ANNUAL REPORT TO SHAREHOLDERS

Published on March 31, 2006

EXHIBIT 13.1

Commonwealth

Biotechnologies, Inc.

| A Solutions Provider to the Life Sciences Industry |

From Concept to Clinic

Annual Report 2005

Commonwealth Biotechnologies, Inc.

Table of Contents

| Memo to Shareholders |

1 | |

| Stockholder Matters |

6 | |

| Management Discussion and Analysis Of Financial Condition and Results Of Operations |

7 | |

| Report of Independent Registered Public Accounting Firm |

17 | |

| Financial Statements |

||

| Balance Sheets |

18 | |

| Statements of Operations |

20 | |

| Statements of Changes in Stockholders Equity |

21 | |

| Statements of Cash Flows |

22 | |

| Summary of Significant Accounting Policies |

23 | |

| Notes to Financial Statements |

29 | |

record performance

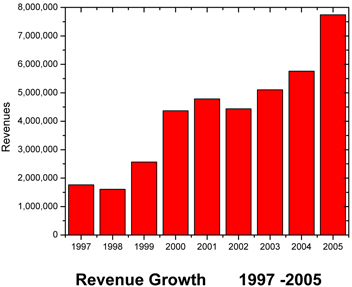

Commonwealth Biotechnologies Inc. posted a record year in 2005. We had the highest revenue and highest return of cash from operations than ever before in our history as a public corporation.

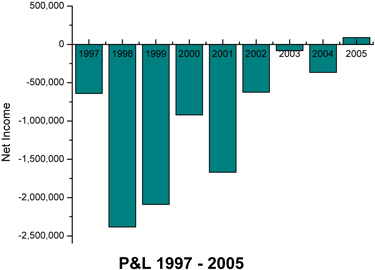

2005 was our first year of modest profits.

strength

CBIs strength in helping clients to think through and creatively solve early-stage problems from both a design and implementation standpoint is not only what drives people inside the organization but is also the reason clients choose CBI over the competition.

broad ranging expertise

CBI has assembled an outstanding group of scientist and technicians which encompass a broad spectrum of technology and experience.

breadth of technologies

CBI has invested in a broad variety of state-of-the-art technologies, providing a range of options to solve almost any problem.

Highlights from 2005

January, 2006. CBI and Prism Pharmaceuticals, Inc., Enter into a License Agreement to Develop Helix-Based Peptide Technologies.

Global Partnership

December, 2005. CBI and Intertek ASG Launch Global Marketing Agreement Companies will Co-Promote Services to the Life Sciences Industry with International Focus.

More Contracts signed April, 2005. CBI Announces New Contract Signings Work to begin in the Second and Third Quarters of 2005.

Includes protein stability, developing antibodies and novel immuno-assays, and qualifying molecular genetic assays for use in clinical trial work.

Contracts signed March, 2005. CBI Announces Contract Signings

New contract awards totaling nearly $2 million. Expands Work-Load at CBI in Support of Vaccine Development.

January, 2005. CBI Announces Contract Signings Totaling $1.1 million, Includes First Major Contract for CBIs new division, Fairfax Identity Labs (FIL).

To Our Shareholders:

Our Company recorded many exciting accomplishments in 2005. CBI recorded its highest revenues ever, and it was our first year of profitability, however modest. 2005 marked CBIs re-entrance into the arena of forensic analysis, and it was the year in which CBIs Fairfax Identity Lab (FIL) rapidly transitioned to CBI ownership. FIL quickly captured its first major forensics contract and completed its first year of operations under CBI leadership with a performance that out-paced our budget expectations. In 2005, CBI completed a branding survey and as a consequence, has re-positioned itself as a Solutions Provider, rather than as a purveyor of a menu of individual service offerings. In January, 2006, CBI executed a License and Royalty Agreement for commercialization of HepArrest®, the premier entry in our IP portfolio. We expanded our presence overseas through a strategic alliance with Intertek ASG, and continue to pursue client leads brought to us by domestic alliance partners, including Fisher Scientific, LLC. The BSL3 laboratory suite was expanded to include virology, and the Company quickly captured several contracts which require BSL3 virology capabilities. We are currently building out a 1,000 sq ft laboratory to house its select agent toxin production activities in support of an on-going contract that will extend into 2008. To accommodate new staff, we have completed the construction of nearly 2,000 sq ft of office space. All of these new labs and offices are housed within our existing facility. CBI added critical new instruments, which enable it to pursue the latest methods in proteomics and high throughput DNA sequence analysis. In addition to these our capital projects, the Company added key scientific staff in virology, mass spectrometry, and in the FIL division. Many of our new clients come to us through the internet, and so, CBI re-vamped its web page to make it more user-friendly and informative. New entry pages for bio-defense, vaccine development, and forensic work were added.

FINANCIAL HIGHLIGHTS

| Years Ended December 31, |

1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | ||||||||||||||||||||||||||

| in thousands, except per share amounts | |||||||||||||||||||||||||||||||||||

| Revenue |

$ | 1,761 | $ | 1,604 | $ | 2,565 | $ | 4,366 | $ | 4,786 | $ | 4,434 | $ | 5,104 | $ | 5,748 | $ | 7,803 | |||||||||||||||||

| Net Income (loss) |

$ | (1,168 | ) | $ | (2,096 | ) | $ | (2,091 | ) | $ | (921 | ) | $ | (1,673 | ) | $ | (625 | ) | $ | (80 | ) | $ | (367 | ) | 79 | ||||||||||

| Net income(loss) per share - basic |

$ | (3.55 | ) | $ | (1.29 | ) | $ | (1.27 | ) | $ | (0.51 | ) | $ | (0.81 | ) | $ | (0.29 | ) | $ | (0.03 | ) | $ | (0.12 | ) | 0.02 | ||||||||||

| Net income (loss) per share - diluted |

$ | (3.55 | ) | $ | (1.29 | ) | $ | (1.27 | ) | $ | (0.51 | ) | $ | (0.81 | ) | $ | (0.29 | ) | $ | (0.03 | ) | $ | (0.12 | ) | 0.02 | ||||||||||

| At year end: |

|||||||||||||||||||||||||||||||||||

| Cash, cash equivalents |

$ | 6,273 | $ | 2,091 | $ | 31 | $ | 587 | $ | 116 | $ | 270 | $ | 294 | $ | 2,742 | $ | 2,811 | |||||||||||||||||

| Total Assets |

$ | 7,931 | $ | 10,401 | $ | 8,250 | $ | 10,343 | $ | 8,348 | $ | 7,823 | $ | 7,581 | $ | 11,003 | $ | 11,144 | |||||||||||||||||

| Long Term Debt |

$ | 624 | $ | 5,000 | $ | 4,000 | $ | 4,077 | $ | 3,890 | $ | 3,730 | $ | 3,630 | $ | 4,081 | $ | 4,007 | |||||||||||||||||

| EBITDA |

$ | (655 | ) | $ | (1,602 | ) | $ | (1,252 | ) | $ | 8 | $ | (729 | ) | $ | 289 | $ | 776 | $ | 882 | $ | 1,285 | |||||||||||||

CBI continues to be a well-recognized key player in bio-defense, vaccine development, clinical trial support, and genetic identity work. We continued to meet the needs of our clients with superior service, and added new clients in 2005 who are industry leaders in our core focus areas. We believe that CBI is very well positioned for continued growth in these areas, and that our Company presents an integrated team to deliver what we believe to be the best service possible to our clients.

CBI posted record revenues of about $7.80 million for fiscal year 2005, which represents 35.7% revenue growth over 2004. CBI also posted its first ever year-end profit of $79,123, which compares to a loss of $367,549 in 2004. 2005 is the first fiscal year since its initial public offering in 1997, that the Company has returned positive earnings per share. These earnings were $0.02 calculated on a primary and fully diluted basis.

