DEF 14A: Definitive proxy statements

Published on September 17, 2009

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

COMMONWEALTH BIOTECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

COMMONWEALTH BIOTECHNOLOGIES, INC.

601 Biotech Drive, Richmond, Virginia 23235

PROXY STATEMENT AND NOTICE OF

2009 ANNUAL MEETING OF SHAREHOLDERS

| To the shareholders of |

September 17, 2009 | |

| Commonwealth Biotechnologies, Inc. |

Richmond, Virginia |

To our shareholders:

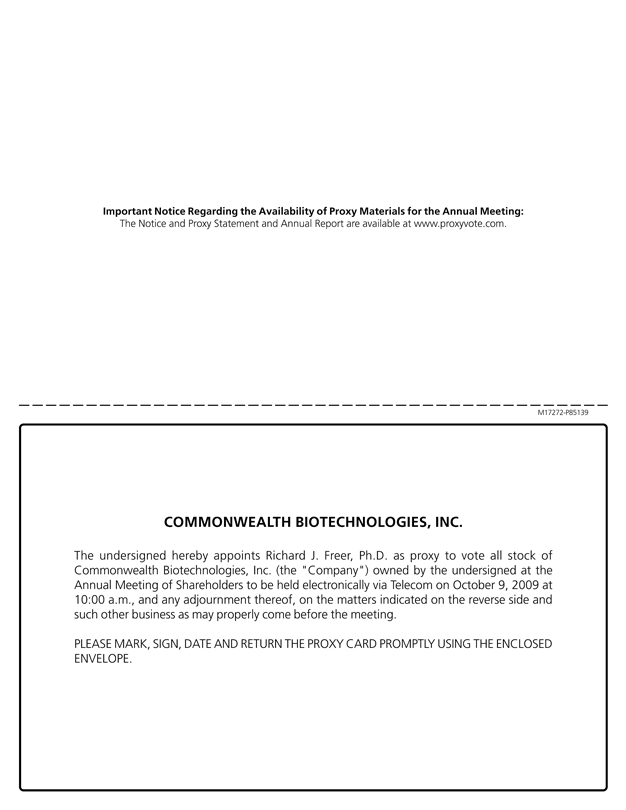

It is my pleasure to invite you to attend our 2009 Annual Meeting of Shareholders on October 9, 2009, at 10:00 a.m., Eastern Time. The meeting will be held electronically via Telecom.

The matters to be acted upon at the meeting are described in the Notice of 2009 Annual Meeting of Shareholders and Proxy Statement. At the meeting, we will also report on the Companys performance and operations during the fiscal year ended December 31, 2008 and respond to shareholder questions.

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING OF SHAREHOLDERS, WE URGE YOU TO VOTE AND SUBMIT YOUR PROXY BY TELEPHONE, THE INTERNET OR BY MAIL. IF YOU ARE A REGISTERED SHAREHOLDER AND ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON. IF YOU HOLD YOUR SHARES THROUGH A BANK OR BROKER AND WANT TO VOTE YOUR SHARES IN PERSON AT THE MEETING, PLEASE CONTACT YOUR BANK OR BROKER TO OBTAIN A LEGAL PROXY. THANK YOU FOR YOUR SUPPORT.

| By order of the Board of Directors, |

| /s/ Richard J. Freer, Ph.D. |

| Richard J. Freer, Ph.D. |

| Chief Operating Officer and Acting |

| Secretary |

NOTICE OF ANNUAL MEETING

OF THE SHAREHOLDERS OF

COMMONWEALTH BIOTECHNOLOGIES, INC.

| TIME: | 10:00 a.m., Eastern Time, on October 9, 2009 | |

| METHOD: | Telecom |

ITEMS OF BUSINESS:

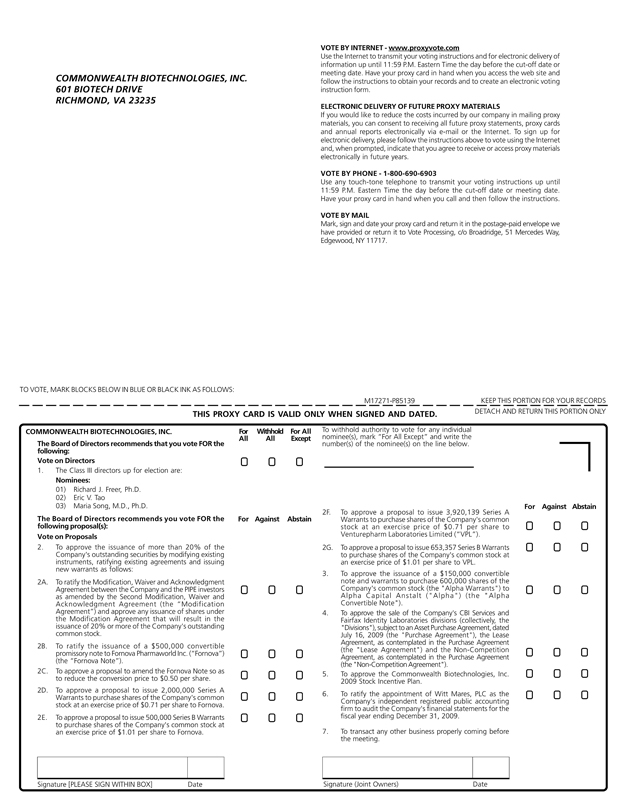

(1) To elect three Class III members of the Board of Directors, each to serve a term expiring at the Annual Meeting of the Shareholders in 2012 or until a successor is duly elected and qualified;

(2) To approve the issuance of more than 20% of the Companys outstanding securities by modifying existing instruments, ratifying existing agreements and issuing new warrants as follows:

Note: Items 2(A) 2(G) must all be approved in order for any of them to be approved. If any of these subparts is not approved, all other subparts will not pass, even if they otherwise receive a majority vote by the shareholders.

(2(A)) To ratify the Modification, Waiver and Acknowledgment Agreement between the Company and the PIPE investors as amended by the Second Modification, Waiver and Acknowledgment Agreement (the Modification Agreement) and approve any issuance of shares under the Modification Agreement that will result in the issuance of 20% or more of the Companys outstanding common stock;

(2(B)) To ratify the issuance of a $500,000 convertible promissory note to Fornova Pharmaworld Inc. (Fornova) (the Fornova Note);

(2(C)) To approve a proposal to amend the Fornova Note so as to reduce the conversion price to $0.50 per share;

(2(D)) To approve a proposal to issue 2,000,000 Series A Warrants to purchase shares of the Companys common stock at an exercise price of $0.71 per share to Fornova;

(2(E)) To approve a proposal to issue 500,000 Series B Warrants to purchase shares of the Companys common stock at an exercise price of $1.01 per share to Fornova;

(2(F)) To approve a proposal to issue 3,920,139 Series A Warrants to purchase shares of the Companys common stock at an exercise price of $0.71 per share to Venturepharm Laboratories Limited (VPL);

(2(G)) To approve a proposal to issue 653,357 Series B Warrants to purchase shares of the Companys common stock at an exercise price of $1.01 per share to VPL;

(3) To approve the issuance of a $150,000 convertible note and warrants to purchase 600,000 shares of the Companys common stock (the Alpha Warrants) to Alpha Capital Anstalt (Alpha) (the Alpha Convertible Note);

Note: While Alpha and the PIPE investors are related, Items 2 and 3 are independent. Item 2 need not be approved in order for Item 3 to pass and Item 3 need not be approved in order for Item 2 to pass.

(4) To approve the sale of the Companys CBI Services and Fairfax Identity Laboratories divisions (collectively, the Divisions), subject to an Asset Purchase Agreement, dated July 16, 2009 (the Purchase Agreement), the Lease Agreement, as contemplated in the Purchase Agreement (the Lease Agreement) and the Non-Competition Agreement, as contemplated in the Purchase Agreement (the Non-Competition Agreement);

(5) To approve the Commonwealth Biotechnologies, Inc. 2009 Stock Incentive Plan;

(6) To ratify the appointment of Witt Mares, PLC as the Companys independent registered public accounting firm to audit the Companys financial statements for the fiscal year ending December 31, 2009; and

(7) To transact any other business properly coming before the meeting.

| WHO MAY VOTE: | You may vote if you were a shareholder of record on September 14, 2009. | |

| ANNUAL REPORT: | A copy of our 2008 Annual Report is enclosed. | |

| DATE OF MAILING: | This Notice and the Proxy Statement are first being mailed to shareholders on or about September 17, 2009. |

| By order of the Board of Directors, |

| /s/ Richard J. Freer, Ph. D. |

| Richard J. Freer, Ph. D., |

| Chief Operating Officer and Acting Secretary |

ABOUT THE 2009 ANNUAL MEETING OF SHAREHOLDERS

What am I voting on?

