SC 13D/A: Schedule filed to report acquisition of beneficial ownership of 5% or more of a class of equity securities

Published on September 26, 2008

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment

No. 1)*

Commonwealth

Biotechnologies Inc.

Common

Stock, with no par value per share

CUSIP

Number: 202739108

Venturepharm

Laboratories Limited

No.3

Jinzhuang, Si Ji Qing

Haidian

District, Beijing

People’s

Republic of China

Attn:

George Peng

Tel:

+86

(10) +86 (10) 88500088 ext 280

September

12, 2008

If

the

filing person has previously filed a statement on Schedule 13G to report

the

acquisition that is the subject of this Schedule 13D, and is filing this

schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the

following box. o

Note:

Schedules filed in paper format shall include a signed original and five

copies

of the schedule, including all exhibits. See §240.13d-7 for other parties to

whom copies are to be sent.

*

The

remainder of this cover page shall be filled out for a reporting person’s

initial filing on this form with respect to the subject class of securities,

and

for any subsequent amendment containing information which would alter

disclosures provided in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed

to

be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but

shall be subject to all other provisions of the Act (however, see the

Notes).

SCHEDULE

13D

CUSIP

Number: 202739108

|

1

|

Names

of Reporting Persons

I.R.S.

Identification Nos. of above persons (entities only)

Venturepharm

Laboratories Limited

|

||

|

2

|

Check

the Appropriate Box if a Member

of a Group (See Instructions)

(a)

o

(b)

x

|

||

|

3

|

SEC

Use Only

|

||

|

4

|

Source

of Funds (See Instructions)

WC

and OO

|

||

|

5

|

Check

if Disclosure Of Legal Proceedings Is

Required

o

Pursuant

to Items 2(d) OR 2(e)

|

||

|

6

|

Citizenship

or Place of Organization

Cayman

Islands

|

||

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

Sole

Voting Power

2,613,426

|

|

|

8

|

Shared

Voting Power

|

||

|

9

|

Sole

Dispositive Power

2,613,426

|

||

|

10

|

Shared

Dispositive Power

|

||

|

11

|

Aggregate

Amount Beneficially Owned By Each Reporting Person

2,613,426

|

||

|

12

|

Check

if the Aggregate Amount In Row (11) Excludes

Certain

Shares

o

(See

Instructions)

|

||

|

13

|

Percent

of Class Represented by Amount in Row (11)

43.3%*

|

||

|

14

|

Type

of Reporting Person (See Instructions)

CO

|

||

*

Calculated on the basis of the Issuer having 6,037,788 issued and outstanding

shares of common stock, according to the information provided by the

Issuer on

September 12, 2008.

SCHEDULE

13D

CUSIP

NO.: 202739108

|

1

|

Names

of Reporting Persons

I.R.S.

Identification Nos. of above persons (entities only)

William

Xia Guo

|

||

|

2

|

Check

the Appropriate Box if a Member

of a Group (See Instructions)

(a)

o

(b)

x

|

||

|

3

|

SEC

Use Only

|

||

|

4

|

Source

of Funds (See Instructions)

WC

and OO

|

||

|

5

|

Check

if Disclosure Of Legal Proceedings Is

Required

o

Pursuant

to Items 2(d) OR 2(e)

|

||

|

6

|

Citizenship

or Place of Organization

Canada

|

||

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

Sole

Voting Power

2,613,4261

|

|

|

8

|

Shared

Voting Power

|

||

|

9

|

Sole

Dispositive Power

2,613,4262

|

||

|

10

|

Shared

Dispositive Power

|

||

|

11

|

Aggregate

Amount Beneficially Owned By Each Reporting Person

2,613,4263

|

||

|

12

|

Check

if the Aggregate Amount In Row (11) Excludes

Certain

Shares

o

(See

Instructions)

|

||

|

13

|

Percent

of Class Represented by Amount in Row (11)

43.3%4

|

||

|

14

|

Type

of Reporting Person (See Instructions)

IN

|

||

1

William

Xia Guo indirectly owns 2,613,426 shares of common stock in the Issuer

merely by

virtue of him being the majority owner of Venturepharm Laboratories

Limited.

2

See note

1 above.

3

See note

1 above.

4

See note

1 above.