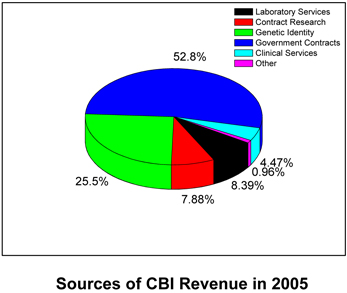

CBI signed over $8 million in contracts in 2005. The Company has been operating solely on revenues from day-to-day operations. CBIs overall gross revenues have increased from $5.7 million in 2004 to $ 7.8 million in 2005. Revenues generated from government contracts amounted to 54% of the total revenue in 2005; the remainder was derived from non-government sources and of these, 25% of our revenues were recognized due to genetic testing. Equalizing our revenue stream has been a focus of CBI management, but clearly our job is not done. We must dramatically increase our revenues in the private sector.

The Company has been EBITDA positive for four consecutive years, and in 2005, recorded EBITDA of about $1.28 million which compares to $882 thousand in 2004.

EBITDA CALCULATIONS

| 2005 | 2004 | ||||||

| Net Income (Loss) |

$ | 79,123 | $ | (367,549 | ) | ||

| Depreciation |

$ | 666,106 | $ | 586,620 | |||

| Bond Prepayment Penalties |

$ | | $ | 217,800 | |||

| Bond Write-off Costs |

$ | | $ | 206,930 | |||

| Interest/Amortization |

$ | 540,208 | $ | 238,077 | |||

| EBITDA |

$ | 1,285,436 | $ | 881,878 | |||

The Companys financial condition continues to improve through organic growth, CBI will continue to capitalize from its successful acquisition of Fairfax Identity Labs. Through other acquisitions, not only will CBI continue to look for targets that are

2

compatible with existing capabilities, but will look into expansion of our service offerings into new markets.

CBI entered 2006 with approximately $6.3 million in anticipated laboratory work for the year. The Company is actively engaged in on-going contract work and has submitted numerous long-term contract proposals to prospective government and private sector clients, not the least of which is oversight of GMP synthesis of HepArrest, and pre-clinical development work in anticipation of an Investigational New Drug (IND) filing in late 2006.

Thank You for Your Continued Support

In 2006, CBI welcomed one new Board members, Mr. Joseph Slay, and said goodbye to Mr. Pete Einselen. Pete has been with CBI since its inception, and has weathered all of the same storms that we founders went through. We thank Pete for his efforts on our behalf, and look forward to Joes insights and contributions. He is already hard at work in helping to implement CBIs branding strategy to new potential clients. Management is again beholden to the efforts of its Board of Directors.

Through press releases, 8-K announcements, and now, on-site presentations and quarterly electronic newsletters, CBI endeavors to keep its shareholders informed of new contract signings and significant news of Companys operations.

CBIs continued improvement is testament to our employees productivity. Fully 34% of our employees hold advanced degrees in various life science disciplines, and it is their commitment to excellence that has brought us our diverse client base.

3

You are cordially invited to attend CBIs 2005 Annual Meeting of Shareholders on May 19, 2006 at 11:00 a.m. at the Companys facility.

| With best regards, |

||||

|

|

|

|||

| Richard J. Freer, Ph.D. |

Robert B. Harris, Ph.D. |

|||

| Chairman of the Board, COO |

President, CEO |

|||

|

|

|||

| Thomas R. Reynolds |

James H. Brennan |

|||

| Executive Vice-President, |

Vice President, Financial Operations |

|||

| Science and Technology |

||||

4

CBI is a premiere solutions provider

In the private sector, a client will look to CBI in the early stage of research and development work because we offer:

Innovative approaches and Optimized Technology

Depth and breath of expertise needed

Exceptional Problem-Solving Abilities

Wide range of options for complex questions

Faster, cheaper, and innovative solutions and tools

CBI is accredited by the CDC, the AABB, the USDA, the NFSTC and operates accredited CLIA laboratories

A partner and

In the government sector, our clients

Appreciate CBIs sophisticated level of expertise

Value CBIs breadth of service offerings

Benefit from CBIs flexibility and cooperative management style.

CBI offers innovative and custom services

CBI facilitates one-time and strategic decisions

Accommodates short term and long term clients

Offers flexibility in services options

Offers GLP and non-GLP rated services

CBI accommodates ALL levels of service

Bench to production scales

High throughput, automation

Operates Specialty labs, including

Biosafety level 3 labs

DNA Identity labs

Calorimetry and mass spectrometry labs

Cell culture/fermentation labs

High throughput DNA sequence labs

Peptide synthesis labs

Stockholder Matters

Market for Common Equity

The Company completed its initial public offering on October 28, 1997 at a price per share of $6.00. Since that time, the common stock has traded on the NASDAQ Capital Market (NASDAQ). The following table sets forth the range of high and low sales price per share of common stock for 2005 and 2004. These market quotations reflect inter-dealer prices, without retail mark-up, markdown, or commission and may not necessarily represent actual transactions.

| Period |

High Stock Price | Low Stock Price | ||||

| 1st Quarter, 2005 |

$ | 6.27 | $ | 3.59 | ||

| 2nd Quarter, 2005 |

$ | 4.78 | $ | 3.69 | ||

| 3rd Quarter, 2005 |

$ | 5.70 | $ | 4.05 | ||

| 4th Quarter, 2005 |

$ | 5.14 | $ | 3.80 | ||

| Period |

High Stock Price | Low Stock Price | ||||

| 1st Quarter, 2004 |

$ | 10.41 | $ | 3.00 | ||

| 2nd Quarter, 2004 |

$ | 10.12 | $ | 4.66 | ||

| 3rd Quarter, 2004 |

$ | 7.66 | $ | 3.78 | ||

| 4th Quarter, 2004 |

$ | 7.47 | $ | 5.74 | ||

On March 17, 2006, the last reported sales price for a share of the Companys Common Stock on NASDAQ was $ 3.62. As of March 17, 2006 there were 32 holders of record of the Companys Common stock and 1208 beneficial holders.

The Company has not paid any cash dividends on its Common Stock. The Company intends to retain its earnings to finance the growth and development of its business and does not expect to declare or pay dividends in the foreseeable future. The declaration of dividends is within the discretion of the Company.

Selected Financial Data

Set forth below is selected financial data with respect to the Company for the years ended December 31, 2005, December 31, 2004, and December 31, 2003, which has been derived from the audited financial statements of the Company. The selected financial data set forth below should be read in conjunction with Managements Discussion and Analysis of Financial Conditions and Results of Operation.

6

For the years Ended December 31,

| 2005 | 2004 | 2003 | |||||||||

| Operational Data |

|||||||||||

| Revenues |

$ | 7,802,891 | $ | 5,748,704 | $ | 5,104,056 | |||||

| Net Income (loss) |

$ | 79,123 | $ | (367,549 | ) | $ | (80,601 | ) | |||

| Net income (loss) per common share - basic |

$ | 0.02 | $ | (0.12 | ) | $ | (0.03 | ) | |||

| Net income (loss) per common share - diluted |

$ | 0.02 | $ | (0.12 | ) | $ | (0.03 | ) | |||

| Weighted average common shares outstanding |

3,229,243 | 3,001,682 | 2,488,699 | ||||||||

| Balance Sheet Data: |

|||||||||||

| Total Current Assets |

$ | 4,276,348 | $ | 4,139,195 | $ | 1,155,839 | |||||

| Total Assets |

$ | 11,143,632 | $ | 11,003,008 | $ | 7,581,213 | |||||

| Total Current Liabilities |

$ | 1,120,522 | $ | 959,747 | $ | 579,920 | |||||

| Total Liabilities |

$ | 5,127,032 | $ | 5,041,200 | $ | 4,209,920 | |||||

| Total Stockholders equity |

$ | 6,016,600 | $ | 5,961,808 | $ | 3,371,293 | |||||

MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following should be read in conjunction with Selected Financial Data and the Companys Audited Financial Statements and Notes thereto included herein.

