ANNUAL REPORT

Published on April 9, 2008

Highlights

from 2007

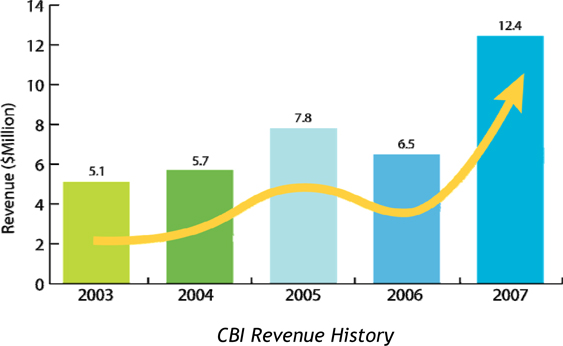

| | Revenue of approximately $12.4M, up from $6.5M in 2006; |

| | Over $12M in new contracts signed; |

| | Successful acquisition and integration of leading discovery chemistry companies, Mimotopes and Exelgen, with $1.6M in annual cost savings to be achieved through restructuring and targeted salary savings; |

| | Appointment of key management personnel, including Dr Paul DSylva as CEO, Mr Mark Hober as Vice President Business Development and Marketing and Dr Mark Warne as Managing Director for Exelgen Ltd. |

| | Attraction of seven out of the ten largest global pharmaceutical and biotechnology companies as clients; |

| | Completion of $1.95M capital raising with a consortium of institutional investors. |

6

To Our

Shareholders

2007 was a very active year for Commonwealth Biotechnologies Inc. (CBI) that was characterized by a near doubling in revenues, the addition of key management personnel, business assets, clients and investors. The most significant events for the year were the acquisitions of UK-based medicinal chemistry company Exelgen Ltd (Exelgen; formerly Tripos Discovery Research Ltd.) and Australian-based peptide chemistry company Mimotopes Pty Ltd, (Mimotopes), transforming CBI into a full-service pre-clinical drug discovery services provider with a global base of operations and clients. We believe that CBI is well positioned for continued strong growth in 2008 with over $12 million of new contracts signed, a growing market for high-quality research and development outsourcing and a commercially-focused management team, which is committed to building shareholder value.

The acquisition of Mimotopes and Exelgen has significantly enhanced CBIs research and development outsourcing capabilities and presence in the global drug discovery outsourcing market.

1

Expenditure on R&D outsourcing by Pharmaceutical and Biotechnology companies is now estimated to exceed $5 billion per annum and is expected to grow by over 15% per annum until 2010. With a strong reputation for high quality service and product delivery, the CBI Group is well positioned to capitalize on the need for high quality and competitively priced products and services in this growing market.

The Company recorded revenues of $12.4 million in 2007, up from $6.5 million in 2006, with a net loss of $2.8 million. However, these results significantly under-play the Companys operating performance because of the timing of the Exelgen acquisition and significant one-off costs associated with the acquisition. In December 2007, CBI completed a company-wide reorganization aimed at realigning its sales and marketing capabilities and attaining cost synergies following the successful acquisitions of Mimotopes and Exelgen. Beginning in 2008, cost synergies, through targeted redundancies and salary savings will generate annual savings of $1.6 million. The reorganization of our sales and marketing team will provide the global drug discovery market with a one-stop-shop for pre-clinical products and services in small molecule, peptide and biologics development. We believe that this strategy is already starting to yield results with strong 2007 4th quarter revenues of $4.3 million and over $12 million in new contracts signed going into 2008.

2

With a focus on both revenue and cost synergies, integration of Mimotopes and Exelgen into the CBI Group in 2007 resulted in new contract signings and significant cost savings. The Company aims to build on these successes in 2008 to further strengthen its position in the global contract drug-discovery industry. CBI will pursue a number of strategic initiatives in 2008 aimed at increasing revenues, increasing margins, managing costs and increasing market awareness and value. CBI will also actively pursue opportunities to acquire or partner with complementary companies in the drug discovery outsourcing industry. By actively pursuing merger & acquisition and partnering opportunities, the Company ultimately aims to provide clients with a seamless link between drug discovery to scale up, multi-kilogram synthesis and GMP manufacture, thus capturing more value down the supply chain and proving the market with a truly vertically integrated product offering.

Several key appointments were made during 2007, significantly bolstering the Companys scientific and commercial management experience. Upon completion of the Mimotopes transaction in February, former Mimotopes Managing Director Dr Paul D'Sylva was appointed to the Board of Directors of CBI and also assumed the

3

duties of Chief Executive Officer. Dr D'Sylva brings an exceptional skill set in business and finance to CBI that compliments the skills of CBI's existing senior management. Within the Exelgen business unit, former Manager of Strategic Affairs, Dr Mark Warne, was appointed as Managing Director in July. Dr Warne has significant experience in the drug discovery industry and a successful track record of successfully evolving research concepts to commercial products and processes. As part of the sales and marketing reorganization in December, Mr Mark Hober was appointed as Vice President, Business Development and Marketing for the Group. Mr. Hober was previously the Vice President of Business Development for Exelgen. In that role, he was responsible for directing Exelgens business development efforts and significantly growing the business by establishing multiple drug discovery and synthesis collaborations in North America.

CBI embarked on a process of business transformation in 2007 and is set to continue this process into 2008. With a leading, comprehensive array of discovery services, high quality human and physical infrastructure, a cross-functional sales team and an entrepreneurial and commercially focused management team, we believe that the Company has strong potential for sustainable and profitable growth in 2008 and beyond.

Thank you for your continued support.