This

amended and restated statement on Schedule 13D/A amends and restates the

statement on Schedule 13D originally filed by Venturepharm Laboratories Limited

and William Xia Guo jointly, with the Securities and Exchange Commission on

July

25, 2008, and relates to the shares of the common stock of Commonwealth

Biotechnologies Inc.

Item

1 - Security and Issuer

This

Schedule 13D relates to the common stock with no par value per share of

Commonwealth Biotechnologies, Inc (the “Issuer”).

The

address of the Issuer’s principal office is at 601 Biotech Drive, Richmond,

Virginia 23235.

Item

2 - Identity and Background

Venturepharm

Laboratories Limited (“VPL”)

is a

corporation incorporated in the Cayman Islands, and its shares are listed on

the

Growth Enterprise Market of the Hong Kong Stock Exchange Limited (stock code:

8225). Its principal address is No. 3 Jinzhuang, Si Ji Qing, Haidian District,

Beijing, PRC, 100089. William Xia Guo is a majority owner of VPL5 .

He is a

citizen of Canada. His business address is No. 3 Jinzhuang, Si Ji Qing, Haidian

District, Beijing, PRC, 100089. He is the Chief Executive Officer of VPL having

its principal address at No. 3 Jinzhuang, Si Ji Qing, Haidian District, Beijing,

PRC, 100089. VPL and William Xia Guo are collectively referred to as the

“Reporting

Persons”

and

each, a “Reporting

Person”

in

this

Statement.

_________________

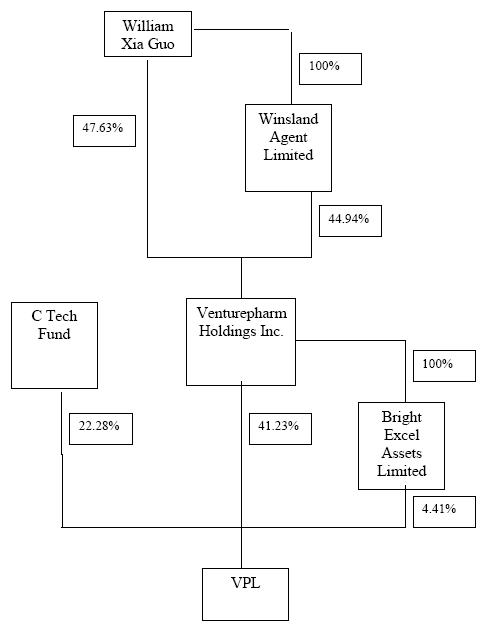

5 See

diagram attached as Schedule II to this Statement showing the interest William

Xia Guo holds in VPL.

The

Reporting Persons are making this single, joint filing pursuant to Rule

13(d)-1(k) promulgated by the Securities and Exchange Commission pursuant to

Section 13 of the Securities Exchange Act of 1934, as amended.

Schedule

I attached to this Statement contains the following information concerning

each

director, executive officer and controlling person of VPL: (i) name and

residence or business address, (ii) principal occupation or employment and

(iii)

the name, principal business and address of any corporation or other

organization in which such employment is conducted. Schedule I is incorporated

by reference. All persons listed on Schedule I are collectively referred to

as

“Schedule

I Persons”

in

this

Statement.

During

the last five years, none of the Reporting Persons and the Schedule I Persons

has been convicted in a criminal proceeding (excluding traffic violations or

similar misdemeanors). During the last five years, none of the Reporting Persons

and the Schedule I Persons has been a party to a civil proceeding of a judicial

or administrative body of competent jurisdiction and, as a result of such

proceeding, is or was subject to a judgment, decree or final order enjoining

future violations of, or prohibiting or mandating activities subject to, federal

or state securities laws or finding any violation with respect to such laws.

Item

3 - Source and Amount of Funds or Other Consideration

The

securities reported in this Statement were acquired as follows: (a) 463,426

shares (the “Ancillary

Shares”)

were

acquired on June 26, 2008 through the exercise of a put option by the Issuer

pursuant to an Ancillary Agreement dated 28 March 2008 between VPL and the

Issuer (the “ Ancillary

Agreement”)

as

amended and supplemented by a Subscription and Waiver Agreement dated 8 May

2008

and between VPL and the Issuer (“ Subscription

and Waiver Agreement ”),

and

(b) 2,150,000 shares (the “Sale

Shares”)

were

acquired on September 12, 2008 under a Share Sale Agreement between VPL and

PharmAust Limited dated 28 March 2008 (the “Share

Sale Agreement”),

under

which PharmAust Limited agreed to sell, and VPL agreed to purchase, the Sale

Shares subject to the satisfaction of certain conditions.