Overview

CBI (The Company) is a solutions provider to the global biotechnology industry, academic institutions, government agencies, and pharmaceutical companies. It offers broad ranging expertise and a complete array of the most current analytical and synthetic chemistries and biophysical analysis technologies, many of which are not available from other commercial sources. The Company has crafted a stimulating, open environment where scientists collaborate among themselves and with our clients, take on interesting challenges and develop creative solutions. CBI offers comprehensive genetic identity testing, including paternity, forensic, and Convicted Offender DNA Index System (CODIS) analyses. We are accredited by the American Association of Blood Banks, Clinical Laboratory Investigation Act (CLIA), and the National Forensic Science Technology Council, and operates fully accredited BSL-3 laboratory. The results of a recent branding analysis done by CBI shows that it enjoys an excellent reputation with its customers and that CBI is valued for its ability to bring novel and imaginative solutions to problems in life-sciences research.

7

CBI is a preferred provider of early development contract research. We facilitate strategic decisions to both short term and long term clients. CBI offers both Good Laboratory Practices (GLP and non-GLP) rated services, and accommodates all levels of service, from bench to production scale processes. The Company prides itself on its high throughput and fully integrated platform technologies, and over the years, has put in place numerous specialty labs, including Biosafety level 3 labs for bacteriology and virology, a DNA reference Lab, calorimetry and mass spectrometry labs, cell culture and fermentation labs, high throughput DNA sequence labs, and peptide synthesis labs.

CBI has the experience and expertise usually found in much larger contract research organizations (CROs). CBI has extensive experience in contract and program management work in both the government and private sectors and is well recognized for expertise in molecular genetics, mass spectrometry, peptide synthesis, DNA sequence analysis and reference lab work.

We are vigorously pursuing revenue opportunities in four principal focus areas: bio-defense; laboratory support services for on-going clinical trials; comprehensive contract projects in the private sector; and DNA reference lab activities. Our revenues are equally divided between the government and private sectors. The bulk of CBIs government derived revenues are from government contracts dealing with bio-defense related matters.

CBI acts as both prime and subcontractor for bio-defense related work. More often than not, we are the prime (if not the only) contractor performing clinical laboratory or comprehensive contracts for its private sector clients.

The Company views commercial and government contracts as its most important sources of revenue. For this reason, it is beginning to move away from concept of piece work for individual investigators. Further, We are now emphasizing its creative solutions approach, rather than its large litany of individual technology offerings. The branding analysis shows that the Companys customers see its creative solutions approach as a value added, and are willing to contract with CBI for this premium service. CBI has entirely re-vamped its web page (www.cbi-biotech.com) to help clarify its potential role is solving its customers problems. With all its contracts, revenues are generally recognized as services are rendered or as products are delivered. In some instances, revenue is also recognized with performance-based installments payable over the contract as milestones are achieved.

8

Results of Operations

Year Ended December 31, 2005 Compared to Year Ended December 31, 2004.

Revenues

Gross revenues increased by $2,054,187 or 35.7% from $5,748,704 during the year ended December 31, 2004 (2004) to $7,802,891 during the year ended December 31 2005 (2005).

The Company experiences fluctuations in all revenue categories. Continuation of existing projects or engagement for future projects is usually dependent upon the customers satisfaction with the scientific results provided in initial phases of the scientific program. Continuation of existing projects or engagement of future projects also often depends upon factors beyond the Companys control, such as the timing of product development and commercialization programs of the Companys customers. The Company is unable to predict for more than a few months in advance the volume and dollar amount of future projects. The combined impact of commencement and termination of research contracts from several large customers and unpredictable fluctuations in revenue for laboratory services can result in very large fluctuations in financial performance.

Revenues realized from various government contracts increased by $140,290 or 3.4%, from $4,083,264 during 2004 to $4,223,554 during 2005. This increase was primarily due to the startup of additional work and continuation of additional contracts with the DynPort Company and various government entities during the year.

Revenues realized from genetic identity increased by $1,894,109 or 2,560.3%, from $73,981 during 2004 to $1,968,090 during 2005. This increase was primarily due to The Company acquiring Fairfax Identity Labs in December 2004.

Revenues realized from various commercial contracts decreased by $304,384 or 33.9%, from $897,437 during 2004 to $593,053 during 2005. This decrease is primarily due to (1) work being completed with two major clients and (2) increased focus in government contracts awarded to the Company. Of the $593,053 in commercial contracts, three major clients represented 15.6%, 14.7% and 14.2% respectively of the revenue earned during 2005. The Company will continue to work with these clients in 2006.

Revenues realized from various clinical services increased by $133,799 or 66.8%, from $194,473 during 2004 to $328,272 during 2005. This increase is a direct result of the of startup of two major contracts in performing genetic identity analysis.

9

Cost of Services

Cost of services consists primarily of materials, labor, subcontractor costs and overhead. The cost of services increased by $1,725,387 or 45.8%, from $3,768,278 during 2004 to $5,493,665 during 2005. The cost of services as a percentage of revenue was 70.4% and 65.5% during 2005 and 2004, respectively.

Direct labor costs increased by $651,420, or 53.5%, from $1,217,386 during 2004 to $1,868,806 during 2005. This increase is a direct result of additional projects initialized during 2005 compared to 2004 as well as the hiring of additional lab support personnel and additional employees retained from the acquisition of FIL.

The costs for direct materials increased by $353,155, or 37.5%, from $939,788 during 2004, to $1,292,943 during 2005. This increase is directly attributable to additional projects in 2005 compared to 2004.

Overhead cost consists of indirect labor, amortization costs associated with the acquisition of Fairfax Identity Labs, depreciation, freight charges, repairs, travel and miscellaneous supplies not directly related to a particular project. Total overhead costs increased by $731,881 or 46.0%, from $1,590,496 during 2004 to $2,322,377 during 2005. Increased costs directly associated with the acquisition of FIL were amortization costs ($297,889), and postage ($98,450). Other increases included maintenance and repairs ($24,099), depreciation ($66,019), and utilities ($94,732).

Sales, General and Administrative

Sales, general and administrative expenses (SGA) consist primarily of compensation and related costs for administrative, facility expenditures, professional fees, consulting, taxes, and depreciation and marketing. Total SGA costs increased by $337,314, or 19.6%, from $1,718,874 during 2004 to $2,056,188 during 2005. As a percentage of revenue, these costs were 26.3% and 29.9% during 2005 and 2004, respectively.

Total compensation and benefits decreased by $18,962 or 3.5% from $546,525 during 2004 to $527,563 during 2005. This decrease is primarily due to the allocation of corporate compensation charged to marketing. Depreciation expense increased by $13,467 or 14.4%, from $93,859 during 2004 to $107,326 during 2005. This increase is primarily due to additional administrative equipment needed to support the acquisition of FIL. Equipment repairs and leases increased by $12,282 or 16.6% from $73,953 during 2004 to $86,235 during 2005. This increase is a result of the additional leased equipment used to support the administrative staff. Professional fees decreased by $98,581, or 26.9%, from $367,056 during 2004 to $268,475 during 2005. This decrease is due to a reduction in consulting fees, which is primarily a result of one-time costs associated with the elimination of the Industrial Revenue Bonds that were charged in 2004. Taxes increased by $12,282 or 16.6% from $73,953 during 2004 to $86,235

10

during 2005. This increase is due to additional sales tax paid for materials purchased. Office expenses increased by $24,227 or 18.2%, from $133,193 during 2004 to $157,420 during 2005. This increase is primarily due to additional costs associated with travel expenses for employees attending meetings with potential clients.

Other costs decreased by $18,086, or 16.6% from $108,921 during 2004 to $90,825 during 2005. Decreases in this category were from expenses associated with the relocation of employees from the acquisition of Fairfax Identity Labs as well as increasing the allowance for potential write-offs in bad debt in 2004 that did not occur in 2005.

Marketing costs increased by $422,000 or 143.4%, from $294,347 during 2004 to $716,347 during 2005. This increase was primarily due to staff brought on by the FIL acquisition and the allocation of salaries and benefit costs to marketing ($371,657). Additional increases included consulting costs ($13,008), advertising ($11,108), public relations ($11,224) and trade shows ($16,612).