You will be voting on the following:

(1) The election of three Class III members of the Board of Directors, each to serve a term expiring at the Annual Meeting of Shareholders in 2012 or until a successor is duly elected and qualified;

(2) The approval of issuances of more than 20% of the Companys outstanding securities by modifying existing instruments, ratifying existing agreements and issuing new warrants as follows:

Note: Items 2(A) 2(G) must all be approved in order for any of them to be approved. If any of these subparts is not approved, all other subparts will not pass, even if they otherwise receive a majority vote by the shareholders.

(2(A)) The ratification of the Modification Agreement and approval of any issuance of shares under the Modification Agreement that will result in the issuance of 20% or more of the Companys outstanding common stock;

(2(B)) The ratification of the Fornova Note;

(2(C)) The amendment of the Fornova Note to reduce the conversion price to $0.50 per share;

(2(D)) The issuance of 2,000,000 Series A Warrants to purchase shares of the Companys common stock to Fornova;

(2(E)) The issuance of 500,000 Series B Warrants to purchase shares of the Companys common stock to Fornova;

(2(F)) The issuance of 3,920,139 Series A Warrants to purchase shares of the Companys common stock to VPL;

(2(G)) The issuance of 653,357 Series B Warrants to purchase shares of the Companys common stock to VPL;

(3) The approval of the issuance of the Alpha Convertible Note and the Alpha Warrants to purchase 600,000 shares of the Companys common stock;

Note: While Alpha and the PIPE investors are related, Items 2 and 3 are independent. Item 2 need not be approved in order for Item 3 to pass and Item 3 need not be approved in order for Item 2 to pass.

(4) The approval of the sale of the Divisions, subject to the Asset Purchase Agreement, the Lease Agreement and the Non-Competition Agreement;

(5) The approval of the Commonwealth Biotechnologies, Inc. 2009 Stock Incentive Plan;

(6) The ratification of the appointment of Witt Mares, PLC as the Companys independent registered public accounting firm to audit the Companys financial statements for the fiscal year ending December 31, 2009; and

(7) The transaction of any other business properly coming before the meeting.

1

Who is entitled to vote?

You may vote if you owned shares of the Companys common stock as of the close of business on September 14, 2009. Each share of common stock is entitled to one vote. As of September 14, 2009, we had 8,171,796 shares of common stock outstanding.

How do I vote before the meeting?

If you are a registered shareholder, meaning that you hold your shares in certificate form, you have three voting options:

(1) Over the Internet, which we encourage if you have Internet access, at the address shown on your proxy card;

(2) By phone, by calling 1-800-690-6903 using any touch-tone telephone to transmit your voting instructions; or

(3) By mail, by completing, signing and returning the enclosed proxy card.

If you hold your shares through an account with a bank or broker, your ability to vote by the Internet depends on their voting procedures. Please follow the directions that your bank or broker provides.

May I vote at the meeting?

You may vote your shares at the meeting if you register for and participate in the Telecom meeting in person. If you hold your shares through an account with a bank or broker, you must obtain a legal proxy from the bank or broker in order to vote at the meeting. A legal proxy is an authorization from your bank or broker to vote the shares it holds in its name for your benefit on the records of the Companys transfer agent. Even if you plan to attend the Telecom meeting, we encourage you to vote your shares by proxy. You may vote by proxy through the Internet, by telephone or by mail.

Can I change my mind after I return my proxy?

You may change your vote at any time before the polls close at the conclusion of voting at the meeting. You may do this by (1) signing another proxy card with a later date and returning it to us before the meeting, (2) voting again over the Internet prior to 11:59 p.m., Eastern Time, on October 8, 2009, (3) voting again via the telephone prior to 11:59 p.m., Eastern Time, on October 8, 2009, or (4) voting at the Telecom meeting if you are a registered shareholder or have obtained a legal proxy from your bank or broker.

What if I return my proxy card but do not provide voting instructions?

Proxies that are signed and returned but do not contain instructions will be voted as follows:

(1) FOR the election of the three nominees for Class III directors, each as named herein;

(2) FOR all subparts of Proposal Two;

(3) FOR the approval of the Alpha Convertible Note and Alpha Warrants;

(4) FOR the approval of the sale of the Divisions;

(5) FOR the approval of the Commonwealth Biotechnologies, Inc. 2009 Stock Incentive Plan;

(6) FOR the ratification of Witt Mares, PLC as the Companys independent registered public accounting firm to audit the Companys financial statements for the fiscal year ended December 31, 2009; and

(7) in accordance with the best judgment of the named proxies on any other matters properly brought before the meeting.

What does it mean if I receive more than one proxy card or instruction form?

It indicates that your shares are registered differently and are in more than one account. To ensure that all shares are voted, please either vote each account by telephone or on the Internet, or sign and return all proxy cards. We encourage you to register all your accounts in the same name and address. Those holding shares through a bank or broker should contact your bank or broker and request consolidation.

2

Will my shares be voted if I do not provide my proxy or instruction form?

If you are a registered shareholder and do not provide a proxy, you must attend the Telecom meeting in order to vote your shares. If you hold shares through an account with a bank or broker, your shares may be voted even if you do not provide voting instructions on your instruction form. Brokerage firms have the authority to vote shares for which their customers do not provide voting instructions on certain routine matters. The election of directors and the ratification of Witt Mares, PLC as the Companys independent registered public accounting firm to audit the Companys financial statements for the fiscal year ending December 31, 2009 are considered routine matters for which brokerage firms may vote without specific instructions. The other proposals to be voted on at the meeting are not considered routine under applicable rules. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. Shares that a broker is not authorized to vote are counted as broker non-votes.

How can I attend the Telecom meeting?

The Telecom meeting is open to all holders of the Companys common stock as of September 14, 2009. To join the Telecom you must register by 12:00 noon eastern time on October 2, 2009. You may register by calling 1-800-735-9224 or 1-804-648-3820, or you may send an email to shareholder@cbi-biotech.com indicating your wish to register for the annual shareholder meeting. After registering, you will be provided with the necessary dial-in instructions no later than October 6, 2009.

May shareholders ask questions at the meeting?

Yes. Representatives of the Company will answer questions of general interest at the end of the meeting.

How many votes must be present to hold the meeting?

Your shares are counted as present at the meeting if you attend the Telecom meeting and vote in person or if you properly return a proxy by Internet, telephone or mail. In order for us to conduct our meeting, a majority of our outstanding shares of common stock as of September 14, 2009 must be present in person or by proxy. This is referred to as a quorum. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the meeting.

How many votes are needed to approve the Companys proposals?

Proposal 1. The nominees receiving the highest number of For votes will be elected as directors. This number is called a plurality. Shares not voted will have no impact on the election of directors. The proxy given will be voted For each of the nominees for director unless a properly executed proxy card is marked Withhold as to a particular nominee or nominees for director.

Proposal 2 (A-G). Note: Items 2(A) 2(G) must all be approved in order for any of them to be approved. If any of these subparts is not approved, all other subparts will not pass, even if they otherwise receive a majority vote by the shareholders.

Proposal 2(A). The ratification of the Modification Agreement and approval of any issuance of shares under the Modification Agreement that will result in the issuance of 20% or more of the Companys outstanding common stock requires that a majority of the votes cast at the meeting be voted For the proposal and that the holders of a majority of the shares entitled to vote cast a vote, whether For, Against or Abstain.

Proposal 2(B). The ratification of the issuance of the Fornova Note requires that a majority of the votes cast at the meeting be voted For the proposal and that the holders of a majority of the shares entitled to vote cast a vote, whether For, Against or Abstain.

Proposal 2(C). The amendment of the Fornova Note to reduce the conversion price to $0.50 per share requires that a majority of the votes cast at the meeting be voted For the proposal and that the holders of a majority of the shares entitled to vote cast a vote, whether For, Against or Abstain.