4

Introducing the CBI Group

| FIL

|

||

| Fairfax Identity Laboratories (FIL) has been at the forefront of DNA technology of profiling for identity since it open its doors in 1990. FILs rigorous standards guarantee beyond a reasonable doubt the credible evidence that clients demand. Their results affect decisions regarding criminal trials, paternity, immigration, estate settlement, adoption, and other issues of identity. FIL provides state of the art Forensics, Paternity and CODIS services to government and private concerns. FIL is accredited by the American Association of Blood Banks, the National Forensic Science Technology Center, the State of New York and CLIA. Its Directors have extensive laboratory and courtroom experience. |

|

|

|

Mimotopes

|

||

| Mimotopes Pty Ltd (Mimotopes) is an industry leader with over 18 years experience in the development, synthesis and distribution of research grade peptides for the drug discovery industry. Mimotopes patented synthesis technologies, state-of-the-art facilities and highly educated and experienced staff make it one of the leading research grade peptide synthesis companies in the world. Mimotopes products and services are delivered to both commercial clients and to discovery and alliance partners. In 2006/2007, Mimotopes developed significant partnerships with peptide partner company PepScan and global key life science companies Invitrogen and Genzyme. |

|

|

|

Exelgen

|

||

| Exelgen Ltd (Exelgen) is a leading, knowledge driven, drug discovery services business that provides pharmaceutical and biotechnology companies with novel approaches to drug discovery. Applying proprietary computational design and therapeutic medicinal chemistry tools and expertise, Exelgen believes that it is able to reduce drug discovery timelines by up to 30%. Since 1997, Exelgen has been offering compound libraries under the LeadQuest® brand, screening libraries under the LeadScreen® brand and custom de novo compound libraries under the LeadSelect® brand. |

|

2

Stockholder Matters

The Companys common stock trades on the NASDAQ Capital Market (NASDAQ) under the symbol CBTE. The following table sets forth the range of high and low sales price per share of common stock for the years ended December 31, 2007 and December 31, 2006, respectively. These market quotations reflect inter-dealer prices, without retail mark-up, markdown, or commission and may not necessarily represent actual transactions.

| Period |

High Stock Price |

Low Stock Price |

||||

| 1st Quarter, 2007 |

$ | 2.30 | $ | 1.86 | ||

| 2nd Quarter, 2007 |

$ | 3.79 | $ | 1.95 | ||

| 3rd Quarter, 2007 |

$ | 3.79 | $ | 2.39 | ||

| 4th Quarter, 2007 |

$ | 3.59 | $ | 2.36 | ||

| 1st Quarter, 2006 |

$ | 4.99 | $ | 3.54 | ||

| 2nd Quarter, 2006 |

$ | 3.63 | $ | 2.48 | ||

| 3rd Quarter, 2006 |

$ | 2.99 | $ | 2.13 | ||

| 4th Quarter, 2006 |

$ | 2.95 | $ | 1.98 | ||

On March 28, 2008, the last reported sales price for a share of the Companys Common Stock on NASDAQ was $1.91. As of March 28, 2008, there were 38 holders of record of the Companys Common stock and 935 beneficial holders.

The Company has not paid any cash dividends on its Common Stock. The Company intends to retain its earnings to finance the growth and development of its business and does not expect to declare or pay dividends in the foreseeable future. The declaration of dividends is within the discretion of the Company.

3

Commonwealth Biotechnologies, Inc.

Selected Financial Data

Set forth below is selected financial data with respect to the years ended December 31, 2007, December 31, 2006, and December 31, 2005, which have been derived from the audited financial statements of the Company. The selected financial data set forth below should be read in conjunction with Managements Discussion and Analysis of Financial Conditions and Results of Operation. In 2007 the selected financial data includes financial information from two of the acquisitions that were completed in 2007.

As of and for the years ended December 31,

| 2007 | 2006 | 2005 | |||||||||

| Operational Data |

|||||||||||

| Revenues |

$ | 12,422,193 | $ | 6,532,482 | $ | 7,802,891 | |||||

| Net income (loss) before extraordinary gain |

(3,540,934 | ) | (1,152,649 | ) | 79,123 | ||||||

| Extraordinary gain |

782,833 | | | ||||||||

| Net income (loss) after extraordinary gain |

(2,758,101 | ) | (1,152,649 | ) | 79,123 | ||||||

| Net income (loss) per common share basic and diluted before extraordinary gain |

(0.69 | ) | $ | (0.35 | ) | $ | 0.02 | ||||

| Net income (loss) per common share basic and diluted after extraordinary gain |

(0.54 | ) | $ | (0.35 | ) | $ | 0.02 | ||||

| Weighted average common shares outstanding |

5,135,951 | 3,281,360 | 3,229,243 | ||||||||

| Balance Sheet Data: |

|||||||||||

| Total Current Assets |

$ | 8,240,285 | $ | 2,797,861 | $ | 3,776,348 | |||||

| Total Assets |

20,038,052 | $ | 9,501,958 | $ | 11,143,632 | ||||||

| Total Current Liabilities |

6,861,578 | $ | 586,967 | $ | 1,120,522 | ||||||

| Total Liabilities |

$ | 10,105,103 | $ | 4,373,036 | $ | 5,127,032 | |||||

| Total Stockholders equity |

$ | 9,932,949 | $ | 5,128,922 | $ | 6,016,600 | |||||

4

Management Discussion and Analysis of Financial Condition and Results of Operation

The following should be read in conjunction with Selected Financial Data and the Companys Audited Financial Statements and Notes thereto included herein.