Other Income (Expenses)

Other income during the 2004 Period compared to the 2005 Period increased by $45,441 or 197.8% from $22,963 during 2004 to $68,404 during 2005. This increase represents interest earned from the Companys investments.

Other expenses decreased by $409,745 or 62.8% from $652,064 during 2004 to $242,319 during 2005. Other expenses include (1) interest expense paid in 2005 for the refinance of the facility with Branch Banking and Trust, and in 2004 (1) interest paid for the Companys IRBs; (2) prepayment penalty for the refinancing of the industrial revenue bonds to a variable rate mortgage and (3) write-off of remaining unamortized bond issuance costs.

Year Ended December 31, 2004 Compared to Year Ended December 31, 2003.

Revenues

Gross revenues increased by $644,648 or 12.6% from $5,104,056 during the year ended December 31, 2003 (2003) to $5,748,704 during the year ended December 31 2004 (2004).

Revenues realized from various commercial contracts decreased by $100,243 or 10.1%, from $997,680 during 2003 to $897,437 during 2004. This decrease is primarily due to (1) work being completed with two major clients and (2) increased focus in government contracts awarded to the Company. Of the $897,437 in commercial contracts, two major clients represented 59.8% and 11.0%, respectively of the revenue earned during 2004. The Company continued to work with both of these clients in 2005.

11

Revenues realized from various government contracts increased by $929,574 or 29.5%, from $3,153,690 during 2003 to $4,083,264 during 2004. This increase was primarily due to eight new contracts awarded to the Company in 2004. Revenue in 2004 amounted to $1,916,620 for these projects. In addition work that is being performed on fourteen projects that were awarded in prior years, are still continuing to bring revenue into the Company.

Revenues realized from various genetic testing decreased by $156,441 or 67.9%, from $230,422 during 2003 to $73,981 during 2004. This decrease is a direct result of the ending of two major contracts in performing genetic identity analysis.

Cost of Services

Cost of services consists primarily of materials, labor, subcontractor costs and overhead. The cost of services increased by $239,779 or 6.8% from $3,528,499 during 2003 to $3,768,278 during 2004. The cost of services as a percentage of revenue was 65.6% and 69.2% during 2004 and 2003, respectively.

Direct labor costs increased by $75,835, or 6.6%, from $1,141,551 during 2003 to $1,217,386 during 2004. This increase is a direct result of additional projects initialized during the year.

The costs for direct materials increased by $3,583, or 0.4%, from $936,205 during 2003, to $939,788 during 2004. Costs in materials remained constant due to the more efficient utilization of the purchasing of materials from the Companys suppliers.

Overhead cost consists of indirect labor, depreciation, freight charges, repairs, travel and miscellaneous supplies not directly related to a particular project. Total overhead costs increased by $151,788 or 10.6%, from $1,438,708 during 2003 to $1,590,496 during 2004. This increase is primarily due additional staff added to the Company in the last month from the Fairfax Identity Labs acquisition and additional repairs needed to equipment throughout the course of the year.

Sales, General and Administrative

Sales, general and administrative expenses (SGA) consist primarily of compensation and related costs for administrative, marketing, facility expenditures, professional fees, consulting, taxes, and depreciation. Total SGA costs increased by $297,995, or 21.0%, from $1,420,879 during 2003 to $1,718,874 during 2004. As a percentage of revenue, these costs were 29.9% and 27.8% during 2004 and 2003, respectively.

12

Total compensation and benefits increased by $40,847 or 8.1% from $505,678 during 2003 to $546,525 during 2004. This increase is primarily due to corporate bonuses accrued in 2004.

Professional fees increased by $133,768 or 57.3% from $233,288 during 2003 to $367,056 during 2004. This increase is primarily due one-time costs associated with the elimination of the Industrial Revenue Bonds. Additional costs associated with recruitment charges for the hiring of additional personnel. Office expenses increased by $32,843 or 32.7%, from $100,350 during 2003 to $133,193 during 2004. This increase is primarily due to additional costs associated with travel expenses for employees attending meetings with potential clients. Other costs increased by $36,105 or 49.6% from $72,816 during 2003 to $108,921 during 2004. Increases in this category were from expenses associated with the relocation of employees from the acquisition of Fairfax Identity Labs as well as increasing the allowance for potential write-offs in bad debt.

Marketing costs increased by $61,395 or 26.4%, from $232,950 during 2003 to $294,345 during 2004. This increase was primarily due to consulting fees. Additional costs associated with press releases for the Company also led to the increase over 2003.

Other Income (Expenses)

Other income remained relatively flat from 2004 compared to 2003.

Other expenses includes (1) interest expense paid in the fourth quarter for the refinance of the facility with Branch Banking and Trust, (2) interest paid for the Companys IRBs; (3) prepayment penalty for the refinancing of the industrial revenue bonds to a variable rate mortgage and (4) write-off of remaining unamortized bond issuance costs. Interest costs increased by $197,629 or 79.8% from $247,505 during 2003 to $445,134 during 2004. Amortization costs increased by $196,186 or 1,826.0% from $10,744 during 2003 to $206,930 during 2004. This increase is due to paying off the Industrial Revenue Bonds in November 2004.

Liquidity and Capital Resources

The 2005 Period reflected cash provided by operating activities of $1,007,757, as compared to cash used in operating activities of $40,334 during the 2004 Period. This increase was the result of the Companys positive cash flow changes in the working capital accounts, primarily in accounts receivable and accounts payable. The 2005 Period reflected a use of cash from investing activities of $479,658, as compared to $1,089,690 during the 2004 Period. This decrease is due to the FIL acquisition in 2004, partially offset by an increase in the purchase of equipment in 2005 needed to maintain and begin servicing new contract work. The 2005 Period reflected net cash used in financing activities of $459,005, as compared to net cash provided by financing

13

activities of $3,577,136 during the 2004 Period, primarily due to issuance of common stock for proceeds of $2,979,905, net during the 2004 Period.

Net working capital as of December 31, 2005 and December 31, 2004 was $3,115,826 and $3,179,448 respectively. The current ratio for the 2005 Period is 3.81 as compared to 4.31 during the 2004 Period.

Critical Accounting Policies

A summary of the Companys accounting policies follows:

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of asset and liabilities and disclosure of contingent asset and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Revenue Recognition: The Company recognizes revenue upon the completion of laboratory service projects, or upon the delivery and acceptance of biologically relevant materials that have been synthesized in accordance with project terms. Laboratory service projects are generally administered under fee for service contracts. Any revenues from research and development arrangements, including corporate contracts and research grants, are recognized pursuant to the terms of the related agreements as work is performed, or scientific milestones, if any are achieved. Amounts received in advance of the performance of services or acceptance of a milestone, are recorded as deferred revenue.

Accounts receivable: Accounts receivable are carried at original invoice amount less an estimate for doubtful receivables based on a review of all outstanding amounts on a monthly basis. Management determines the allowance for doubtful accounts by regularly evaluating individual customer receivables and considering a customers financial condition, credit history, and current economic conditions. Accounts receivable are written off when deemed uncollectible. Recoveries of accounts receivable previously written off are recorded when received.

CBI has met the SEC and NASDAQ Corporate Governance Rules.

As a consequence of the Sarbanes-Oxley Act, the NASDAQ imposed certain changes in the rules of corporate governance which are aimed at strengthening its listing standards. The Securities and Exchange Commission (SEC) approved the rules imposed by NASDAQ which include

| | Independent Directors. CBIs Board is composed of 5 independent and 3 employee directors. |

14

| | The Independent Directors serve on the three principal committees; Audit, Compensation, and Nominations. |

| | The Independent Directors meet in executive session at each quarterly Board meeting. |

| | At least one Independent Director, Mr. Sam Sears, who serves on the Audit Committee, meets all of the requirements as defined by the SEC for being a financial expert. |

| | The Audit Committee reviews and approves all related-party transactions. CBI has adapted a formal Corporate Code of Conduct. Copies are available on request from Dr. Robert B. Harris, President and Chief Executive Officer, and on the Companys website at www.cbi-biotech.com. |

Forward Looking Statements

Management has included herein certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used, statements that are not historical in nature, including the words anticipated, estimate, should, expect, believe, intend, and similar expressions are intended to identify forward-looking statements. Such statements are, by their nature, subject to certain risks and uncertainties.