3

Proposal 2(D). The issuance of 2,000,000 Series A Warrants to purchase shares of the Companys common stock to Fornova requires that a majority of the votes cast at the meeting be voted For the proposal and that the holders of a majority of the shares entitled to vote cast a vote, whether For, Against or Abstain.

Proposal 2(E). The issuance of 500,000 Series B Warrants to purchase shares of the Companys common stock to Fornova requires that a majority of the votes cast at the meeting be voted For the proposal and that the holders of a majority of the shares entitled to vote cast a vote, whether For, Against or Abstain.

Proposal 2(F). The issuance of 3,920,139 Series A Warrants to purchase shares of the Companys common stock to VPL requires that a majority of the votes cast at the meeting be voted For the proposal and that the holders of a majority of the shares entitled to vote cast a vote, whether For, Against or Abstain.

Proposal 2(G). The issuance of 653,357 Series B Warrants to purchase shares of the Companys common stock to VPL requires that a majority of the votes cast at the meeting be voted For the proposal and that the holders of a majority of the shares entitled to vote cast a vote, whether For, Against or Abstain.

Proposal 3. The approval of the Alpha Convertible Note and the Alpha Warrants requires that a majority of the votes cast at the meeting be voted For the proposal and that the holders of a majority of the shares entitled to vote cast a vote, whether For, Against or Abstain.

Note: While Alpha and the PIPE investors are related, Items 2 and 3 are independent. Item 2 need not be approved in order for Item 3 to pass and Item 3 need not be approved in order for Item 2 to pass.

Proposal 4. The approval of the sale of the Divisions requires that a majority of the votes cast at the meeting be voted For the proposal and that the holders of a majority of the shares entitled to vote cast a vote, whether For, Against or Abstain.

Proposal 5. The approval of the Companys 2009 Stock Incentive Plan requires that a majority of the votes cast at the meeting be voted For the proposal and that the holders of a majority of the shares entitled to vote cast a vote, whether For, Against or Abstain.

Proposal 6. The ratification of the appointment of Witt Mares, PLC as the Companys independent registered public accounting firm to audit the Companys financial statements for the fiscal year ending December 31, 2009 requires that a majority of the votes cast at the meeting be voted For the proposal. A properly executed proxy card marked Abstain with respect to this proposal will not be voted.

4

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE INFORMATION

What if a nominee is unwilling or unable to serve?

Each of the nominees listed in the Proxy Statement has agreed to serve as a director, if elected. If for some unforeseen reason a nominee becomes unwilling or unable to serve, proxies will be voted for a substitute nominee selected by the Board of Directors.

How are directors compensated?

All non-employee directors will receive an annual retainer fee (Retainer Fee) and a fee for each of the five regularly scheduled Board meetings attended per year (collectively, the Directors Fee). Employee directors will not be eligible to receive the Retainer Fee or the Directors Fee. The Retainer Fee and Directors Fee for the upcoming year will be set at the last Board meeting during a calendar year. In addition to the Directors Fee, all non-employee directors will receive reimbursement for travel and other related expenses incurred in attending Board meetings and committee meetings. For 2009, the Board set the Retainer Fee at $7,500 and the Directors Fee at $1,000 for each Board meeting attended.

DIRECTOR COMPENSATION

The following table shows all cash compensation paid to the Companys directors in 2008. Directors did not receive any compensation other than as stated in the chart below. Each option granted in the chart below has an exercise price of $2.32 and expires on March 22, 2018.

| Name |

Fees Earned or Paid in Cash | Options Received | |||

| Donald A. McAfee, Ph.D.(1) |

$ | 11,000 | 3,000 | ||

| Daniel O. Hayden(2) |

$ | 13,500 | 3,000 | ||

| James D. Causey |

$ | 13,500 | 3,000 | ||

| Samuel P. Sears, Jr. |

$ | 13,500 | 3,000 | ||

| (1) | Dr. McAfee resigned from CBIs Board of Directors on January 21, 2009. |

| (2) | Mr. Hayden resigned from CBIs Board of Directors on March 31, 2009. |

How does the Board determine which directors are independent?

The Board of Directors reviews the independence of each director yearly. During this review, the Board of Directors considers transactions and relationships between each director (and his or her immediate family and affiliates) and the Company and its management to determine whether any such relationships or transactions are inconsistent with a determination that the director is independent in light of applicable law, listing standards and the Companys director independence standards. The Company believes that it meets the independence standards adopted by the Securities and Exchange Commission and the NASDAQ Capital Market.

What role does the Nominating Committee play in selecting nominees to the Board of Directors?

Two of the primary purposes of the Boards Nominating Committee are (i) to develop and implement policies and procedures that are intended to ensure that the Board of Directors will be appropriately constituted and organized to meet its fiduciary obligations to the Company and its shareholders and (ii) to identify individuals qualified to become members of the Board of Directors and to recommend to the Board of Directors the director nominees for the annual meeting of shareholders. The Nominating Committee is also responsible for considering candidates for membership on the Board of Directors submitted by eligible shareholders. The Nominating Committees charter is available on the Companys website at www.cbi-biotech.com and in print upon request. The Nominating Committee of the Companys Board of Directors was the only entity or person to nominate and/or recommend any of the director nominees.

5

Are the members of the Nominating Committee independent?

Yes. All members of the Nominating Committee have been determined to be independent by the Board of Directors.

How does the Nominating Committee identify and evaluate nominees for director?

The Nominating Committee considers candidates for nomination to the Board of Directors from a number of sources. Current members of the Board of Directors are considered for re-election unless they have notified the Company that they do not wish to stand for re-election. The Nominating Committee also considers candidates recommended by current members of the Board of Directors, members of management or eligible shareholders. From time to time the Board may engage a firm to assist in identifying potential candidates, although the Company did not engage such a firm to identify any of the nominees for director proposed for election at the meeting.

The Nominating Committee evaluates all candidates for director, regardless of the person or firm recommending such candidate, on the basis of the length and quality of their business experience, the applicability of such candidates experience to the Company and its business, the skills and perspectives such candidate would bring to the Board of Directors and the personality or fit of such candidate with existing members of the Board of Directors and management.

What are the Nominating Committees policies and procedures for considering director candidates recommended by shareholders?

The Nominating Committee will consider all candidates recommended by eligible shareholders. An eligible shareholder is a shareholder (or group of shareholders) who owns at least 5% of the Companys outstanding shares and who has held such shares for at least one year as of the date of the recommendation. A shareholder wishing to recommend a candidate must submit the following documents to the Secretary of the Company at Commonwealth Biotechnologies, Inc., 601 Biotech Drive, Richmond, Virginia 23235:

| | a recommendation that identifies the name and address of the shareholder and the person to be nominated; |

| | documentation establishing that the shareholder making the recommendation is an eligible shareholder; |

| | the written consent of the candidate to serve as a director of the Company, if elected; |

| | a description of all arrangements between the shareholders and such nominee pursuant to which the nomination is to be made; and |

| | such other information regarding the nominee as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC. |

Upon timely receipt of the required documents, the Companys Secretary will determine whether the shareholder submitting the recommendation is an eligible shareholder based on such documents. If the shareholder is not an eligible shareholder, the Nominating Committee may, but is not obligated to, evaluate the candidate and consider such candidate for nomination to the Board of Directors.

If the candidate is to be evaluated by the Nominating Committee, the Secretary will request a detailed resume, an autobiographical statement explaining the candidates interest in serving as a director of the Company, a completed statement regarding conflicts of interest, and a waiver of liability for a background check from the candidate.

6

What are the minimum qualifications required to serve on the Companys Board of Directors?

All members of the Board of Directors must possess the following minimum qualifications as determined by the Nominating Committee:

| | A director must demonstrate integrity, accountability, informed judgment, financial literacy, creativity and vision; |

| | A director must be prepared to represent the best interests of all Company shareholders, and not just one particular constituency; |

| | A director must have a record of professional accomplishment in his or her chosen field; and |

| | A director must be prepared and able to participate fully in Board activities, including membership on committees. |

What other considerations does the Nominating Committee consider?