Overview

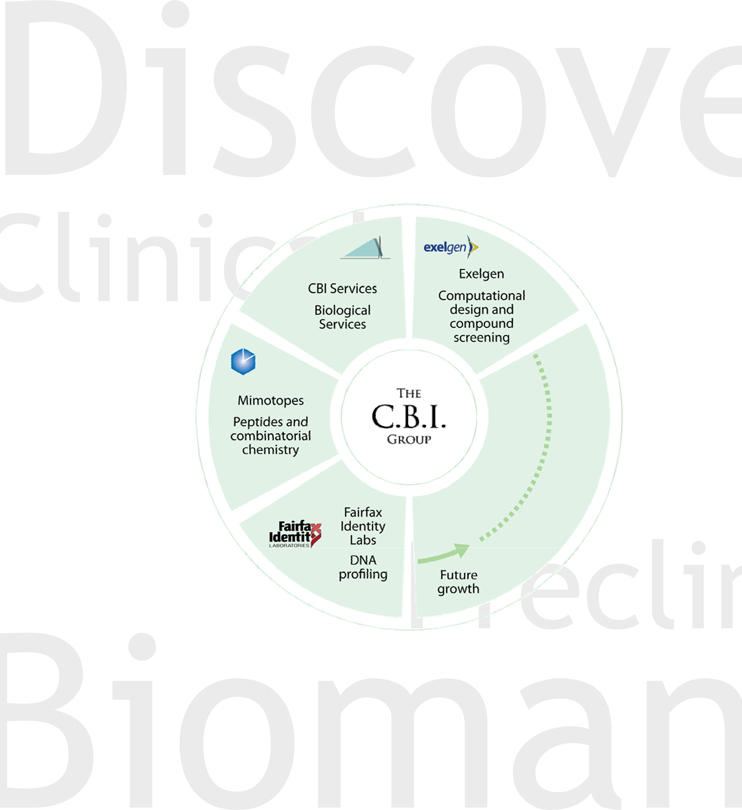

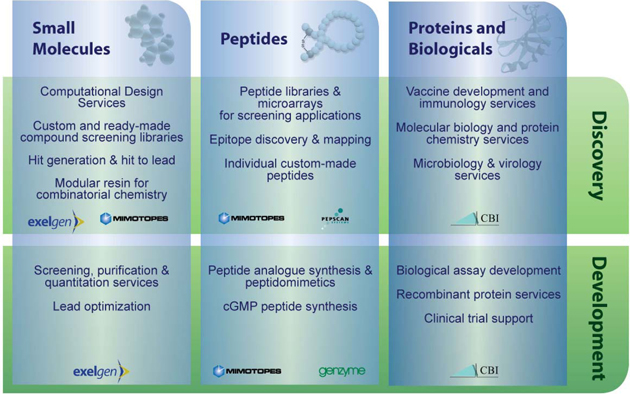

The CBI Group provides sophisticated research and development support services to the global biotechnology and pharmaceutical markets. Since 2004, CBI has pursued a strategy of acquiring or merging with complementary companies that extend its technological capabilities and that have strong growth potential. This strategy has significant cost and strategic benefits through economies of scale, access to new markets and the potential to win a broader range of business from existing customers. CBI now operates 4 complimentary business units: (1) CBI Services, a discovery phase contract research organization, (2) FIL, a DNA reference business, (3) Mimotopes, a peptide and discovery chemistry business, and (4) Exelgen, a medicinal and synthetic discovery chemistry business.

Revenues from all four business units are derived principally from providing drug discovery and analytical services to the biotechnology and pharmaceutical industries, government and academic institutions. The market for drug discovery outsourcing was estimated to be US$4.1 billion in 2005 and expected to grow at 20% to reach US$7.2 billion in 2009 (Kalorama, 2006). CBI is well positioned to compete in this growing market with an experienced and business-focused management team and over 100 highly trained staff located in three world-class laboratories in Richmond (VA), Melbourne (Australia) and Bude (UK) and additionally sales offices located in the USA, UK, and Asia-Pacific region. All scientific and marketing staff are trained chemists, biochemists or biologists, many of whom have published papers in peer-reviewed journals. The time difference between sites means that CBI now operates 24 hours, 6 days a week across its three primary research sites. Strong links to preferred suppliers in Asia also means that the customers can access the best mix of fast, secure, high quality, and innovative research services at globally competitive prices.

Each business unit has its own distinct capabilities and market focus, although significant overlap exists between the customer bases.

5

Commonwealth Biotechnologies, Inc.

CBI Services, Exelgen and Mimotopes all cater for the outsourcing requirements of pharmaceutical and biotechnology companies for reagents (such as small molecules, peptides and antibodies) as well as drug research and development. Many large biotechnology companies have synthesis capabilities in-house but choose to outsource much of their custom synthesis work to providers such as Mimotopes and Exelgen. Likewise, pharmaceutical companies, with significant in-house regulatory capabilities but no technical capabilities, outsource components of their development program to contract research organizations such as CBI Services.

CBI businesses have a strong reputation for world-leading expertise in drug development and discovery and an innovative and collaborative culture. Across the Group, CBI companies have technical capabilities and proprietary technology platforms that differentiate them from other providers. For example Mimotopes patented SynPhase Technology provides it with a competitive advantage to rapidly, efficiently and cost-effectively produce large libraries of research grade peptides. Exelgens proprietary computational design and therapeutic medicinal chemistry tools and expertise are able to significantly reduce their clients drug discovery timelines. FIL provides DNA identity information at accuracies ten times greater than the average DNA testing laboratory and is accredited by all major US authorities. CBI Services state-of-the-art laboratories, bio-defense facility, government security clearance and accreditations provide the company with access to contracts not appropriate for most contract research organizations.

The experience of CBIs staff coupled with its patented technology platforms and advanced laboratory facilities position the Company well for partnering with research institutions and discovery companies in drug development. CBI companies have developed strategic alliances with key life science companies including Invitrogen, Genzyme, Thermo Fisher, GSK, Elan, Abbott and Schering Plough. Mimotopes partnership with Genzyme Pharmaceuticals (cGMP peptides) has created a brand that provides a total suite of peptide products and act as an integrated one-stop-shop for peptide customers. CBI is looking to adopt a similar partnering model with small molecule and biological cGMP manufacturers.

All CBI companies have an excellent customer service reputation. Sales and business development staff employ their technical know-how by way of a consultative/collaborative selling strategy and routinely assist clients with the design of their projects and synthesis of their products. In 2007, CBI companies boasted seven out of the top ten global Pharmaceutical companies as clients. The reorganization of the CBI Groups global Sales and Marketing team in 2007 created an integrated service offering that provides cross selling opportunities across the CBI business units for clients based anywhere in the world.

6

Commonwealth Biotechnologies, Inc.

Results of Operations

Year Ended December 31, 2007 Compared with Year Ended December 31, 2006.

Revenues

During the course of the year, the Company had experienced fluctuations in all revenue categories. Continuation of existing projects or engagement for future projects is usually dependent upon the customers satisfaction with the scientific results provided in initial phases of the scientific program. Continuation of existing projects or engagement of future projects also often depends upon factors beyond the Companys control, such as the timing of product development and commercialization programs of the Companys customers. The combined impact of commencement and termination of research contracts from several large customers and unpredictable fluctuations in revenue for laboratory services can result in very large fluctuations in financial performance.