Among the factors that could cause the actual results to differ materially from those projected are the following:

| | business conditions and the general economy, |

| | the development and implementation of the Companys long-term business goals, |

| | federal, state, and local regulatory environment, |

| | lack of demand for the Companys services, |

| | the ability of the Companys customers to perform services similar to those offered by the Company in-house, |

| | potential cost containment by the Companys customers resulting in fewer research and development projects, |

| | the Companys ability to receive accreditation to provide various services, including, but not limited to paternity testing, and |

15

| | the Companys ability to hire and retain highly skilled employees, |

Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are detailed from time to time in reports filed by the company with the Securities and Exchange Commission, including Forms 8-K, 10-QSB, and 10-KSB.

Controls and Procedures

The Companys Chief Executive Officer and Controller have concluded that the Companys controls and other procedures designed to ensure that information required to be disclosed by the Company in the reports that it files or submits under the Securities and Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods as specified in the Commissions rules and forms are effective, based upon their evaluation of these controls and procedures as of December 31, 2005.

There were no significant changes in the Companys internal controls or in other factors that could significantly affect those controls subsequent to the date of this evaluation, including any corrective actions with regard to significant deficiencies and weaknesses.

16

Report of Independent Registered Public Accounting Firm

Board of Directors

Commonwealth Biotechnologies, Inc.

Richmond, Virginia

We have audited the accompanying balance sheets of Commonwealth Biotechnologies, Inc. as of December 31, 2005 and 2004, and the related statements of operations, comprehensive income, stockholders equity and cash flows for the years then ended. These financial statements are the responsibility of the Companys management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits include consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Companys internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Commonwealth Biotechnologies, Inc. as of December 31, 2005 and 2004, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

BDO Seidman, LLP

Richmond, Virginia

February 6, 2006

17

Commonwealth Biotechnologies, Inc.

Balance Sheets

| December 31, |

2005 | 2004 | ||||

| Assets | ||||||

| Current Assets (Note 2) |

||||||

| Cash and cash equivalents |

$ | 2,811,129 | $ | 2,742,034 | ||

| Accounts receivable, net of allowance for doubtful accounts of approximately $90,000 and $92,000 (Note 5) |

1,342,292 | 1,331,940 | ||||

| Prepaid expenses and other current assets |

122,927 | 65,221 | ||||

| Total current assets |

4,276,348 | 4,139,195 | ||||

| Property and equipment, net (Notes 1 and 2) | 5,971,730 | 5,701,158 | ||||

| Other Assets |

||||||

| Intangible assets (Note 9) |

317,879 | 561,569 | ||||

| Mortgage costs (Note 2) |

87,675 | 111,086 | ||||

| Goodwill (Note 9) |

490,000 | 490,000 | ||||

| Total other assets |

895,554 | 1,162,655 | ||||

| $ | 11,143,632 | $ | 11,003,008 | |||

See accompanying summary of accounting policies and notes to financial statements.

18

Commonwealth Biotechnologies, Inc.

Balance Sheets

(continued)

| December 31, |

2005 | 2004 | ||||||

| Liabilities and Stockholders Equity | ||||||||

| Current liabilities |

||||||||

| Current maturities of long-term debt (Note 2) |

$ | 512,729 | $ | 409,541 | ||||

| Accounts payable and other current liabilities |

406,370 | 377,862 | ||||||

| Deferred compensation |

126,830 | | ||||||

| Deferred revenue |

57,904 | 161,511 | ||||||

| Interest payable |

16,689 | 10,833 | ||||||

| Total current liabilities |

1,120,522 | 959,747 | ||||||

| Long-term debt, less current maturities (Notes 2) |

4,006,510 | 4,081,453 | ||||||

| Total liabilities |

5,127,032 | 5,041,200 | ||||||

| Commitments and contingencies (Notes 3 and 4) |

||||||||

| Stockholders equity |

||||||||

| Common stock, no par value, 10,000,000 shares authorized, 2005 3,253,556; 2004 3,203,556, shares issued and outstanding (Notes 7 and 8) |

| | ||||||

| Additional paid-in capital |

15,489,370 | 15,273,870 | ||||||

| Restricted Stock (Note 7) |

(191,556 | ) | | |||||

| Other Comprehensive Income/(Loss) |

(48,275 | ) | | |||||

| Accumulated deficit |

(9,232,939 | ) | (9,312,062 | ) | ||||

| Total stockholders equity |

6,016,600 | 5,961,808 | ||||||

| $ | 11,143,632 | $ | 11,003,008 | |||||

See accompanying summary of accounting policies and notes to financial statements.

19

Commonwealth Biotechnologies, Inc.

Statements of Operations

| Year Ended December 31, |

2005 | 2004 | ||||||

| Revenues (Note 5) |

||||||||

| Government contracts |

$ | 4,223,554 | $ | 4,083,264 | ||||

| Genetic identity |

1,968,090 | 73,981 | ||||||

| Laboratory services |

623,473 | 486,719 | ||||||

| Commercial contracts |

593,053 | 897,437 | ||||||

| Clinical services |

328,272 | 194,473 | ||||||

| Other revenue |

66,449 | 12,830 | ||||||

| Total revenues |

7,802,891 | 5,748,704 | ||||||

| Cost of services |

||||||||

| Overhead |

2,322,377 | 1,590,496 | ||||||

| Direct labor |

1,868,806 | 1,217,386 | ||||||

| Direct materials |

1,292,943 | 939,788 | ||||||

| Other direct costs |

9,539 | 20,608 | ||||||

| Total cost of services |

5,493,665 | 3,768,278 | ||||||

| Gross profit |

2,309,226 | 1,980,426 | ||||||

| Selling, general and administrative expenses |

2,056,188 | 1,718,874 | ||||||

| Operating income |

253,038 | 261,552 | ||||||

| Other income (expense) |

||||||||

| Interest expense and financing costs |

(242,319 | ) | (652,064 | ) | ||||

| Other income |

68,404 | 22,963 | ||||||

| Total other income (expense) |

(173,915 | ) | (629,101 | ) | ||||

| Net income (loss) |

$ | 79,123 | $ | (367,549 | ) | |||

| Income (loss) per common share, basic and diluted |

$ | 0.02 | $ | (0.12 | ) | |||

See accompanying summary of accounting policies and notes to financial statements

20

Commonwealth Biotechnologies, Inc.

Statements of Changes in Stockholders Equity

| Number of Shares Outstanding |

Additional Paid-in Capital |

Restricted Stock |

Other Comprehensive Income(Loss) |

Accumulated Deficit |

Total | ||||||||||||||||

| Balance, December 31, 2003 |

2,534,928 | $ | 12,315,806 | $ | | $ | | $ | (8,944,513 | ) | $ | 3,371,293 | |||||||||

| Stock options exercised |

668,628 | 2,958,064 | | | | 2,958,064 | |||||||||||||||

| Net loss |

| | (367,549 | ) | (367,549 | ) | |||||||||||||||

| Balance, December 31, 2004 |

3,203,556 | 15,273,870 | | | (9,312,062 | ) | 5,961,808 | ||||||||||||||

| Restricted Stock |

50,000 | 215,500 | (191,556 | ) | | | (23,944 | ) | |||||||||||||

| Net income |

| | | | 79,123 | 79,123 | |||||||||||||||

| Change in unrealized gain (loss) on interest rate swap |

| | | (48,275 | ) | | (48,275 | ) | |||||||||||||

| Total comprehensive income |

30,848 | ||||||||||||||||||||

| Balance, December 31, 2005 |

3,253,556 | $ | 15,489,370 | $ | (191,556 | ) | $ | (48,275 | ) | $ | (9,232,939 | ) | $ | 6,016,600 | |||||||

See accompanying summary of accounting policies and notes to financial statements.