The Nominating Committee believes it is important to have directors from various backgrounds and professions in order to ensure that the Board of Directors has a wealth of experiences to inform its decisions. Consistent with this philosophy, in addition to the minimum standards set forth above, business and managerial experience and an understanding of financial statements and financial matters are very important.

How may shareholders communicate with the members of the Board of Directors?

Shareholders and others who are interested in communicating directly with members of the Board of Directors, including communication of concerns relating to accounting, internal accounting controls or audit matters, or fraud or unethical behavior, may do so by writing to the directors at the following address:

Name of Director or Directors

c/o Secretary

Commonwealth Biotechnologies, Inc.

601 Biotech Drive

Richmond, Virginia 23235

Does the Company have a Code of Conduct?

The Company has adopted a Code of Conduct, which is applicable to all directors, officers and associates of the Company, including the principal executive officer and the principal financial and accounting officer. The complete text of the Code of Conduct is available on the Companys web site at www.cbi-biotech.com and is also available in print upon request. The Company intends to post any amendments to or waivers from its Code of Conduct (to the extent applicable to the Companys principal executive officer and principal financial and accounting officer) at this location on its web site.

How often did the Board meet in fiscal 2008?

The Board of Directors met a total of nine times, at five regular meetings and four special meetings, during fiscal 2008. The Compensation Committee, the Audit Committee and the Nominating Committee each met five times during fiscal 2008. Each incumbent director attended at least 75% of the meetings of the Board of Directors and of the standing committees of which he or she was a member during fiscal 2008. Although the Company has not adopted a formal policy regarding Board of Directors attendance at annual meetings of shareholders, seven directors attended the 2008 Annual Meeting of Shareholders.

7

What are the committees of the Board?

During fiscal 2008, the Board of Directors had standing Audit, Nominating, and Compensation Committees. The members of each of the Committees as of September 14, 2009, their principal functions and the number of meetings held during the fiscal year ended December 31, 2008 are shown below:

Compensation Committee

The members of the Compensation Committee are:

James D. Causey, Chairman

Samuel P. Sears, Jr.

The Compensation Committee held five meetings during the fiscal year ended December 31, 2008. The Compensation Committees charter is available on the Companys website at www.cbi-biotech.com and in print upon request. The Compensation Committees principal responsibilities include:

| | Making recommendations to the Board of Directors concerning executive management organization matters generally; |

| | In the area of compensation and benefits, making recommendations to the Board of Directors concerning employees who are also directors of the Company, consult with the CEO on matters relating to other executive officers, and make recommendations to the Board of Directors concerning policies and procedures relating to executive officers; provided, however, that the Committee shall have full decision-making powers with respect to compensation for executive officers to the extent such compensation is intended to be performance-based compensation within the meaning of Section 162(m) of the Internal Revenue Code; |

| | Making recommendations to the Board of Directors regarding all contracts of the Company with any officer for remuneration and benefits after termination of regular employment of such officer; |

| | Making recommendations to the Board of Directors concerning policy matters relating to employee benefits and employee benefit plans, including incentive compensation plans and equity based plans; and |

| | Administering the Companys formal incentive compensation programs, including equity based plans. |

The Compensation Committee may not delegate its authority to other persons. Similarly, the Compensation Committee has not engaged a compensation consultant to assist in the determination of executive compensation issues. While the Companys executives will communicate with the Compensation Committee regarding executive compensation issues, the Companys executive officers do not participate in any executive compensation decisions.

Audit Committee

The members of the Audit Committee are:

Samuel P. Sears, Jr., Chairman

James D. Causey

Eric V. Tao

The Audit Committee held five meetings during the fiscal year ended December 31, 2008. The primary responsibility of the Audit Committee is to assist the Board of Directors in monitoring the integrity of the Companys financial statements and the independence of its external auditors. The Company believes that each of the members of the Audit Committee is independent and that Mr. Sears qualifies as an audit committee financial expert in accordance with applicable NASDAQ Capital Market listing standards. In carrying out its responsibility, the Audit Committee undertakes to:

| | Review and recommend to the directors the independent auditors to be selected to audit the financial statements of the Company; |

8

| | Meet with the independent auditors and management of the Company to review the scope of the proposed audit for the current year and the audit procedures to be utilized, and at the conclusion thereof review such audit, including any comments or recommendations of the independent auditors; |

| | Review with the independent auditors and financial and accounting personnel the adequacy and effectiveness of the accounting and financial controls of the Company. The Committee elicits recommendations for the improvement of such internal control procedures or particular areas where new or more detailed controls or procedures are desirable. The Committee emphasizes the adequacy of such internal controls to expose any payments, transactions, or procedures that might be deemed illegal or otherwise improper; |

| | Review the internal accounting function of the Company, the proposed audit plans for the coming year and the coordination of such plans with the Companys independent auditors; |

| | Review the financial statements contained in the annual report to shareholders with management and the independent auditors to determine that the independent auditors are satisfied with the disclosure and contents of the financial statements to be presented to the shareholders; |

| | Provide sufficient opportunity for the independent auditors to meet with the members of the Committee without members of management present. Among the items discussed in these meetings are the independent auditors evaluation of the Companys financial, accounting, and auditing personnel, and the cooperation that the independent auditors received during the course of the audit; |

| | Review accounting and financial human resources and succession planning within the Company; |

| | Submit the minutes of all meetings of the Audit Committee to, or discuss the matters discussed at each committee meeting with, the Board of Directors; and |

| | Investigate any matter brought to its attention within the scope of its duties, with the power to retain outside counsel for this purpose, if, in its judgment, that is appropriate. |

The Audit Committee has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls and auditing matters, including procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

Nominating Committee

The members of the Nominating Committee are:

Samuel P. Sears, Jr., Chairman

Eric V. Tao

The Nominating Committee had five meetings during the fiscal year ended December 31, 2008. All members of the Nominating Committee are independent, as such term is defined by the NASDAQ Capital Market listing standards. The Nominating Committee undertakes to:

| | Identify individuals qualified to become members of the Board of Directors and to make recommendations to the Board of Directors with respect to candidates for nomination for election at the next annual meeting of shareholders or at such other times when candidates surface and, in connection therewith, consider suggestions submitted by shareholders of the Company; |

9

| | Determine and make recommendations to the Board of Directors with respect to the criteria to be used for selecting new members of the Board of Directors; |

| | Oversee the process of evaluation of the performance of the Companys Board of Directors and committees; |

| | Make recommendations to the Board of Directors concerning the membership of committees of the Board and the chairpersons of the respective committees; |

| | Make recommendations to the Board of Directors with respect to the remuneration paid and benefits provided to members of the Board in connection with their service on the Board or on its committees; and |

| | Evaluate Board and committee tenure policies as well as policies covering the retirement or resignation of incumbent directors. |

The Board of Directors has determined to provide a process by which shareholders may communicate with the Board as a whole, a Board committee or individual director. Shareholders wishing to communicate with the Board as a whole, a Board committee or an individual member may do so by sending a written communication addressed to the Board of Directors of the Company or to the committee or to an individual director, c/o Secretary, Commonwealth Biotechnologies, Inc., 601 Biotech Drive, Richmond, Virginia 23235. All communications will be compiled by the Secretary of the Company and submitted to the Board of Directors or the addressee not later than the next regular Board meeting.

10

PROPOSAL ONE

ELECTION OF DIRECTORS AND DIRECTOR BIOGRAPHIES

(ITEM 1 ON THE PROXY CARD)

A brief biography of each Director in each Class follows. The terms of the Class I members of the Board of Directors continue until 2010, the terms of the Class II members of the Board of Directors continue until 2011 and the Class III members of the Board of Directors are up for re-election this year.

Class I members of the Board of Directors whose terms continue to 2010:

PAUL DSYLVA, PH.D.

Director

Age 40

Director since 2007

Dr. DSylva assumed the position of Chief Executive Officer of the Company in January 2007 and served in that position until 2009. Dr. DSylva served previously as the co-founder and Managing Director of PharmAust Chemistry Ltd. (PharmAust). Prior to the listing of PharmAust, Dr. DSylva served as the Director of Research and Development at Murdoch University from 2001 to 2005. Dr. DSylva has a strong track record in raising investment capital for early stage business ventures and has led the development of a number of successful research joint-venture institutes, companies and funds. During his tenure at Murdoch University, he founded and directed the AU$12.5m Investment Fund Murdoch Westscheme Enterprise Partnership, founded and directed the commercial consulting company MurdochLink Pty Ltd, and was involved in the establishment and governance of a number of key research centers and institutes. He sits on the advisory board of the Centre for Computational Comparative Genomics, a joint-venture research institute in Bioinformatics based at Murdoch University and retains a non-executive role at Murdoch University as an Adjunct Professor of Business. He received a Ph.D. from the University of Arizona in public finance and econometrics.