The

consideration for the Ancillary Shares was US$1,000,000, which was satisfied

by

(a) VPL paying to the Issuer US$500,000 by wire transfer of immediate available

funds and (b) VPL issuing 2,229,664 shares in VPL (“ VPL

Consideration Shares ”)

to the

Issuer. Pursuant to the terms of the Ancillary Agreement, the number of VPL

Consideration Shares was arrived at by dividing HK$3,895,000, (equivalent to

approximately US$500,000) by HK$1.7469, which was approximately 90% of the

arithmetic average of the closing prices of one share in VPL as published in

the

Daily Quotation Sheets published by the Hong Kong Stock Exchange Limited for

the

50 consecutive trading days immediately prior to and including 25 April 2008.

The

cash

consideration in the sum of US$500,000 was funded by working capital of VPL.

The

consideration for the Sale Shares was US$3,117,500, which was satisfied by

VPL

paying to the Issuer US$3,117,500 by wire transfer of immediate available funds.

The

cash

consideration in the sum of US$3,117,500 was funded by working capital of VPL.

Item

4 - Purpose of the Transaction

The

Issuer engages in the business of, among others, biology, lead optimization

and

chemical syntheses while VPL and its subsidiaries engage in the business of,

among others, formulation and clinical trials. Both the Issuer and the VPL’s

group operate in the business of drug discovery process development and

scale-up. The services of the Issuer and VPL cover the key areas in the value

chain of the life science R&D outsourcing industry. VPL considered that

through the acquisition of the securities in the Issuer, VPL would be able

to

strengthen its research and development services in existing therapeutic areas,

expand its therapeutic capacity by entering into new segments of industry and

complement its geographical expansion strategy to strengthen delivery

capabilities.

Except

as

disclosed below, the Reporting Persons have no plan or proposal which relate

to

or would result in (a) the acquisition by any person of additional securities

of

the Issuer, or the disposition of securities of the Issuer; (b) an extraordinary

corporate transaction, such as a merger, reorganization or liquidation,

involving the Issuer or any of its subsidiaries; (c) a sale or transfer of

a

material amount of assets of the Issuer or any of its subsidiaries; (d) any

change in the present board of directors or management of the Issuer, including

any plans or proposals to change the number or term of directors or to fill

any

existing vacancies on the board; (e) any material change in the present

capitalization or dividend policy of the Issuer; (f) any other material change

in the Issuer’s business or corporate structure, including but not limited to,

if the Issuer is a registered closed-end investment company, any plans or

proposals to make any changes in its investment policy for which a vote is

required by section 13 of the Investment Company Act of 1940; (g) changes in

the

Issuer’s charter, bylaws or instruments corresponding thereto or other actions

which may impede the acquisition of control of the Issuer by any person; (h)

causing a class of securities of the Issuer to be delisted from a national

securities exchange or to cease to be authorized to be quoted in an inter-dealer

quotation system of a registered national securities association; (i) a class

of

equity securities of the Issuer becoming eligible for termination of

registration pursuant to section 12(g)(4) of the Securities Exchange Act of

1934, as amended; and (j) any action similar to any of those enumerated above.

| a) |

VPL

entered into the Share Sale Agreement with PharmAust Limited, a company

incorporated in Australia. Under the Share Sale Agreement, PharmAust

agreed to sell, and VPL agreed to purchase, subject to the satisfaction

of

certain conditions, 2,150,000 shares of the common stock of the Issuer.