Total revenues increased by $5,889,711 or 90.2% from $6,532,482 during 2006 to $12,422,193 during 2007. Total revenues associated with the acquired companies (Mimotopes and Exelgen) represented $6,941,858 of this increase. Due to a decrease in government contracts, revenues from CBI Services and FIL decreased by $1,052,148 or 16.1% from $6,532,482 during 2006 to $5,480,334 in 2007.

Revenues realized from commercial contracts increased by $6,270,761 or 467.6%, from $1,340,996 during 2006 to $7,611,757 during 2007. Revenues for CBI Services amounted to $2,121,034 in 2007 as compared to $1,340,996 in 2006, an increase of $780,038 or 58.2%. Revenues for Mimotopes and Exelgen amounted to $3,253,818 and $2,236,905, respectively: comprising $5,490,723 of the increase in commercial contract revenue.

Revenues realized from various government contracts decreased by $1,513,350 or 49.9%, from $3,031,713 during 2006 to $1,518,363 during 2007. This decrease was primarily due to budget revisions of existing proposals which have pushed back the start dates of new contract work and to re-allocation of existing budget funds away from bio-defense into other areas. Expected start dates for three of the contracts are expected to begin in early April 2008.

Genetic identity decreased by $132,140 or 8.6%, from $1,542,129 during 2006 to $1,409,989 during 2007. This decrease is a result in the delay in one of the contracts that was expected to begin during the third quarter in 2007 and did not begin until the first quarter of 2008.

Product sales in 2007 amounted to $851,247. All product sales were from Exelgen. Sales from this category were from existing inventories are hand. There were no sales in 2006 for the Company.

Clinical testing decreased by $180,514 or 31.1%, from $580,279 during 2006 to $399,765 during 2007. The decrease was a result of one of the Companys clients down sizing of forensic contract work and the elimination of a one time non-renewable project.

7

Commonwealth Biotechnologies, Inc.

Cost of Services

Cost of services consists primarily of materials, labor and overhead. The cost of services increased by $5,186,434 or 95.4%, from $5,438,706 during 2006 to $10,625,140 during 2007. The cost of services as a percentage of revenue was 85.5% and 83.3% during 2007 and 2006, respectively. CBI Services and Fairfax Identity Labs cost of services amounted to $4,565,680 in 2007 compared to $5,438,706 in 2006. In 2007, Mimotopes and Exelgen costs of services were $2,882,584 and $3,176,876, respectively.

Total direct labor increased by $1,515,084, or 86.3% from $1,754,664 during 2006 to $3,269,748 during 2007. CBI Services and Fairfax Identity Labs direct labor amounted to $1,367,254 during 2007 as compared to $1,754,664 during the 2006 Period. This decrease in CBI Services and Fairfax Identity Labs is primarily due to lower contract revenue in 2007 in some of the government projects. In 2007 Mimotopes and Exelgen direct labor was $844,101 and $1,058,393, respectively resulting in $1,902,494 in additional cost of direct labor.

Total costs for direct materials increased by $1,249,351, or 111.1%, from $1,124,846 during 2006, to $2,374,197 during 2007. CBI Services and Fairfax Identity Labs direct materials amounted to $974,175 during the 2007 Period as compared to $1,124,846 during the 2006 Period. This decrease in CBI Services and Fairfax Identity Labs is primarily due to lower contract revenue in 2007 in some of the government projects. In 2007, Mimotopes and Exelgen direct materials were $1,035,663 and $364,359, respectively.

Overhead cost consists of indirect labor, depreciation, freight charges, repairs and miscellaneous supplies not directly related to a particular project. Total overhead costs increased by $2,421,999 or 94.6%, from $2,559,196 during 2006 to $4,981,195 during 2007. CBI Services and Fairfax Identity Labs overhead amounted to $2,224,251 during 2007 as compared to $2,559,196 during the 2006 Period. This decrease is primarily due to the costs associated with the acquisition of Fairfax Identity Labs being fully amortized. In 2007 Mimotopes and Exelgen overhead costs was $1,002,821 and $1,754,124, respectively.

Sales, General and Administrative

Sales, general and administrative expenses (SGA) consist primarily of compensation and related costs for administrative, marketing and sales personnel, facility expenditures, professional fees, consulting, taxes, and depreciation. Total SGA costs increased by $2,558,460 or 124.6%, from $2,053,176 during 2006 to $4,611,636 during 2007. As a percentage of revenue, these costs were 37.3% and 31.4% during 2007 and 2006, respectively.

Total compensation and benefits increased by $1,476,477 or 261.2% from $564,096 during 2006 to $2,040,873 during 2007. This increase is primarily attributable to the acquisition of Mimotopes and Exelgen and the addition of their support staff. This increase is also attributable to the accrual for the restricted stock compensation package for senior management, as well as accrual for the issuance of incentive stock options that are now expensed by the Company. Stock option expenses increased by $92,563 or 147% from $62,796 in 2006 to $155,359 in 2007. Facility expenses increased by $119,738 or 162.8% from $73,542 during 2006 to $193,280 during 2007. Additional costs in utilities, telephones and internet services contributed to this increase. Professional fees increased by $448,919 or 161.7% from $277,706 during 2006 to $726,625 during 2007. This increase is primarily due to compliance costs associated with the Sarbanes-Oxley Act which is effective for the year ended December 31, 2007 and consulting costs related to the current year acquisitions.

8

Commonwealth Biotechnologies, Inc.

Sales and Marketing costs increased by $540,603 or 71.9% from $752,187 during 2006 to $1,292,790 during the 2007 Period. In 2007, with the acquisition of Mimotopes and Exelgen, the Company organized a sales department consisting of employees from all operations. In 2006, the Company did not have a sales unit.

Other Income (Expenses)

Other income during 2007 compared to 2006 decreased by $4,990 or 4.8% from $104,624 during 2006 to $99,634 during 2007. Interest expense increased by $436,116 or 146.4% from $297,873 during 2006 to $733,989 during 2007. The 2007 Period amount includes interest expense paid by Exelgen in the amount of $320,727. Interest expense for CBI Services and Fairfax Identity Labs amounted to $314,791 during the 2007 Period and $297,873 during the 2006 Period.

