in Control, as such term is defined in the severance agreement, Mr. Brennan will be entitled to receive a cash payment equal to two times his annual salary at the rate in effect immediately prior to the termination.

AUDIT COMMITTEE REPORT AND FEES PAID TO INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Who served on the Audit Committee of the Board of Directors?

The members of the Audit Committee as of December 31, 2005 were Samuel P. Sears, Jr., James D. Causey, Joseph R. Slay and Gerald P. Krueger. Each member of the Audit Committee is independent under the rules of the SEC and the Nasdaq Capital Market. The Board of Directors has determined that Samuel P. Sears, Jr., who served on the Audit Committee throughout 2005, is an audit committee financial expert as such term is defined in Item 401(h)(2) of Regulation S-K promulgated under the Exchange Act.

What document governs the activities of the Audit Committee?

The Audit Committee acts under a written charter, which sets forth its responsibilities and duties, as well as requirements for the Audit Committees composition and meetings. The Audit Committee Charter is attached as Exhibit B to this Proxy Statement and is available on the Companys website at www.cbi-biotech.com under Investor Relations.

How does the Audit Committee conduct its meetings?

During 2005, the Audit Committee met with the senior members of the Companys financial management team and the Companys independent registered public accounting firm. The Audit Committees agenda was established by the Chairman. At each meeting, the Audit Committee reviewed and discussed various financial and regulatory issues. The Audit Committee also had private, separate sessions from time to time with representatives of BDO Seidman, LLP and the Companys Controller, at which meetings candid discussions of financial management, accounting and internal control issues took place.

Does the Audit Committee review the periodic reports and other public financial disclosures of the Company?

The Audit Committee reviews each of the Companys quarterly and annual reports, including Managements Discussion of Results of Operations and Financial Condition. As part of this review, the Audit Committee discusses the reports with the Companys management and considers the audit and review reports prepared by the independent registered public accounting firm about the Companys quarterly and annual reports, as well as related matters such as the quality (and not just the acceptability) of the Companys accounting principles, alternative

29

methods of accounting under generally accepted accounting principles and the preferences of the independent registered public accounting firm in this regard, the Companys critical accounting policies and the clarity and completeness of the Companys financial and other disclosures.

What is the role of the Audit Committee in connection with the financial statements and controls of the Company?

Management of the Company has primary responsibility for the financial statements and internal control over financial reporting. The independent registered public accounting firm has responsibility for the audit of the Companys financial statements and internal control over financial reporting. The responsibility of the Audit Committee is to oversee financial and control matters, among other responsibilities fulfilled by the Committee under its charter. The Committee meets regularly with the independent registered public accounting firm, without the presence of management, to ensure candid and constructive discussions about the Companys compliance with accounting standards and best practices among public companies comparable in size and scope to the Company. The Audit Committee also regularly reviews with its outside advisors material developments in the law and accounting literature that may be pertinent to the Companys financial reporting practices.

What has the Audit Committee done with regard to the Companys audited financial statements for fiscal 2005?

The Audit Committee has:

| | reviewed and discussed the audited financial statements with the Companys management; and |

| | discussed with BDO Seidman, LLP, independent registered public accounting firm for the Company, the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended. |

Has the Audit Committee considered the independence of the Companys auditors?

The Audit Committee has received from BDO Seidman, LLP the written disclosures and the letter required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and the Audit Committee has discussed with BDO Seidman, LLP its independence. The Audit Committee has concluded that BDO Seidman, LLP is independent from the Company and its management.

Has the Audit Committee made a recommendation regarding the audited financial statements for fiscal 2005?

Based upon its review and the discussions with management and the Companys independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements for the Company be included in the Companys Annual Report on Form 10-KSB for fiscal 2005.

30

Has the Audit Committee reviewed the fees paid to the independent registered public accounting firm during fiscal 2005?

The Audit Committee has reviewed and discussed the fees paid to BDO Seidman, LLP during 2005 for audit, audit-related, tax and other services, which are set forth below under Fees Paid to Independent Registered Public Accounting Firm. The Audit Committee has determined that the provision of non-audit services is compatible with BDO Seidman, LLPs independence.

Who prepared this report?

This report has been furnished by the members of the Audit Committee as of December 31, 2005:

Samuel P. Sears, Jr., Chairman

James D. Causey

Joseph R. Slay

Gerald P. Krueger

What is the Companys policy regarding the retention of the Companys auditors?

The Audit Committee has adopted a policy regarding the retention of the independent registered public accounting firm that requires pre-approval of all services by the Audit Committee.

FEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Audit Fees

During fiscal 2005 and 2004, the Company paid BDO Seidman, LLPs fees in the aggregate amount of $71,290 and $61,050, respectively, for the annual audit of our financial statements and the quarterly reviews of the financial statements included in our Forms 10-QSB.

Audit Related Fees

During fiscal 2005 and 2004, the Company paid BDO Seidman, LLP $0 and $0, respectively, for audit-related services.

Tax Fees

During fiscal 2005 and 2004, the Company paid BDO Seidman, LLP $0 and $16,678, respectively, for tax services. In fiscal 2004, such fees were for generating the Companys tax returns.

31

All Other Fees

Aggregate fees billed for all other services rendered by BDO Seidman, LLP for fiscal 2005 and 2004 were $0 and $0, respectively.

This table below contains certain information about the beneficial owners known to the Company as of March 17, 2006 of more than 5% of the Companys outstanding shares of common stock.

| Name and Address of Beneficial Owner |

Shares of Common Stock Beneficially Owned |

Percent of Class |

|||