21

Commonwealth Biotechnologies, Inc.

Statement of Cash Flows

| Years Ended December 31, |

2005 | 2004 | ||||||

| Operating activities |

||||||||

| Net income (loss) |

$ | 79,123 | $ | (367,549 | ) | |||

| Adjustments to reconcile net income (loss) to cash provided by (used in) operating activities |

||||||||

| Depreciation and amortization |

963,526 | 793,082 | ||||||

| Changes in assets and liabilities |

||||||||

| Accounts receivable |

(10,353 | ) | (531,958 | ) | ||||

| Prepaid expenses and inventory |

(57,707 | ) | (4,286 | ) | ||||

| Accounts payable and accrued expenses |

136,865 | (76,929 | ) | |||||

| Deferred revenue |

(103,698 | ) | 147,306 | |||||

| Cash provided by (used in) operating activities |

1,007,757 | (40,334 | ) | |||||

| Investing activities |

||||||||

| Purchases of property and equipment |

(450,711 | ) | (551,272 | ) | ||||

| Purchase of FIL, net |

(28,947 | ) | (538,418 | ) | ||||

| Cash used in investing activities |

(479,658 | ) | (1,089,690 | ) | ||||

| Financing activities |

||||||||

| Decrease (increase) in restricted cash |

| 569,255 | ||||||

| Principal payments on debt obligations, including capital lease obligations |

(457,634 | ) | (100,000 | ) | ||||

| Increase in loan costs, net |

(1,371 | ) | (111,086 | ) | ||||

| Proceeds from debt obligations, net |

| 260,903 | ||||||

| Proceeds from issuance of common net stock |

| 2,958,064 | ||||||

| Cash provided by (used in) financing activities |

(459,005 | ) | 3,577,136 | |||||

| Net increase in cash and cash equivalents |

69,094 | 2,447,112 | ||||||

| Cash and cash equivalents, beginning of year |

2,742,035 | 294,922 | ||||||

| Cash and cash equivalents, end of year |

$ | 2,811,129 | $ | 2,742,034 | ||||

| Supplemental Disclosure of Cash Flow Information |

||||||||

| Cash payments for interest |

$ | 248,175 | $ | 247,505 | ||||

| Non cash investing and financing activities, purchase of equipment through a capitalized lease |

$ | 485,968 | | |||||

See accompanying summary of accounting policies and notes to financial statements.

22

Commonwealth Biotechnologies, Inc.

Summary of Significant Accounting Policies

Nature of Business

Commonwealth Biotechnologies, Inc., (the Company), was formed on September 30, 1992, for the purpose of providing specialized analytical laboratory services for the life scientist. As the Company matured, it re-focused its core business activities and now provides integrated contract research support in four principal areas; bio-defense; laboratory support services for on-going clinical trials; comprehensive contract projects in the private sector; and through FIL, paternity testing, forensic case-work analysis and CODIS work. In each of these areas, the Company provides sophisticated macromolecular synthetic and analytical services, integrating individual platform technologies so as to provide a comprehensive approach to solving complex problems in life science research.

Estimates

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent asset and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Revenue Recognition

The Company recognizes revenue upon the completion of laboratory service projects, or upon the delivery and acceptance of biologically relevant materials that have been synthesized in accordance with project terms. Laboratory service projects are generally administered under fee-for-service contracts or purchase orders. Any revenues from research and development arrangements, including corporate contracts and research grants, are recognized pursuant to the terms of the related agreements as work is performed, or as scientific milestones, if any, are achieved. Amounts received in advance of the performance of services or acceptance of a milestone, are recorded as deferred revenue.

Long-Lived Assets

Long-lived assets, such as property, plant, and equipment, are evaluated for impairment when events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable through the estimated undiscounted future cash flows from the use of those assets. When any such impairment exists, the related assets will be written down to fair value. No impairment losses have been recorded through December 31, 2005.

23

Commonwealth Biotechnologies, Inc.

Summary of Significant Accounting Policies

(continued)

Cash and Cash Equivalents

The Company considers all highly liquid debt instruments purchased with an original maturity of three months or less to be cash equivalents. At times, the Company maintains cash balances in excess of FDIC insured amounts. As of December 31, 2005 the excess over the FDIC amount was approximately $2,400,000.

Accounts Receivable

Accounts receivable are carried at original invoice amount less an estimate made for doubtful receivables based on a review of all outstanding amounts on a monthly basis. Management determines the allowance for doubtful accounts by regularly evaluating individual customer receivable and considering a customers financial condition, credit history, and current economic conditions. Accounts receivable are written off when deemed uncollectible. Recoveries of accounts receivable previously written off are recorded when received.

Property and Equipment

Property and equipment are recorded at cost. Depreciation is computed principally by the straight-line method over the following estimated useful lives providing depreciation and amortization for financial reporting purposes. The cost of repairs and maintenance is expensed as incurred. The estimated useful lives of the assets are as follows:

| Years |

||

| Buildings |

39.5 | |

| Laboratory and computer equipment |

3 10 | |

| Furniture and fixtures and office equipment |

7 |

Intangible assets

Intangible assets consist of a covenant not to compete, commercial contracts, listing of draw sites, listing of providers to assist in paternity testing and other related intangibles acquired in the purchase of Fairfax Identity Labs (FIL) which are being amortized over 2 to 3 years.

24

Commonwealth Biotechnologies, Inc.

Summary of Significant Accounting Policies

(continued)

Loan Costs

Loan costs are being amortized on a straight-line basis over the expected term of the mortgage.

Goodwill

Goodwill, which represents the excess of purchase price over fair value of net assets acquired, is evaluated at least annually for impairment by comparing its fair value with its recorded amount and is written down when appropriate. Projected net operating cash flows are compared to the carrying amount of the goodwill recorded and if the estimated net operating cash flows are less than the carrying amount, a loss is recognized to reduce the carrying amount to fair value. The goodwill as of December 31, 2005 is a result of the acquisition by the Company of Fairfax Identity Labs during 2004.

Income Taxes

Deferred taxes are provided on the asset and liability method whereby deferred tax assets are recognized for deductible temporary differences and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Income (Loss) Per Common Share

Basic income (loss) per share has been computed on the basis of the weighted-average number of common shares outstanding. Common shares which can be issued upon exercise of stock options and warrants (see Note 7) have not been included in the computation because their inclusion would have been antidilutive in 2004. Weighted average shares outstanding for basic and diluted income (loss) per common share were 3,229,243 and 3,001,682 for the years ended December 31, 2005 and 2004, respectively.

25

Commonwealth Biotechnologies, Inc.

Summary of Significant Accounting Policies

(continued)

Employee Stock Plans

The Company adopted a Stock Incentive Plan on June 24, 1997. The Plan provides for granting to employees, officers, directors, consultants and certain other non-employees of the Company options to purchase shares of common stock. A maximum of 410,000 shares of common stock may be issued pursuant to the Plan. Of the maximum number of shares to be issued under the Plan, 270,000 have been reserved for incentive awards to be granted to the founders of the Company, and 140,000 are reserved for incentive awards to be granted to others.

A 2000 Stock Incentive Plan was adopted by the Board of Directors and approved by the shareholders. The Plan makes up to 300,000 shares of common stock available for grants of restricted stock awards and stock options in the form of incentive stock options and non-qualified options to employees, directors and consultants of the Company.

A 2002 Stock Incentive Plan was adopted by the Board of Directors and approved by the shareholders. The Plan makes up to 600,000 shares of common stock available for grants of restricted stock awards and stock options in the form of incentive stock options and non-qualified options to employees, directors and consultants of the Company.

Incentive awards may be in the form of stock options, restricted stock, incentive stock or tax offset rights. In the case of incentive stock options (within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended), the exercise price will not be less than 100% of the fair market value of shares covered at the time of the grant, or 110% for incentive stock options granted to persons who own more than 10% of the Companys voting stock. Options granted under the Plans generally vest over a five-year period from the date of grant and are exercisable for ten years, except that the term may not exceed five years for incentive stock options granted to persons who own more than 10% of the Companys outstanding common stock. Options granted in 2005 were vested immediately.