Extraordinary Gain from the Purchase of Exelgen

The purchase price for the acquisition of Exelgen was $1,474,581. The Company acquired assets of approximately $8,249,000 and assumed liabilities of approximately $5,991,000 resulting in negative goodwill of $782,833. This amount is recorded as an extraordinary gain on the Consolidated Statement of Operations.

Liquidity and Capital Resources

Recent operating losses may continue into future periods and there can be no assurance by management that the Companys financial outlook will improve. For the years ended December 31, 2007, and 2006, operating losses were $2,758,101 and $1,152,649, respectively. The Company generated negative cash flows from operations in 2007 of $867,728, however in 2006 generated positive cash flows from operations of $77,074. Net working capital as of December 31, 2007 and 2006 was $1,378,707 and $2,210,894, respectively.

If operational results do not improve in 2008, the Company has the opportunity of obtaining additional funding from Venturepharm Laboratories Limited, (see footnote 14). The Company has the option to obtain a $1 million put from CBI to VPL. In addition, the Company has a $3 million call option from VPL to CBI.

As of December 31, 2007, the Company had $2,533,910 in cash and cash equivalents, this resulted in a 81.8% increase over the cash balance at December 31, 2006. This increase was the result of completing the convertible debt transaction between the Company and LH Financial. Of the total cash balance at December 31, 2007, approximately $1,725,000 represented proceeds from the LH Financial.

Accounts receivables in December 2007 were approximately $2,895,000. The Company anticipates collection of these funds during the first quarter in 2008. The increase in receivables was primarily a result of higher sales in the fourth quarter of 2007.

Overall

Cash used by operating activities in 2007 was $867,728 as compared to cash provided by operations of $77,074 during 2006. The net decrease was primarily the result of the operating loss sustained during the period offset by increased accounts payable and other current liabilities of $2,631,627. With the acquisition of Exelgen in June 2007, the Company experienced a delay in contract revenues and incurred additional operational expenses contributing to the loss in 2007. Depreciation and amortization of $893,050, a decrease in prepaid expenses and inventory of $900,846 also offset the decrease. The extraordinary gain from the purchase of Exelgen in the amount of $782,833 and an increase in accounts receivable of $200,764 contributed to the increase in cash used by operating activities. Cash provided by investing activities in 2007 was $2,211,069, as compared to cash used in investing activities of $493,938 during 2006. This increase was primarily related to the net cash received in the acquisition of Exelgen in 2007. Net cash used in financing activities in 2007 amounted to $508,849 as compared to $489,895 during 2006. The cash received from LH Financial convertible debt was offset by debt repayments and an increase in restricted cash resulting in the financing use of cash for 2007. Cash used for financing activities in 2006 primarily consisted of debt payments.

Convertible Debt

On December 31, 2007 the Company issued $1,950,000 of convertible debt in a subscription agreement between the Company and LH Financial. The debt carries an interest rate of 10% annually and matures in June 2009. The Company plans to convert the quarterly interest payments into shares of common stock at a conversion price of $2.00 per shares. In conjunction with the debt, the Company also issued Class A warrants to purchase 975,000 shares of common stock at an exercise price of $2.85 per share and expire in May 2013. The fair value of the Class A warrants is $1.79 per share. The fair value of the Class A warrants is calculated using the Black-Scholes method. Assumptions for Class A options include the stock asset price at $2.55 and a stock option price of $2.85 with a maturity date of 5 years and risk free interest rate of 3.4%. The Company also issued Class B warrants to purchase 243,000 shares of common stock at an exercise price of $5.00 per share. The fair value of the Class B warrants is $.36 per share. The fair value of the Class B warrants is calculated using the Black-Scholes method. The debt carries a beneficial conversion feature and as a result a debt discount of approximately $1,950,000 was recorded and offset in additional paid in capital. This discount will be amortized as interest expense over the life of the debt.

Capital Leases

The Company leases equipment under non-cancelable capitalized leases. Total lease payments for the year ended December 31, 2007 amounted to $2,560,563. Future minimum lease payments in 2008 are approximately $2,101,899. All leases are collateralized by equipment and mature within the next eighteen months.

As mentioned above, the Company has the ability to obtain additional funding from Venturepharm Laboratories Limited, (see footnote 14), that would provide the Company up to a $1 million within sixty days of signing and a $3 million call option. With this additional financing, the Company will have the ability to meet all future lease payments in 2008.

Additional Capital Resources

In the event the Company does not opt for additional funding, management will continue to take necessary steps to improve the cash flow and liquidity of the Company. In December 2007, the Company reduced personnel levels, curtailed research and development costs, reduced marketing expenditures, deferred directors fees and a portion of employees salaries. The company has also reduced or delayed expenditures on items that are not critical to operations.

The Companys business has undergone substantial change over the last twelve months in relation to size, scale and scope of activities. During this time, the Company has developed significant capacity in peptide chemistry and medicinal chemistry through the acquisitions of Mimotopes and Exelgen. These strategic transactions compliment the core capabilities in genomics and proteomics at CBI Services and FIL. The Company is currently reviewing the consolidation of the activities of each operation. As such, the Company in December 2007 implemented a Profit Recovery Plan, which identifies clear and immediate objectives related to the following:

1. Strengthening of cash position to protect solvency through cost reduction efforts

2. Maximizing revenue contracts in pharmaceutical and governmental sectors

3. Monitoring monthly operations against budget projections

9

Commonwealth Biotechnologies, Inc.

New Accounting Pronouncements

In July 2006, the FASB issued FASB Interpretation No. 48 (FIN 48), Accounting for Uncertainty in Income Taxesan interpretation of FASB Statement 109, which provides guidance on the measurement, recognition, and disclosure of tax positions taken or expected to be taken in a tax return. The interpretation also provides guidance on de-recognition, classification, interest and penalties, and disclosure. FIN 48 prescribes that a tax position should only be recognized if it is more-likely-than-not that the position will be sustained upon examination by the appropriate taxing authority. A tax position that meets this threshold is measured as the largest amount of benefit that is more likely than not (greater than 50 percent) realized upon ultimate settlement. The cumulative effect of applying FIN 48 is to be reported as an adjustment to the beginning balance of retained earnings in the period of adoption. FIN 48 is effective for fiscal years beginning after December 15, 2006. The adoption of this standard did not have an impact on the Companys financial condition or results of operations.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements. This Statement defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. SFAS No. 157 applies to other accounting pronouncements that require or permit fair value measurements, the Board having previously concluded in those accounting pronouncements that fair value is the relevant measurement attribute. The Statement does not require any new fair value measurements and was initially effective for the Company beginning January 1, 2008. In February 2008, the FASB approved the issuance of FASB Staff Position (FSP) FAS 157-2. FSP FAS 157-2 defers the effective date of SFAS No. 157 until January 1, 2009 for nonfinancial assets and nonfinancial liabilities except those items recognized or disclosed at fair value on an annual or more frequently recurring basis. Management has not completed its review of the new guidance; however, the effect of the Statements implementation is not expected to be material to the Companys results of operations or financial position.