As

of the date of this Statement, all the conditions for completion

of the

sale and purchase of the Sale Shares were

satisfied.

|

| b) |

Upon

completion of the sale and purchase under the Share Sale Agreement,

VPL

became entitled to nominate a director to the board of the Issuer

in

accordance with the Issuer’s Articles of Incorporation and Bylaws and

applicable U.S. federal and state

laws.

|

| c) |

The

Sale Shares were subject to certain restrictions under the Virginia

Control Share Acquisition Statute. On March 21, 2008, the Issuer

amended

its Bylaws to remove the applicability of the Virginia Control Share

Acquisition Statute to the effect that upon acquisition of the Sale

Shares

by VPL, the Sale Shares shall be outstanding voting shares of the

Issuer’s

common stock, and rank pari passu with all issued and outstanding

shares

of the Issuer.

|

| d) |

Under

the Ancillary Agreement, among other things, the Issuer granted

VPL

two separate options to purchase, at any time prior to the date that

is

the third anniversary of the date of the Ancillary Agreement, up

to an

aggregate of US$3,000,000 of shares of the common stock of the Issuer

(“Call

Shares”).

Pursuant to the Ancillary Agreement, the Call Shares shall be purchased

at

a price per share equal to 90% of the arithmetic average of the closing

sale prices of one share of the common stock of the Issuer as reported

by

the NASDAQ Capital Market, for the fifty consecutive trading days

immediately prior to (but not including) the second business day

before

the date on which VPL will purchase the Call Shares from the Issuer.

The

consideration for the Call Shares will be satisfied by VPL as to

one-half

by cash and one-half by ordinary shares of

VPL.

|

Although

the number of shares that could be purchased pursuant to these additional

options cannot be precisely determined, if the option had been exercised on

September 12, 2008, approximately 3,000,000 shares could have been

purchased.

Item

5 - Interest in Securities of the Issuer

| a) |

As

at September 12, 2008 the Issuer has 6,037,788 issued and outstanding

shares of its common stock (including the securities reported in

this

Amendment). VPL directly beneficially owns 2,613,426 shares of the

common

stock of the Issuer, which consists of approximately 43.3% of the

outstanding common stock of the Issuer. In addition, as of 28 March

2008,

VPL has the ability to acquire additional shares based on a formula

price;

see Item 4 above. As at September 12, 2008, William Xia Guo indirectly

owns 2,613,426 shares of the common stock of the Issuer, which consists

of

approximately 43.3% of the outstanding common stock of the

Issuer6.

There is no person who together with any of the persons named in

Item 2

above, comprise a group within the meaning of section 13(d)(3) of

the

Act.

|

_________________

6 See

note 1 above.

| b) |

VPL

holds 2,613,426 shares of the common stock of the Issuer as to which

there

is sole power to vote and to dispose. William Xia Guo indirectly

holds

2,613,426 shares of the common stock of the Issuer7

as

to which there is sole power to direct the vote or to direct the

disposition.

|

| c) |

Neither

VPL nor William Xia Guo has effected any transactions in the common

stock

of the Issuer since the most recent filing of Schedule 13D.

|

| d) |

William

Xia Guo, by virtue of being the majority owner of VPL, has the right

to

receive or the power to direct the receipt of dividends from, or

the

proceeds from the sale of, the securities reported in this Statement.

|

| e) |

Not

applicable.

|

Item

6 - Contracts, Arrangements, Understanding or Relationship with

respect

of Securities of the Issuer

| a) |

VPL

and PharmAust entered into the Sale Share Agreement on 28 March 2008

in

relation to the sale and purchase of the Sale Shares. Please refer

to Item

4 above for further details.

|

| b) |

VPL

and the Issuer entered into the Ancillary Agreement on 28 March 2008

whereby (i) VPL granted the Issuer a put option to sell to VPL the

securities reported in this Amendment, and (ii) the Issuer granted

VPL two

call options to purchase from the Issuer, at any time prior to the

date

that is the third anniversary of the date of the Ancillary Agreement

(i.e.