26

Commonwealth Biotechnologies, Inc.

Summary of Significant Accounting Policies

(continued)

The Company applies Accounting Principles Board Opinion No. 25 and related accounting interpretations in accounting for its plan and for management warrants and, accordingly, no compensation cost has been recognized. Had compensation cost for the Companys plan been determined based on the fair value at the grant dates for awards under the plan consistent with the method prescribed by FASB No. 123, Accounting for Stock-Based Compensation, the Companys net income (loss) and income (loss) per share would have increased to the pro-forma amounts indicated below:

| 2005 | 2004 | |||||||

| Net income (loss) |

||||||||

| As reported |

$ | 79,123 | $ | (367,549 | ) | |||

| Proforma effect of recognizing stock-based compensation in accordance with FASB No. 123 |

(670,927 | ) | (144,964 | ) | ||||

| Proforma net income (loss) |

$ | (591,804 | ) | $ | (512,513 | ) | ||

| Basic and diluted income (loss) per common share |

||||||||

| As reported |

$ | 0.02 | $ | (0.12 | ) | |||

| Proforma effect of recognizing stock-based compensation in accordance with FASB No. 123 |

(0.18 | ) | (0.17 | ) | ||||

| Proforma |

$ | (0.16 | ) | $ | (0.29 | ) | ||

Under FASB No. 123, the fair value of each stock option and warrant is estimated on the date of grant using the Black-Scholes option pricing model. The following weighted-average assumptions were used for grants in 2005 and 2004, respectively: No dividend yield, expected volatility of 42% and 93%, risk-free interest rate of 4.39% and 4.28%, and expected lives of 10 years. In 2005, the Company vested all outstanding options of employees, excluding certain members of senior management.

Fair Value of Financial Instruments

The Company has determined, based on available market information and appropriate valuation methodologies, that the fair value of its financial instruments approximates carrying value. The carrying amounts of cash and cash equivalents, accounts receivable and accounts payable approximate fair value due to the short-term maturity of the instruments. The carrying amount of debt approximates fair value because the interest rates under the credit agreement are predominantly variable, based on current market conditions.

27

Commonwealth Biotechnologies, Inc.

Derivative Instruments and Hedging Activities

The Company uses interest rate swap agreements to manage variable interest rate exposure on the majority of its long-term debt. The Companys objective for holding these derivatives is to decrease the volatility of future cash flows associated with interest payments on its variable rate debt. The Company does not issue derivative instruments for trading purposes. The Company accounts for its interest rate swap agreements as cash flow hedges. For derivatives designated as cash flow hedges, the effective portion of changes in the fair value of the derivative is initially reported in accumulated other comprehensive income or loss on the consolidated balance sheets and subsequently reclassified to interest expense when the hedged exposure affects income (i.e. as interest expense accrues on the related outstanding debt). Differences between the amounts paid and amounts received under the swap agreements are recognized in interest expense.

Changes in the ineffective portion of the fair value of the derivative are accounted for through interest expense. The notional principal value of the Companys swap agreement outstanding as of December 31, 2005 is equal to the outstanding principal balance of the corresponding debt instrument.

New Accounting Pronouncements

SFAS No. 123 (Revised 2004), Share-Based Payment, issued in December 2004, is a revision of FASB Statement 123, Accounting for Stock-Based Compensation and supersedes APB Opinion No. 25, Accounting for Stock Issued to Employees, and its related implementation guidance. The Statement focuses primarily on accounting for transactions in which an entity obtains employee services in share-based payment transactions. SFAS No. 123 (Revised 2005) requires an entity to measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award (with limited exceptions). That cost will be recognized over the period during which an employee is required to provide service in exchange for the award. This statement is effective as of the beginning of the interim or annual reporting period that begins after June 15, 2007. The Company estimates the impact on the financial position or results of operations will be approximately $81,000, $48,000 and $41,000 in 2006, 2007 and 2008 respectively.

28

Commonwealth Biotechnologies, Inc.

Notes to Financial Statements

| 1. | Property and Equipment |

Property and equipment consisted of the following:

| December 31, |

2005 | 2004 | ||||

| Land |

$ | 403,919 | $ | 403,919 | ||

| Building |

5,107,006 | 4,999,496 | ||||

| Laboratory equipment |

5,043,837 | 3,851,501 | ||||

| Furniture, fixtures and office and computer equipment |

618,638 | 498,737 | ||||

| 11,173,400 | 9,753,653 | |||||

| Less accumulated depreciation |

5,201,670 | 4,052,495 | ||||

| $ | 5,971,730 | $ | 5,701,158 | |||

Depreciation expense was $666,106 and $586,620 for the years ended December 31, 2005 and 2004, respectively.

29

Commonwealth Biotechnologies, Inc.

Notes to Financial Statements

(continued)

| 2. | Long-Term Debt |

Long-term debt consists of:

| December 31, |

2005 | 2004 | ||||

| Mortgage note payable to bank with interest at prime minus 0.25%. The note payable will mature in November 2009; with estimated monthly payments of principal and interest of $32,351; collateralized by building and other assets of the Company. The Company also entered into a swap transfer agreement with the Bank essentially locking the interest rate paid by the Company to 7.725% | $ | 3,825,433 | $ | 3,890,994 | ||

| Note payable to Genetics & IVF Institute due on two installments due December 15, 2005 and December 15, 2006. The note is secured by letter of credit. | 300,000 | 600,000 | ||||

| On January 20, 2005, the Company entered into a capitalized leasing agreement with Technology Leasing Concepts for leasing of two pieces of laboratory equipment. The monthly principal and interest payments are $11,378. Both leases are for a 48 month period. | 393,806 | | ||||

| 4,519,239 | 4,490,994 | |||||

| Less current maturities |

512,729 | 409,541 | ||||

| $ | 4,006,510 | $ | 4,081,453 | |||

Scheduled maturities of long-term debt are as follows:

| 2006 |

$ | 512,729 | |

| 2007 |

224,457 | ||

| 2008 |

238,979 | ||

| 2009 |

3,543,074 | ||

| 2010 |

| ||

| $ | 4,519,239 | ||

30

Commonwealth Biotechnologies, Inc.

Notes to Financial Statements

(continued)

| 2. | Long Term Debt (continued): |

The mortgage agreements required the Company to maintain a reserve fund for a period of one year which is held in a certificate of deposit. This reserve fund, in the amount of $360,345 is included in the balance sheet as a cash equivalent at December 31, 2005.

| 3. | Leasing Commitments |

The Company leases equipment under non-cancelable operating leases. Total expense for the years ended December 31, 2005 and 2004 was $28,636 and $37,236, respectively. Future minimum rental commitments under operating leases as of December 31, 2005 are as follows:

| 2006 |

$ | 42,394 | |

| 2007 |

41,302 | ||

| 2008 |

40,159 | ||

| 2009 |

11,924 | ||

| $ | 135,779 | ||

| 4. | Retirement Plan |

The Company maintains a 401(k) Plan (the Plan) which covers substantially all employees. Under the Plan, employees may elect to defer a portion of their salary, up to the maximum allowed by law, and the Company can elect to match the contribution up to 1% of the employees salary. Company contributions in 2005 and 2004 were $6,331 were $5,231 respectively.

| 5. | Major Customers |

Revenues for the years ended December 31, 2005 and 2004 include revenues from five major customers in 2005 of approximately $3,534,004 or 45% and 2004 of approximately $2,779,278 or 48% of total revenues. Trade receivables due from these customers as of December 31, 2005 and 2004 were $775,079 and $938,714, respectively.

31

Commonwealth Biotechnologies, Inc.