JAMES D. CAUSEY

Independent Director

Age 55

Director since 2004

Since 2004, Mr. Causey has served as Vice President of Trader Publishing Company, a nationwide network of classified publications. From 2003 until 2004, Mr. Causey served as a consultant in the publishing industry. From 1999 to 2003, Mr. Causey served as the chief executive officer of Sabot Publishing, a Richmond, Virginia based publisher of leading special interest publications. Mr. Causey received a masters degree in business from the University of Maryland.

Class II members of the Board of Directors whose terms continue to 2011:

BILL GUO

Chairman of the Board and Director

Acting Chief Executive Officer

Age 43

Director since 2008

Mr. Guo is the Chairman and founder of Venturepharm Group, a leading full service pharmaceutical company in Asia, and led its flagship VPL to become the first CRO company listed on the Hong Kong Stock Exchange. Mr. Guo has over ten years of experience in the global pharmaceutical industry in positions ranging from researcher to senior executive at Johnson & Johnson, Novapharm and Venturepharm Canada. Mr. Guo has over nine years of experience as an entrepreneur in China. Mr. Guo was a Ph.D candidate in the Department of pharmaceutics and was awarded an MSC degree in industrial pharmacy from the University of Toronto, an MBA program certificate from Herriot Watt University and an Executive Education certificate from the Judge Business School at the University of Cambridge.

11

Mr. Guo has been recognized by Fortune magazine as one of the top emerging entrepreneurs in China. He has also been the recipient of various awards, including: the State Council of Chinas National Hero Award in 2005; Chinas top ten elite in management in 2004; Chinas top ten most influential individuals in business in 2005; Business Week Asias Youth Chinese Entrepreneur Award in 2005; and the British Chamber of Commerce Entrepreneurs and Innovation Award in 2005.

SAMUEL P. SEARS, JR.

Independent Director

Age 65

Director since 2001

Since March 1999, Mr. Sears has been in private practice as an attorney and has been providing business consulting services. From December 1998 through February 1999, Mr. Sears served as Vice Chairman of American Prescription Providers, Inc., a specialty pharmacy network offering prescriptions and nutriceuticals to patients with chronic diseases. From 1995 through May 1998, Mr. Sears was Chief Executive Officer and Chairman to Star Scientific, Inc., a tobacco company focusing on demonstrating the commercial viability of potentially less harmful tobacco products. Mr. Sears is a graduate of Harvard College and Boston College Law School.

Nominees for election as Class III members of the Board of Directors to serve a three year term expiring in 2012:

RICHARD J. FREER, PH.D.

Chief Operating Officer, acting Secretary and Director

Age - 67

Director since 1992

Since co-founding the Company in 1992, Dr. Freer has served as a director of the Company and he served as the Chairman of the Board up until September of 2008. He assumed the role of Chief Operating Officer in 2002. From 1975 until 1997, Dr. Freer was employed in the Department of Pharmacology and Toxicology at Virginia Commonwealth University (VCU), first as an Associate Professor and then a full Professor. In addition, from 1988 through 1995, Dr. Freer was first Director and then Chair of the Biomedical Engineering Program. From 1996 through 1997, Dr. Freer served as a Professor in VCUs Department of Biochemistry and Molecular Biophysics. Dr. Freer received a bachelors degree in Biology from Marist College and a doctorate degree in Pharmacology from Columbia University.

ERIC V. TAO

Independent Director

Age 42

Director since 2009

Mr. Tao is the Chief Investment Officer and a Director of AGI Capital Group, Inc., a San Francisco based real estate development and asset management firm. Since 2006, Mr. Tao has also been a principal and Director with Avant Housing, an AGI Capital Group joint venture with the California Public Employees Retirement System and TMG Partners, the largest mixed-use real estate development company in the San Francisco Bay area. Mr. Tao is a graduate of Pomona College and the University of California Hastings College of Law.

12

MARIA SONG, M.D., Ph.D.

Independent Director

Age 41

Director since 2009

Dr. Song currently serves as the Chairman of VPS Global. Dr. Song previously served as the General Manager of a Sino-Hong Kong joint venture pharmaceutical company. Dr. Song has over fifteen years of experience in drug development and has conducted a number of multi-center clinical trials, local registration trials, and Phase IV studies for a variety of international clients. Dr. Song is also an expert on regulatory submissions to the Chinese State Food and Drug Administration (SFDA) and often advises the SFDA on policy matters. Dr. Song received her M.D. and Ph.D. from the University of Peking Union Medical College. Dr. Song also received a Master of Economics degree from the Central University of Finance and Economics.

THE BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS THAT YOU

VOTE FOR THE ELECTION OF EACH OF THE CLASS III NOMINEES TO THE BOARD OF

DIRECTORS.

13

PROPOSAL TWO

RATIFICATION OF EXISTING AGREEMENTS AND ISSUANCE OF SECURITIES

(ITEMS 2(A) (G) ON THE PROXY CARD)

Introduction and Summary

The Company has contractual and business relationships with (a) PIPE investors, (b) Fornova and (c) VPL. While these parties, to the Companys knowledge, are not contractually or otherwise related to each other, any change in the Companys relationship with one party is likely to affect its relationships with the other parties. Because the approval of less than all of the items affecting these parties would, management believes, harm the Company, the following items must all be approved if any are to be approved. The failure of a single subpart 2(A) (G) will result in the failure of all other subparts, including any subpart that otherwise receives a majority vote.

PIPE Transaction

On December 31, 2007, the Company completed a private placement (the PIPE) in which it issued $1,950,000 of convertible subordinated notes (the PIPE Notes) and Class A and Class B Warrants to purchase shares of the Companys common stock to the PIPE investors. The PIPE Notes had a conversion price of $2.00 per share. The PIPE Notes are also subject to a limitation prohibiting each PIPE investor from making any individual conversion for a number of shares in excess of 4.99% of the Companys outstanding shares.

Under the PIPE, the Company issued Class A Warrants to purchase 975,000 shares of the Companys common stock. The Class A Warrants had an exercise price of $2.85 per share and expire on May 31, 2013. The Company also issued Class B Warrants to purchase 243,750 shares of the Companys common stock. The Class B Warrants had a purchase price of $5.00 per share and expire on June 30, 2009.

The Modification Agreement

For various reasons, several months after the completion of the PIPE, the Company found itself unable to repay the interest on the PIPE Note. The global economic crisis reduced funding for the Companys projects, which hurt the Companys revenues and the tightening of credit markets hurt the Companys ability to renegotiate terms or obtain financing from other sources. In addition the Company was forced to devote a significant amount of its capital to the operations of its British subsidiary, Exelgen, which has now gone into administration, the British version of bankruptcy. All of theses circumstances left the Company in a position in which it was unable to pay the interest on the PIPE Note. The PIPE investors were willing to waive the default, provided the Company executed the Modification Agreement. The Modification Agreement originally reduced the conversion price of 33% of the remaining principal amount underlying the PIPE Notes from $2.00 to $0.50 per share, however, on July 9, 2009 the Company and the PIPE Investors agreed to lower the conversion price to $0.50 per share for the entire principal amount remaining under the PIPE Note subject to shareholder approval. However, the Company would not issue any shares in excess of 20% without getting shareholder approval. The Modification Agreement also provides that all interest accrued on the PIPE Notes through March 31, 2008 must be paid at a rate of 10% in shares of the Companys common stock and all interest accrued between April 1, 2008 and June 30, 2008 must be paid at a rate of 12% in shares of the Companys common stock. All such interest accrued through June 30, 2009 is deferred until September 30, 2009. Lastly, the exercise price of the Class A Warrants was reduced from $2.85 per share to $0.71 per share and the exercise price of the Class B Warrants was reduced from $5.00 to $1.01 per share.