28 March 2008), up to an aggregate of US$3,000,000 of shares of the

common

stock of the Issuer. By the Subscription and Waiver Agreement entered

into

between VPL and the Issuer on 8 May 2008, VPL and the Issuer agreed

to

waive the prohibition under the Ancillary Agreement that the Issuer

may

not exercise the put option until the expiration of a 60-day period

following the completion of the acquisition of the Sale Shares, and

the

Issuer agreed to exercise the put

option.

|

_________________

7 See

note 1 above.

| c) |

VPL

and the Issuer entered into a Registration Rights Agreement on 28

March

2008 (the “Registration

Rights Agreement”),

whereby VPL may, at any time after the date that is the second anniversary

of the date of the Registration Rights Agreement, request registration

under the United States Securities Act of 1933, as amended, of all

or any

portion of the Sale Shares on an applicable Securities Exchange Commission

(the “SEC”)

form. Subject to the decision of the board of directors of the Issuer,

the

Issuer may postpone for up to 90 days the filing or the effectiveness

of a

registration statement for the demand

registration.

|

| d) |

VPL

and the Issuer entered into a Voting and Lock-Up Agreement on 28

March

2008 (the “Voting

and Lock-Up Agreement”),

whereby, (i) for the period beginning on the completion of the acquisition

of the Sale Shares and expiring on the date that is the six month

anniversary of the completion of the acquisition of the Sale Shares,

VPL

would agree to vote all shares of the common stock of the Issuer

that it

controls (including the Sale Shares) in favor of all proposals requiring

shareholder approval that are adopted by the board of directors of

the

Issuer; and (ii) during the period beginning on the completion of

the

acquisition of the Sale Shares and ending on the date that is the

18 month

anniversary of such date of completion, VPL would not offer, sell,

contract to sell, grant any option to purchase or otherwise dispose

of any

shares of the Issuer’s capital stock, or any securities convertible into

or exercisable or exchangeable for the Issuer’s capital stock, or warrants

to purchase shares of the Issuer’s capital stock (including, without

limitation, securities of the Issuer which may be deemed to be

beneficially owned by VPL in accordance with the rules and regulations

of

the SEC and securities which may be issued upon the exercise of a

stock

option or warrant) without the prior written consent of the Issuer,

which

consent will not be unreasonably

withheld.

|

| e) |

VPL

and the Issuer entered into a letter agreement on 28 March 2008 (the

“Letter

Agreement”)

in connection with the sale by VPL of the Sale Shares under the Sale

Share

Agreement.

|

Item

7 - Materials to be Filed as Exhibits

|

Exhibit

99.1

|

Sale

Share Agreement

|

|

Exhibit

99.2

|

Subscription

and Waiver Agreement

|

|

Exhibit

99.3

|

Ancillary

Agreement

|

|

Exhibit

99.4

|

Registration

Rights Agreement

|

|

Exhibit

99.5

|

Voting

and Lock-Up Agreement

|

|

Exhibit

99.6

|

Letter

Agreement

|

SIGNATURES

After

reasonable inquiry and to the best of his or her knowledge and belief, each

of

the undersigned certifies that the information set forth in this Statement

is

true, complete and correct.

Dated

this 24 day of September 2008.

Venturepharm

Laboratories Limited

/s/

William Xia GUO

______________________________

Name:

William Xia GUO

Title:

Executive Director and CEO

/s/

William Xia Guo

________________________________

William

Xia Guo

Schedule

I

DIRECTORS

AND EXECUTIVE OFFICERS

OF

VENTUREPHARM

LABORATORIES LIMITED

The

name

and present principal occupation of each director and executive officer of

VPL

are set forth below. Unless otherwise stated, the business address for each

person listed below is c/o Venturepharm Laboratories Limited, No. 3 Jinzhuang,

Si Ji Qing, Haidian District, Beijing PRC 100089

|

Name

and Business Address (if applicable)

|

Principal

Occupation and Principal Business (if

applicable)

|

|

William

Xia Guo

|

Chairman,

executive director and chief executive officer of VPL

|

|

Dr.

Maria Xue Mei Song

|

Executive

director and Vice President of VPL

|

|

Mr.

Feng Tao

|

Non-executive

director of VPL

|

|

Mr.

Wu Xin

|

Non-executive

director of VPL

|

|

Dr.

Nathan Xin Zhang

|

Non-executive

director of VPL

|

|

Ms.

Wang Hong Bo

|

Independent

non-executive director of VPL

|

|

Mr.

Paul Contomichalos

|

Independent

non-executive director of VPL

|

|

Mr.

Wu Ming Yu

|

Independent

non-executive of VPL

|

Schedule

II

Note

1:

CBI holds 0.62% and other public shareholders hold 31.43% respective in

VPL.

Note

2: C

Tech Fund is held by 6 independent third parties.