In December 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No. 141(R), Business Combinations, to further enhance the accounting and financial reporting related to business combinations. SFAS No. 141(R) establishes principles and requirements for how the acquirer in a business combination (1) recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any non controlling interest in the acquiree, (2) recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase, and (3) determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination. SFAS No. 141(R) applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. Therefore, the effects of the Companys adoption of SFAS No. 141(R) will depend upon the extent and magnitude of acquisitions after December 31, 2008.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements an amendment of ARB No. 51, to create accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS No. 160 establishes accounting and reporting standards that require (1) the ownership interest in subsidiaries held by parties other than the parent to be clearly identified and presented in the consolidated balance sheet within equity, but separate from the parents equity, (2) the amount of consolidated net income attributable to the parent and the noncontrolling interest to be clearly identified and presented on the face of the consolidated statement of income, (3) changes in a parents ownership interest while the parent retains its controlling financial interest in its subsidiary to be accounted for consistently, (4) when a subsidiary is deconsolidated, any retained noncontrolling equity investment in the former subsidiary to be initially measured at fair value, and (5) entities to provide sufficient disclosures that clearly identify and distinguish between the interests of the parent and the interests of the noncontrolling owners. SFAS No. 160 applies to fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008, and prohibits early adoption. Management has not completed its review of the new guidance; however, the effect of the Statements implementation is not expected to be material to the Companys results of operations or financial position.

10

Commonwealth Biotechnologies, Inc.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities. This Statement permits entities to choose to measure eligible items at fair value at specified election dates. For items for which the fair value option has been elected, unrealized gains and losses are to be reported in earnings at each subsequent reporting date. The fair value option is irrevocable unless a new election date occurs, may be applied instrument by instrument, with a few exceptions, and applies only to entire instruments and not to portions of instruments. SFAS No. 159 provides an opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting. SFAS No. 159 is effective for the Company beginning January 1, 2008. Management has not completed its review of the new guidance; however, the effect of the Statements implementation is not expected to be material to the Companys results of operations or financial position.

In March 19, 2008, the FASB issued FASB Statement No. 161, Disclosures about Derivative Instruments and Hedging Activities - an Amendment of FASB Statement 133. Statement 161 enhances required disclosures regarding derivatives and hedging activities, including enhanced disclosures regarding how: (a) an entity uses derivative instruments; (b) derivative instruments and related hedged items are accounted for under FASB Statement No. 133, Accounting for Derivative Instruments and Hedging Activities; and (c) derivative instruments and related hedged items affect an entitys financial position, financial performance, and cash flows. Specifically, Statement 161 requires:

| | Disclosure of the objectives for using derivative instruments is disclosed in terms of underlying risk and accounting designation; |

| | Disclosure of the fair values of derivative instruments and their gains and losses in a tabular format; |

| | Disclosure of information about credit-risk-related contingent features; and |

| | Cross-reference from the derivative footnote to other footnotes in which derivative-related information is disclosed. |

Critical Accounting Policies

A summary of the Companys critical accounting policies follows:

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of asset and liabilities and disclosure of contingent asset and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Revenue Recognition: The Company recognizes revenue upon the completion of laboratory service projects, or upon the delivery and acceptance of biologically relevant materials that have been synthesized in accordance with project terms. Laboratory service projects are generally administered under fee for service contracts. Any revenues from research and development arrangements, including corporate contracts and research grants, are recognized pursuant to the terms of the related agreements as work is performed, or scientific milestones, if any are achieved. Amounts received in advance of the performance of services or acceptance of a milestone, are recorded as deferred revenue.

11

Commonwealth Biotechnologies, Inc.

Accounts receivable: Accounts receivable are carried at original invoice amount less an estimate for doubtful receivables based on a review of all outstanding amounts on a monthly basis. Management determines the allowance for doubtful accounts by regularly evaluating individual customer receivables and considering a customers financial condition, credit history, and current economic conditions. Accounts receivable are written off when deemed uncollectible. Recoveries of accounts receivable previously written off are recorded as revenue when received.

CBI has met the SEC and NASDAQ Corporate Governance Rules.

As a consequence of the Sarbanes-Oxley Act, the NASDAQ imposed certain changes in the rules of corporate governance which are aimed at strengthening its listing standards. The Securities and Exchange Commission (SEC) approved the rules imposed by NASDAQ which include:

| | Independent Directors. CBIs Board is composed of four independent and three employee directors. |

| | The Independent Directors serve on the three principal committees: Audit, Compensation and Nominations. |

| | The Independent Directors meet in executive session at each quarterly Board meeting. |

| | At least one independent director, Mr. Samuel P. Sears, who serves on the Audit Committee, meets all of the requirements as defined by the SEC for being a financial expert. |

| | The Audit Committee reviews and approves all related-party transactions. CBI has adopted a formal Corporate Code of Conduct. Copies are available on request from Dr. Richard Freer Chief Operating Officer and on the Companys website at www.cbi-biotech.com. |

Forward Looking Statements

Management has included herein certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used, statements that are not historical in nature, including the words anticipated, estimate, should, expect, believe, intend, and similar expressions are intended to identify forward-looking statements. Such statements are, by their nature, subject to certain risks and uncertainties.