The Company discussed with NASDAQ Staff its position that the Modification Agreement itself did not require shareholder approval because representations made by the Company in the Subscription Agreement, prevent the Company from issuing common stock under the terms of the Modification Agreement if doing so would violate any NASDAQ Marketplace or Listing Rules. These representations limit the number of shares that the Company may issue in connection with the Modification Agreement. The Company has taken the position that it will not issue any shares if such issuance would cause the Company to violate its obligations under the Subscription Agreement. Nor will the Company issue any shares if such issuance will violate any NASDAQ continued listing requirements or any other NASDAQ rules or bylaws. Thus, the Company believes that even if the terms of the

14

Modification Agreement could be interpreted as allowing the issuance of shares of the Companys common stock in an amount exceeding 20% of the Companys issued and outstanding common stock prior to the Modification Agreement, any such issuance is effectively capped at less than 20% of the Companys issued and outstanding common stock by these sections. Therefore, while the Company does not believe that the Modification Agreement would ever require the Company to issue more than the number of shares permitted under the 20% Rule, the PIPE Investors might challenge CBIs refusal to issue shares above the 20% threshold. As such, the Company has agreed with NASDAQ Staff and the PIPE investors to seek shareholder approval of any issuances under the terms of the Modification Agreement.

The Fornova Note

Nine months after completing the PIPE, the Company determined that it needed to obtain additional financing to meet its operational needs. The Company obtained this financing through the issuance of the Fornova Note. Issuance of the Fornova Note was completed on September 4, 2008. The Fornova Note originally had a Maturity Date of August 28, 2009 and an interest rate of 10% per annum, compounded monthly. Fornova may convert the Fornova Note into shares of the Companys common stock at the conversion price of $1.01 per share. On August 29, 2009, the Company and Fornova executed a First Modification, Waiver and Acknowledgment Agreement extending the maturity date of the Fornova Note to January 1, 2010. Pursuant to the terms of the First Modification, Waiver and Acknowledgment Agreement, the Company agreed to seek shareholder approval to lower the conversion price of the Fornova Note to $0.50 per share.

Fornova and VPL Warrants

A majority of the Companys Board of Directors now deems it in the Companys best interests to issue Series A and B Warrants to Fornova and VPL and reduce the conversion price of the Fornova Note. Upon shareholder approval, the Company will reduce the conversion price of the Fornova Note to $0.50, issue Fornova 2,000,000 Series A Warrants with an exercise price of $0.71 and a term of five years and 500,000 Series B Warrants with an exercise price of $1.01 and a term of one year. Upon shareholder approval, the Company will also issue VPL 3,920,139 Series A Warrants with an exercise price of $0.71 and a term of five years from the date of issuance and 653,357 Series B Warrants with an exercise price of $1.01 and a term of one year from the date of issuance. The Company deems it necessary to reduce the conversion price of the Fornova Note and issue the Warrants to Fornova and VPL as part of its plan to achieve and maintain compliance with the NASDAQ Capital Market shareholder equity requirements.

What vote is required to approve the proposal?

Approval of each subpart of the proposal requires the affirmative vote of a majority of the total votes cast on each subpart of this proposal.

What happens if the proposal is not approved?

If any subpart of this proposal is not approved, then all subparts of this proposal will collectively fail, including subparts that receive a majority vote.

A MAJORITY OF THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS THAT YOU

VOTE FOR THE ADOPTION OF ALL SUBPARTS OF THIS PROPOSAL.

15

PROPOSAL 2(A)

RATIFICATION OF THE MODIFICATION AGREEMENT AND APPROVAL OF ISSUANCES

THEREUNDER THAT WILL RESULT IN THE ISSUANCE OF 20% OR MORE OF THE COMPANYS

OUTSTANDING COMMON STOCK

(ITEM 2(A) ON THE PROXY CARD)

Why did the Company enter into the Modification Agreement?

Prior to entering the Modification Agreement, the Company would have been in default under the PIPE due to its failure to repay interest on the PIPE Note. A number of circumstances contributed to the Companys inability to repay the interest on the PIPE Note. The global economic crisis hurt the Companys revenues due to reduced funding for projects, the tightening of credit markets affected the Companys ability to renegotiate terms or obtain financing from other sources, and the Company was forced to devote significant capital to propping up the operations of its English subsidiary Exelgen, which has since gone into administration, the British equivalent of bankruptcy.

To avoid going into default under the PIPE, the Company executed the Modification Agreement on September 18, 2008 as consideration for the agreement of the PIPE investors to waive the restrictions that would have placed the Company in default. The Company and the PIPE investors then amended the Modification Agreement on July 9, 2009. The Modification Agreement lowered the conversion price of the underlying principal amount of the PIPE Notes and lowered the exercise price of the warrants under the PIPE subject to shareholder approval.

Why is CBI seeking approval of the proposal?

As a result of being listed for trading on the NASDAQ Capital Market, issuances of the Companys common stock are subject to the NASDAQ Stock Market Listing Rules, such as Rule 5635. Under Rule 5635, shareholder approval must be sought when (a) the issuance or potential issuance will result in a change of control of the Company or (b) in connection with a transaction other than a public offering involving the sale, issuance or potential issuance by the Company of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for less than the greater of the book or market value of the stock (the 20% Rule).

The Company has discussed with NASDAQ Staff its position that the issuance of the Fornova Note and the execution of the Modification Agreement were separate transactions that did not violate the 20% Rule. Further, the Company has also discussed with NASDAQ Staff its position that the Modification Agreement itself did not require shareholder approval because representations made by the Company in the Subscription Agreement prevent the Company from issuing common stock under the terms of the Modification Agreement if doing so would violate any NASDAQ Marketplace or Listing Rule.

Under Section 5(m) of the Subscription Agreement, Neither the Company nor any of its Affiliates will take any action or steps that would cause the offer or issuance of the Securities to be integrated with other offerings which would impair the exemptions relied upon in this Offering or the Companys ability to timely comply with its obligations hereunder. The Company will not conduct any offering other than the transactions contemplated hereby that will be integrated with the offer or issuance of the Securities that would impair the exemptions relied upon in connection with the offer and sale of the Securities or the Companys ability to timely comply with its obligations hereunder. Furthermore in Section 5(v) of the Subscription Agreement, the Company represents that it satisfies all the requirements for the continued listing of its Common Stock on the NCM. Lastly, in Section 9(b) of the Subscription Agreement, the Company agrees that it will comply in all material respects with the Companys reporting, filing and other obligations under the bylaws or rules of the Principal Market, as applicable.

The Company believes that these sections limit the number of shares that the Company may issue in connection with the Modification Agreement. The Company will not issue any shares if such issuance would cause the Company to violate its obligations under the Subscription Agreement. Nor will the Company issue any shares if

16

such issuance will violate any NASDAQ continued listing requirements or any other NASDAQ rules or bylaws. Thus, the Company believes that even if the terms of the Modification Agreement could be interpreted as allowing the issuance of shares of the Companys common stock in an amount exceeding 20% of the Companys issued and outstanding common stock prior to the Modification Agreement, any such issuance is effectively capped at less than 20% of the Companys issued and outstanding common stock by these sections in the absence of shareholder approval.

In addition, while the Company does not believe that the Modification Agreement would ever require the Company to issue more than the number of shares permitted under the 20% Rule, the PIPE Investors disagree with CBIs refusal to issue shares above the 20% threshold. Therefore, the Company has agreed with NASDAQ Staff and the PIPE investors to seek shareholder approval of any issuances under the terms of the Modification Agreement.

What is the dilutive impact of the Modification Agreement?