Notes to Financial Statements

(continued)

| 6. | Income Taxes |

The difference between expected income tax benefits and actual income tax benefits recorded in the financial statements is explained below:

| Year Ended December 31, |

2005 | 2004 | ||||||

| Income taxes (benefit) computed at 34% statutory rate |

$ | 26,900 | $ | (124,900 | ) | |||

| State income tax benefit, net |

4,000 | (18,400 | ) | |||||

| Change in valuation allowance |

7,500 | 117,400 | ||||||

| Other |

(38,400 | ) | 25,900 | |||||

| $ | | $ | | |||||

The significant components of deferred income tax assets and liabilities consist of the following:

| December 31, |

2005 | 2004 | ||||

| Deferred tax assets |

||||||

| Net operating loss carryforward |

$ | 3,595,000 | $ | 3,625,900 | ||

| Research and development credit carryforward |

52,600 | 52,600 | ||||

| Deferred compensation |

| 20,800 | ||||

| Goodwill |

173,800 | 186,200 | ||||

| Allowance for doubtful accounts |

34,200 | 34,900 | ||||

| Interest rate swap |

48,200 | | ||||

| Other |

106,600 | 96,300 | ||||

| 4,010,400 | 4,016,700 | |||||

| Deferred tax liabilities |

||||||

| Tax depreciation in excess of book depreciation |

302,300 | 301,100 | ||||

| Net deferred tax asset before valuation allowance |

3,708,100 | 3,715,600 | ||||

| Less valuation allowance |

3,708,100 | 3,715,600 | ||||

| $ | | $ | | |||

Operating loss carryforwards of approximately $9,105,000 may be used to offset future taxable income and expire in various years through 2023. The Company also has research and development credit carryforwards of approximately $53,000 that expire in various years through 2020.

32

Commonwealth Biotechnologies, Inc.

Notes to Financial Statements

(continued)

| 7. | Stock Compensation |

During 2005, the Company issued 50,000 restricted shares to an executive officer at the fair market value at the date of grant.

In addition to employee stock option awards, the Company has reserved an aggregate of 57,811 shares of common stock for issuance upon exercise, management warrants (71,053), warrants issued in connection with the 2002 private placement (34,445) and in 2004 the private investment in a public entity (124,000).

Stock option transactions are summarized as follows:

| 2005 | Weighted Average Exercise Price |

2004 | Weighted Average Exercise Price |

|||||||||

| Options and warrants outstanding, beginning of year |

889,598 | $ | 5.03 | 1,186,572 | $ | 5.01 | ||||||

| Granted |

286,021 | 4.98 | 177,903 | 6.47 | ||||||||

| Exercised |

| | (268,628 | ) | 2.69 | |||||||

| Expired |

(188,700 | ) | 6.45 | (206,249 | ) | 3.40 | ||||||

| Options and warrants outstanding, end of year |

986,919 | 5.60 | 889,598 | 6.34 | ||||||||

| Options and warrants exercisable, end of year |

916,331 | 6.01 | 889,598 | 6.34 | ||||||||

| Weighted-average fair value per option and warrants for options and warrants granted during the year |

$ | 2.35 | $ | 2.79 | ||||||||

33

Commonwealth Biotechnologies, Inc.

Notes to Financial Statements

(continued)

| 7. | Stock Compensation (continued): |

The following table summarizes information about stock options and warrants outstanding at December 31, 2005:

| Outstanding | Exercisable | |||||||||||

| Exercise Prices Per Share |

Number Outstanding | Weighted Average (Years) |

Weighted Average Exercise Price Per Share |

Number Exercisable | Weighted Average Exercise Price Per Share |

|||||||

| $0.90 2.00 |

77,882 | 8 | $ | 1.16 | 77,882 | $ | 1.16 | |||||

| $2.01 5.49 |

424,615 | 7 | 4.12 | 364,027 | 4.10 | |||||||

| $5.50 7.00 |

215,663 | 3 | 6.28 | 118,063 | 5.98 | |||||||

| $7.01 9.49 |

139,000 | 6 | 7.56 | 139,000 | 7.56 | |||||||

| $9.50 12.50 |

217,359 | 4 | 9.95 | 217,359 | 9.95 | |||||||

| $0.90 12.50 |

986,919 | $ | 5.60 | 916,331 | $ | 6.01 | ||||||

| 8. | Private Placement Offering |

On May 27, 2004, the Company completed an offering of 400,000 shares of its common stock, without par value per share, and warrants to purchase an additional 100,000 shares of common stock to several accredited investors. The shares were sold for a cash consideration of $6.25 per share, for a total of $2,500,000. Net proceeds to the Company were $2,299,842. The exercise price for the warrants, which are exercisable for a period of five years were set at 110% of the closing price of the Companys common stock on the closing date of the transaction.

| 9. | Purchase of Fairfax Identity Labs |

In December, 2004, the Company purchased the assets of Fairfax Identity Labs, (FIL), a division of Genetics and In-Vitro Fertilization Institute for total consideration, including associated costs of $1,149,000, which includes a $600,000 note payable due in equal installments on December 16, 2005 and December 16, 2006. The principal focus of the purchase was to increase the revenue base of private paternity, contract paternity testing, and forensic DNA analysis. The acquisition has been accounted for by the purchase method of accounting.

34

Commonwealth Biotechnologies, Inc.

Notes to Financial Statements

(continued)

| 9. | Purchase of Fairfax Identity Labs |

A Summary of the transaction was as follows:

| Purchase Price |

$ | 1,149,000 | |

| Less fair value of assets acquired |

|||

| Equipment |

97,000 | ||

| Draw Sites |

307,000 | ||

| Physicians Listing |

145,000 | ||

| Covenant Not to Compete |

110,000 | ||

| Total fair value of assets acquired |

659,000 | ||

| Goodwill |

$ | 490,000 | |

The pro forma, unaudited 2004 financial information below is presented as if the acquisition had occurred at the beginning of the respective period. It is not necessarily indicative of the operating results that would have actually occurred and is not indicative of future operating results.

| Year Ended December 31, 2004 |

||||

| Operating revenue |

$ | 7,355,989 | ||

| Net loss |

(791,806 | ) | ||

| Basic and diluted loss per common share |

$ | (.25 | ) | |

The above proforma results for 2004 include FILs operating results through September 30, 2004, the last interim date prior to the consummation of the acquisition.

35

Corporate Information

Commonwealth Biotechnologies, Inc.

601 Biotech Drive

Richmond, VA 23235

Telephone: 800-735-9224;

Telephone: 804-648-3820

Fax: 804-648-2641

E-mail: info@cbi-biotech.com

Web site: www.cbi-biotech.com

General Counsel

Kaufman and Canoles, PC

1051 E. Cary St

3 James Center

Richmond, VA 23219

Patent Counsel

Burns Doan Swecker and Mathis, LLP

1737 King Street

Alexandria, VA 22314

Transfer Agent and Registrar35

Computershare Trust Co.

350 Indiana St.

Golden, CO 80401

Independent Auditors

BDO Seidman, LLP

300 Arboretum Place

Suite 520

Richmond, VA 23236

36

Executive Officers

| Richard J. Freer, Ph.D. |

Robert B. Harris, Ph.D. | |

| Chairman of the Board; COO |

President; CEO |

|

| Thomas R. Reynolds |

James H. Brennan, MBA | |

| Executive Vice President, |

Vice President, Financial Operations |

|

| Science and Technology; |

||

| Secretary |

||

| Richard J. Freer, Ph.D. |

Robert B. Harris, Ph.D. | |

| Chairman of the Board; COO |

President, CEO |

|

| Thomas R. Reynolds |

Samuel P. Sears, Jr., Esq. | |

| Executive Vice President |

Attorney at Law |

|

| Science and Technology; |

||

| Secretary |

||

| James Causey |

Donald A. McAfee, Ph.D. | |

| VP, Consumer Industry Magazines |

VP New Product Development |

|

| Trader Publications |

Cardiome Pharma Corp |

|

| Joseph Slay |

Gerald P. Krueger, Ph.D., CPE | |

| President |

Director, Human Factors and Ergonomics |

|

| Slay Public Relations |

The Wexford Group International |

|

37