Among the factors that could cause the actual results to differ materially from those projected are the following:

| | business conditions and the general economy, |

| | the development and implementation of the Companys long-term business goals, |

| | federal, state, and local regulatory environment, |

12

Commonwealth Biotechnologies, Inc.

| | lack of demand for the Companys services, |

| | the ability of the Companys customers to perform services similar to those offered by the Company in-house, |

| | potential cost containment by the Companys customers resulting in fewer research and development projects, |

| | the Companys ability to receive accreditation to provide various services, including, but not limited to paternity testing, and |

| | the Companys ability to hire and retain highly skilled employees, |

Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are detailed from time to time in reports filed by the company with the Securities and Exchange Commission, including Forms 8-K, 10-QSB, and 10-KSB.

13

|

|

BDO Seidman, LLP Accountants and Consultants |

300 Arboretum Place Suite 520 Richmond, VA 23236 Telephone (804) 330-3092 Fax (804) 330-7753 |

Report of Independent Registered Public Accounting Firm

Board of Directors and Stockholders

Commonwealth Biotechnologies

Richmond, Virginia

We have audited the accompanying balance sheets of Commonwealth Biotechnologies, Inc. as of December 31, 2007 and 2006 and the related statements of operations, stockholders equity, and cash flows for the years then ended. These financial statements are the responsibility of the Companys management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Companys internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Commonwealth Biotechnologies, Inc. at December 31, 2007 and 2006, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

BDO Seidman, LLP

Richmond, Virginia

April 8, 2008

14

Commonwealth Biotechnologies, Inc.

Consolidated Balance Sheets

| December 31, | ||||||

| 2007 | 2006 | |||||

| Assets | ||||||

| Current assets | ||||||

| Cash and cash equivalents (Note 6) |

$ | 2,533,910 | $ | 1,404,370 | ||

| Accounts receivable, net of allowance for doubtful accounts of approximately $ 176,000 and $55,000 |

2,894,513 | 962,049 | ||||

| Inventory (Note 2) |

2,164,464 | 44,343 | ||||

| Prepaid expenses and other assets |

647,398 | 387,099 | ||||

| Total current assets |

8,240,285 | 2,797,861 | ||||

| Property and equipment, net (Note 1 and 3) | 7,516,715 | 5,612,145 | ||||

| Other assets | ||||||

| Restricted Cash (Note 6) |

735,143 | 500,000 | ||||

| Deferred financing fees |

297,678 | 65,285 | ||||

| Intangible assets, net |

| 36,667 | ||||

| Deposits |

4,500 | | ||||

| Goodwill (Note 9) |

3,243,731 | 490,000 | ||||

| Total other assets |

4,281,052 | 1,091,952 | ||||

| $ | 20,038,052 | $ | 9,501,958 | |||

See accompanying summary of accounting policies and notes to financial statements.

15

Commonwealth Biotechnologies, Inc.

Consolidated Balance Sheets

(continued)

| December 31, | ||||||||

| 2007 | 2006 | |||||||

| Liabilities and Stockholders Equity | ||||||||

| Current liabilities | ||||||||

| Current maturities of long-term debt (Note 3) |

$ | 2,656,571 | $ | 228,545 | ||||

| Accounts payable |

2,137,053 | 307,884 | ||||||

| Other current liabilities |

1,192,160 | | ||||||

| Accrued payroll liabilities |

337,314 | 18,922 | ||||||

| Interest payable |

18,858 | 16,689 | ||||||

| Deferred revenue |

519,622 | 14,927 | ||||||

| Total current liabilities |

6,861,578 | 586,967 | ||||||

| Long-term debt, less current maturities (Note 3) |

3,243,525 | 3,786,069 | ||||||

| Total liabilities |

10,105,103 | 4,373,036 | ||||||

| Commitments and contingencies (Notes 3 and 4) |

||||||||

| Stockholders equity | ||||||||

| Preferred stock, no par value 1,000,000 shares authorized none issued and outstanding (Note 11) |

| | ||||||

| Common stock, no par value, 100,000,000 shares authorized, 2007 5,520,545; 2006 3,322,769, shares issued and outstanding (Note 11) |

| | ||||||

| Additional paid-in capital |

$ | 22,595,023 | $ | 15,823,614 | ||||

| Restricted stock |

(200,667 | ) | (301,000 | ) | ||||

| Other comprehensive income (loss) |

682,282 | (8,104 | ) | |||||

| Accumulated deficit |

(13,143,689 | ) | (10,385,588 | ) | ||||

| Total stockholders equity |

9,932,949 | 5,128,922 | ||||||

| $ | 20,038,052 | $ | 9,501,958 | |||||

See accompanying summary of accounting policies and notes to financial statements.

16

Commonwealth Biotechnologies, Inc.

Consolidated Statements of Operations

| Years Ended December 31, | ||||||||

| 2007 | 2006 | |||||||

| Revenues | ||||||||

| Commercial contracts |

$ | 7,611,757 | $ | 1,340,996 | ||||

| Government contracts |

1,518,363 | 3,031,713 | ||||||

| Genetic identity |

1,409,989 | 1,542,129 | ||||||

| Product sales |

851,247 | | ||||||

| Clinical services |

399,765 | 580,279 | ||||||

| Other revenue |

631,072 | 37,365 | ||||||

| Total revenues |

12,422,193 | 6,532,482 | ||||||

| Cost of services | ||||||||

| Overhead |

4,981,195 | 2,559,196 | ||||||

| Direct labor |

3,269,748 | 1,754,664 | ||||||

| Direct materials |

2,374,197 | 1,124,846 | ||||||

| Total cost of services |

10,625,140 | 5,438,706 | ||||||

| Gross profit |

1,797,053 | 1,093,776 | ||||||

| Selling, general and administrative | 4,611,636 | 2,053,176 | ||||||

| Operating loss |

(2,814,583 | ) | (959,400 | ) | ||||

| Other income (expense) | ||||||||

| Exchange gains (losses) |

(91,996 | ) | | |||||

| Interest expense |

(733,989 | ) | (297,873 | ) | ||||

| Other income |

99,634 | 104,624 | ||||||

| Total other (expense) |

(726,351 | ) | (193,249 | ) | ||||

| Loss before extraordinary gain |

(3,540,934 | ) | (1,152,649 | ) | ||||

| Extraordinary gain (Note 10) |

782,833 | | ||||||

| Net loss |

$ | (2,758,101 | ) | $ | (1,152,649 | ) | ||

| Basic and diluted loss per common share before extraordinary gain |

$ | (0.69 | ) | $ | (0.35 | ) | ||

| Basic and diluted loss per common share after extraordinary gain |

$ | (0.54 | ) | $ | (0.35 | ) | ||

See accompanying summary of accounting policies and notes to financial statements.