The Modification Agreement requires that the conversion price for the remaining balance of the PIPE Notes be lowered from $2.00 per share to $0.50 per share. On the date of the Modification Agreement, the outstanding principal balance on the PIPE Notes was $1,850,000. Additionally, the Company and the PIPE investors entered into a swap agreement on June 22, 2009 whereby the Company issued subordinated notes in the amount of $369,950 to the PIPE investors. The purchase price for these notes was paid for by the partial surrender and deemed payment of interest of a portion of the PIPE Notes, effectively reducing the outstanding balance of the PIPE Notes to $1,480,050. Therefore, without the effect of the Modification Agreement, there are 740,025 shares of common stock underlying the PIPE Note. Following the Modification Agreement, there are 2,960,100 shares underlying the PIPE Note. Additionally, the Modification Agreement provides that the Company make interest payments on the PIPE Notes with common stock at an interest rate of 10% and a conversion price of $0.50 for interest accrued during the quarterly period ended March 31, 2008 and at a rate of 12% and a conversion price of $0.50 for the quarterly period ended June 30, 2008. As a result, there are a further 214,500 shares underlying these interest payments. Thus, with the shares underlying the PIPE Note combined with the interest payments, there are 3,174,600 shares issuable in connection with the Modification Agreement. This represents 47.90% of the currently outstanding shares of the Company. If all these shares are issued, the Company would then have 12,086,296 shares outstanding, of which 32.39% would be issued under the Modification Agreement. The following table illustrates the shares underlying the Modification Agreement and percentages of CBI outstanding shares:

| Number of shares |

Number of shares issuable in connection with the Modification Agreement (revalued PIPE Note + interest shares) |

Percentage of currently outstanding CBI shares represented by Modification Agreement |

Percentage of CBI shares issued under Modification Agreement following issuance* |

|||||

| 740,025 | 3,174,600 | 38.85 | %** | 27.97 | %** |

| * | For purposes of this table, the percentage assumes no other issuances under the other subparts of Proposal 2. See page 30 for a discussion of the cumulative effect of approving all subparts under this Proposal 2. |

| ** | This percentage does not include the shares underlying the Class A and Class B Warrants issued under the PIPE. |

What vote is required to approve the proposal?

Approval of the proposal requires the affirmative vote of a majority of the total votes cast on this proposal and a majority of the total votes cast on each of the other subparts of Proposal 2.

What happens if the proposal is not approved?

If the proposal is not approved by the Companys shareholders, then the Company would continue to refuse to issue shares under the Modification Agreement that surpass the 20% threshold, however it is possible that the PIPE Investors might challenge the Companys refusal to issue such shares and the Company may ultimately be forced to issue shares to the PIPE Investors in excess of the 20% threshold, which would subject the Company to

17

possible delisting from the NASDAQ Capital Market for failing to comply with listing requirements. In addition, if this proposal is not approved, all other subparts of Proposal 2 will fail, as each subpart of Proposal 2 is contingent upon the approval of all subparts of Proposal 2.

THE BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS THAT YOU

VOTE FOR THE ADOPTION OF THIS PROPOSAL.

18

PROPOSAL 2(B)

RATIFICATION OF THE FORNOVA NOTE

(ITEM 2(B) ON THE PROXY CARD)

Why is the Company proposing the action to be voted on?

On December 31, 2007, the Company completed the PIPE in which it issued the PIPE Notes and warrants to purchase shares of the Companys common stock. Nine months after completing the PIPE, the Company determined that it needed to obtain additional financing to meet its operational needs. The Company obtained this financing through the issuance of the Fornova Note. The Fornova Note has a principal amount of $500,000, a Maturity Date of August 28, 2009 and an interest rate of 10% per annum, compounded monthly. The maturity date has been extended to January 1, 2010. Fornova may convert the Fornova Note into shares of the Companys common stock at the conversion price of $1.01 per share. While the Fornova Note did not require shareholder approval, the Board of Directors considers it desirable to have the shareholders ratify the issuance of the Fornova Note.

What is the dilutive impact of the Fornova Note?

Should Fornova exercise its right to convert the Fornova Note into shares of the Companys common stock at the exercise price of $1.01 per share, the Company would have to issue 495,049 shares to Fornova. As of September 14, 2009, the Company had 8,171,796 shares of common stock issued and outstanding. Thus, the shares issuable under the Fornova Note represent 6.06% of the currently outstanding shares. If these shares are issued, the Company would then have 8,666,845 shares outstanding, of which 5.71% would be owned by Fornova. The following table illustrates Fornovas percentage ownership of the Company before and after the issuance of shares under the Fornova Note:

| Number of CBI shares |

Number of CBI shares held by Fornova following conversion of the Fornova Note |

Percentage of currently outstanding CBI shares represented by shares underlying the Fornova Note |

Percentage of CBI shares owned by Fornova following conversion of Fornova Note* |

|||||

| 0 | 495,049 | 6.06 | % | 5.71 | % |

| * | For purposes of this table, the percentage assumes no other issuances under the other subparts of Proposal 2. |

What vote is required to approve the proposal?

Approval of the proposal requires the affirmative vote of a majority of the total votes cast on this proposal and a majority of the total votes cast on each of the other subparts of Proposal 2.

What happens if the proposal is not approved?

If the proposal is not approved by the Companys shareholders, then the Board of Directors will reconsider the Fornova Note and the Companys obligations thereunder. In addition, if this proposal is not approved, all other subparts of Proposal 2 will fail, as each subpart of Proposal 2 is contingent upon the approval of all subparts of Proposal 2.

THE BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS THAT YOU

VOTE FOR THE ADOPTION OF THIS PROPOSAL.

19

PROPOSAL 2(C)

APPROVAL OF THE AMENDMENT OF THE FORNOVA NOTE

TO REDUCE THE CONVERSION PRICE THEREUNDER

(ITEM 2(C) ON THE PROXY CARD)

Why is the Company proposing the action to be voted on?

On April 8, 2009, the Company received a notice stating that the Companys stock was subject to potential delisting from the NASDAQ Capital Market for failing to comply with Marketplace Rule 4310(c)(3) (now NASDAQ Listing Rule 5550(b)), which requires the Company to have a minimum of $2,500,000 in stockholders equity, $35,000,000 market value of listed securities, or $500,000 of net income from continuing operations for the most recently completed fiscal year or two of the three most recently completed fiscal years. NASDAQ has since determined that the Company has not met the requirements of Rule 5550(b). The Company is appealing this decision and will need to provide NASDAQ with a specific plan detailing how it will achieve and sustain compliance with the NASDAQ Capital Market listing requirements. As part of the Companys plan to achieve and sustain compliance, the Company is seeking shareholder approval to lower the exercise price of the Fornova Note from $1.01 to $0.50. This will make it more likely that Fornova will exercise the note, increasing the Companys stockholders equity.

What is the dilutive impact of lowering the conversion price of the Fornova Note?

Should the conversion price of the Fornova Note be lowered to $0.50 per share, then the number of shares underlying the Fornova Note would increase from 495,049 to 1,000,000. This represents 12.24% of the Companys currently outstanding 8,171,796 shares of common stock. If these shares are issued, the Company would then have 9,171,796 shares outstanding, of which 10.90% would be owned by Fornova. The following table illustrates Fornovas percentage ownership of the Company before and after the issuance of shares under the Fornova Note at both the current conversion price and the proposed conversion price:

| Conversion Price |

Number of CBI shares currently held by Fornova |

Number of CBI shares held by Fornova following conversion of the Fornova Note |

Percentage of currently outstanding CBI shares represented by shares underlying the Fornova Note |

Percentage of CBI shares owned by Fornova following conversion of Fornova Note* |

|||||||

| $ | 1.01 | 0 | 495,049 | 6.06 | % | 5.71 | % | ||||

| $ | 0.50 | 0 | 1,000,000 | 12.24 | % | 10.90 | % | ||||

| * | For purposes of this table, the percentage assumes no other issuances under the other subparts of Proposal 2. |

What vote is required to approve the proposal?

Approval of the proposal requires the affirmative vote of a majority of the total votes cast on this proposal and a majority of the total votes cast on each of the other subparts of Proposal 2.

20

What happens if the proposal is not approved?

If the proposal is not approved by the Companys shareholders, then the Company will reconsider lowering the conversion price of the Fornova Note. The potential change of the conversion price will not result in an issuance of common stock in excess of the 20% threshold. As such the Company may lower the conversion price of the Fornova Note without shareholder approval if the Board of Directors believes it to be in the best interests of the Company to do so. However, if this proposal is not approved, all other subparts of Proposal 2 will fail, as each subpart of Proposal 2 is contingent upon the approval of all subparts of Proposal 2.

THE BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS THAT YOU

VOTE FOR THE ADOPTION OF THIS PROPOSAL.

21

PROPOSAL 2(D)

APPROVAL OF THE ISSUANCE OF SERIES A WARRANTS TO FORNOVA

(ITEM 2(D) ON THE PROXY CARD)

Why is the Company proposing the action to be voted on?

On April 8, 2009, the Company received a notice stating that the Companys stock was subject to potential delisting from the NASDAQ Capital Market for failing to comply with Marketplace Rule 4310(c)(3) (now NASDAQ Listing Rule 5550(b)), which requires the Company to have a minimum of $2,500,000 in stockholders equity, $35,000,000 market value of listed securities, or $500,000 of net income from continuing operations for the most recently completed fiscal year or two of the three most recently completed fiscal years. NASDAQ has since determined that the Company has not met the requirements of Rule 5550(b). The Company is appealing this decision and will need to provide NASDAQ with a specific plan detailing how it will achieve and sustain compliance with the NASDAQ Capital Market listing requirements. As part of the Companys plan to achieve and sustain compliance, the Company is seeking shareholder approval to issue 2,000,000 Series A Warrants with an exercise price of $0.71 per share to Fornova. The exercise of these Warrants would raise the Companys stockholders equity and significantly contribute to sustaining the minimum $2,500,000 level required by Listing Rule 5550(b).

While a majority of the Board of Directors believes issuing the Warrants to Fornova is in the best interests of the shareholders and necessary to achieve compliance with the NASDAQ Capital Market listing requirements, it is possible that the PIPE Investors could view the issuance of these Warrants as a default under the PIPE. Under Section 9(s) of the subscription agreement dated December 31, 2007, by and among the Company and the PIPE Investors (the Subscription Agreement), the Company agreed to not (i) directly or indirectly issue any Common stock or instruments convertible, exercisable or exchangeable for Common Stock at a per share of Common Stock equivalent price of less than $2.75. While the Company has received verbal assurance from the PIPE investors that the issuance of the Fornova Warrants will not place the Company in default, should issuance of the Fornova Warrants place the Company in default of its obligations under the PIPE, the Company could be forced to repay all monies currently owed to the PIPE Investors. Nevertheless, the Company believes the issuance of Series A Warrants to Fornova is necessary to both achieve compliance with the NASDAQ Capital Market listing requirements and to maintain the continued investment support of Fornova.

What is the dilutive impact of the Fornova Series A Warrants?

Exercise of all of the Series A Warrants would result in the issuance of 2,000,000 shares to Fornova and would increase the number of outstanding CBI shares to 10,171,796. The 2,000,000 shares owned by Fornova would then equal 19.66% of the outstanding shares of the Company. The effect of exercise of the Fornova Series A Warrants is illustrated in the table below:

| Number of shares underlying currently held by Fornova |

Number of shares underlying proposed Fornova Series A Warrants |

Percentage of outstanding CBI shares represented by proposed Fornova Series A Warrants following exercise* |

|||

| 0 | 2,000,000 | 19.66 | % |

| * | For purposes of this table, the percentage assumes no other issuances under the other subparts of Proposal 2 and does not include any other shares that may be currently held, issuable or convertible. |

What vote is required to approve the proposal?

Approval of the proposal requires the affirmative vote of a majority of the total votes cast on this proposal and a majority of the total votes cast on each of the other subparts of Proposal 2.

22

Why is CBI seeking approval of the proposal?

The warrants to be issued to Fornova, if exercised, could result in an issuance of stock in excess of the 20% threshold. To comply with NASDAQ Marketplace and Listing Rules the Company must first obtain shareholder approval before issuing such warrants.

What happens if the proposal is not approved?

If the proposal is not approved by the Companys shareholders, then the Company will not be able to issue the warrants to Fornova. This would impede the Companys ability to achieve and sustain compliance with the NASDAQ Capital Market listing requirements. As such, the Company would have to modify its plan to achieve and sustain compliance. In addition, if this proposal is not approved, all other subparts of Proposal 2 will fail, as each subpart of Proposal 2 is contingent upon the approval of all subparts of Proposal 2.

When do you expect the Series A Warrants to Fornova to be issued?

The Company currently anticipates that it will issue the warrants on or about October 10, 2009, subject to approval at its annual meeting of shareholders on October 9, 2009.

A MAJORITY OF THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS THAT YOU

VOTE FOR THE ADOPTION OF THIS PROPOSAL.

23

PROPOSAL 2(E)

APPROVAL OF THE ISSUANCE OF SERIES B WARRANTS TO FORNOVA

(ITEM 2(E) ON THE PROXY CARD)

Why is the Company proposing the action to be voted on?

On April 8, 2009, the Company received a notice stating that the Companys stock was subject to potential delisting from the NASDAQ Capital Market for failing to comply with Marketplace Rule 4310(c)(3) (now NASDAQ Listing Rule 5550(b)), which requires the Company to have a minimum of $2,500,000 in stockholders equity, $35,000,000 market value of listed securities, or $500,000 of net income from continuing operations for the most recently completed fiscal year or two of the three most recently completed fiscal years. NASDAQ has since determined that the Company has not met the requirements of Rule 5550(b). The Company is appealing this decision and will need to provide NASDAQ with a specific plan detailing how it will achieve and sustain compliance with the NASDAQ Capital Market listing requirements. As part of the Companys plan to achieve and sustain compliance, the Company is seeking shareholder approval to issue 500,000 Series B Warrants with an exercise price of $1.01 per share to Fornova. The exercise of these Warrants would raise the Companys stockholders equity and significantly contribute to sustaining the minimum $2,500,000 level required by Listing Rule 5550(b).

While the Company believes issuing the Warrants to Fornova is in the best interests of the shareholders and necessary to achieve compliance with the NASDAQ Capital Market listing requirements, it is possible that the PIPE Investors could view the issuance of these Warrants as a default under the PIPE. Under Section 9(s) of the subscription agreement dated December 31, 2007, by and among the Company and the PIPE Investors (the Subscription Agreement), the Company agreed to not (i) directly or indirectly issue any Common stock or instruments convertible, exercisable or exchangeable for Common Stock at a per share of Common Stock equivalent price of less than $2.75. While the Company has received verbal assurance from the PIPE investors that the issuance of the Fornova Warrants will not place the Company in default, should issuance of the Fornova Warrants place the Company in default of its obligations under the PIPE, the Company could be forced to repay all monies currently owed to the PIPE Investors. Nevertheless, the Company believes the issuance of Series B Warrants to Fornova is necessary to both achieve compliance with the NASDAQ Capital Market listing requirements and to maintain the continued investment support of Fornova.

What is the dilutive impact of the Fornova Series B Warrants?

Exercise of all of the Series B Warrants would result in the issuance of 500,000 shares to Fornova and would increase the number of outstanding CBI shares to 8,671,796. The 500,000 shares owned by Fornova would then equal 5.77% of the outstanding shares of the Company. The effect of exercise of the Fornova Series B Warrants is illustrated in the table below:

| Number of shares underlying currently held by Fornova |

Number of shares underlying proposed Fornova Series B Warrants |

Percentage of outstanding CBI shares represented by proposed Fornova Series B Warrants following exercise* |

|||

| 0 | 500,000 | 5.77 | % |

| * | For purposes of this table, the percentage assumes no other issuances under the other subparts of Proposal 2 and does not include any other shares that may be currently held, issuable or convertible. |

What vote is required to approve the proposal?

Approval of the proposal requires the affirmative vote of a majority of the total votes cast on this proposal and a majority of the total votes cast on each of the other subparts of Proposal 2.

24

Why is CBI seeking approval of the proposal?

The warrants to be issued to Fornova, if exercised, could result in an issuance of stock in excess of the 20% threshold. To comply with NASDAQ Marketplace and Listing Rules the Company must first obtain shareholder approval before issuing such warrants.

What happens if the proposal is not approved?

If the proposal is not approved by the Companys shareholders, then the Company will not be able to issue the warrants to Fornova. This would impede the Companys ability to achieve and sustain compliance with the NASDAQ Capital Market listing requirements. As such, the Company would have to modify its plan to achieve and sustain compliance. In addition, if this proposal is not approved, all other subparts of Proposal 2 will fail, as each subpart of Proposal 2 is contingent upon the approval of all subparts of Proposal 2.

When do you expect the Series B Warrants to Fornova to be issued?

The Company currently anticipates that it will issue the warrants on or about October 10, 2009, subject to approval at its annual meeting of shareholders on October 9, 2009.

A MAJORITY OF THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS THAT YOU