17

Commonwealth Biotechnologies, Inc.

Consolidated Statements of Stockholders Equity

|

Number Of Common Shares Outstanding |

Additional Paid-in Capital |

Restricted Stock |

Other Comprehensive (income)/loss |

Accumulated Deficit |

Total | ||||||||||||||||

| Balance, January 1, 2006 | 3,253,556 | $ | 15,489,370 | $ | (191,556 | ) | $ | (48,275 | ) | $ | (9,232,939 | ) | $ | 6,016,600 | |||||||

| Stock options exercised |

16,585 | 22,834 | | | | 22,834 | |||||||||||||||

| Restricted stock |

52,628 | 248,614 | (109,444 | ) | | | 139,170 | ||||||||||||||

| Stock option expense |

| 62,796 | | | | 62,796 | |||||||||||||||

| Net loss |

| | | | (1,152,649 | ) | (1,152,649 | ) | |||||||||||||

| Change in unrealized gain (loss) on interest rate swap |

| | | 40,171 | | 40,171 | |||||||||||||||

| Total comprehensive loss |

| | | | | (1,112,478 | ) | ||||||||||||||

| Balance, December 31, 2006 | 3,322,769 | 15,823,614 | (301,000 | ) | (8,104 | ) | (10,385,588 | ) | 5,128,922 | ||||||||||||

| Issuance of common stock in Mimotopes |

2,150,000 | 4,622,550 | | | | 4,622,550 | |||||||||||||||

| Issuance of common stock |

4,998 | 23,892 | | | | 23,892 | |||||||||||||||

| Stock options exercised |

42,778 | 43,549 | | | | 43,549 | |||||||||||||||

| Relative fair value of warrants and beneficial conversion impact on convertible securities |

| 1,950,000 | | | | 1,950,000 | |||||||||||||||

| Restricted stock |

| | 100,333 | | | 100,333 | |||||||||||||||

| Stock option expense |

| 131,418 | | | | 131,418 | |||||||||||||||

| Net loss |

| | | | (2,758,101 | ) | (2,758,101 | ) | |||||||||||||

| Change in unrealized gain (loss) on interest rate swap |

| | | 8,104 | | 8,104 | |||||||||||||||

| Foreign currency gain |

| | | 682,282 | | 682,282 | |||||||||||||||

| Total comprehensive loss |

| | | | | (2,067,715 | ) | ||||||||||||||

| Balance, December 31, 2007 | 5,520,545 | $ | 22,595,023 | $ | (200,667 | ) | $ | 682,282 | $ | (13,143,689 | ) | $ | 9,932,949 | ||||||||

See accompanying summary of accounting policies and notes to financial statements.

18

Commonwealth Biotechnologies, Inc.

Consolidated Statements of Cash Flows

| Year Ended December 31, | ||||||||

| 2007 | 2006 | |||||||

| Operating activities | ||||||||

| Net loss |

$ | (2,758,101 | ) | $ | (1,152,649 | ) | ||

| Adjustments to reconcile net loss to cash provided by (used in) operating activities |

||||||||

| Depreciation and amortization |

893,050 | 899,891 | ||||||

| Extraordinary gain |

(782,833 | ) | | |||||

| Stock based compensation |

155,359 | 101,634 | ||||||

| Changes in assets and liabilities |

||||||||

| Accounts receivable |

(203,783 | ) | 380,243 | |||||

| Prepaid expenses and inventory |

(900,846 | ) | (51,281 | ) | ||||

| Accounts payable and accrued expenses |

2,631,627 | (57,788 | ) | |||||

| Deposits |

(4,500 | ) | | |||||

| Deferred revenue |

102,299 | (42,976 | ) | |||||

| Cash provided by (used in) operating activities |

(867,728 | ) | 77,074 | |||||

| Investing activities | ||||||||

| Purchase of Mimotopes |

(451,044 | ) | (257,235 | ) | ||||

| Purchase of Exelgen |

2,809,679 | | ||||||

| Purchases of property and equipment |

(147,566 | ) | (236,703 | ) | ||||

| Cash provided by (used in) investing activities |

2,211,069 | (493,938 | ) | |||||

| Financing activities | ||||||||

| Principal payments of debt obligations, FIL |

| (300,000 | ) | |||||

| Principal payments on debt obligations, including capital lease obligations |

(1,892,296 | ) | (212,729 | ) | ||||

| Increase in deferred financing fees |

(254,783 | ) | | |||||

| Increase in restricted cash |

(355,319 | ) | | |||||

| Proceeds from exercise of stock options |

43,549 | 22,834 | ||||||

| Proceeds from issuance of convertible debt |

1,950,000 | | ||||||

| Cash used in financing activities |

(508,849 | ) | (489,895 | ) | ||||

| Effect of exchange rates on cash |

295,048 | | ||||||

| Net increase (decrease) in cash and cash equivalents | 1,129,540 | (906,759 | ) | |||||

| Cash and cash equivalents, beginning of year | 1,404,370 | 2,311,129 | ||||||

| Cash and cash equivalents, end of year | $ | 2,533,910 | $ | 1,404,370 | ||||

| Supplemental Disclosure of Cash Flow Information | ||||||||

| Cash payments for interest |

$ | 726,350 | $ | 297,873 | ||||

| Non cash investing and financing activities: purchase of equipment through a capitalized lease |

$ | 26,535 | | |||||

| Fair value of stock issued in Mimotopes acquisition |

$ | 4,622,000 | | |||||

See accompanying summary of accounting policies and notes to financial statements.

19

Commonwealth Biotechnologies, Inc.

Summary of Significant Accounting Policies

Nature of Business

Commonwealth Biotechnologies, Inc., (the Company or CBI), was formed on September 30, 1992, for the purpose of providing specialized analytical laboratory services for the life scientist. The Company matured, it re-focused its core business activities and now provides integrated contract research support in four principal areas; bio-defense; laboratory support services for on-going clinical trials; comprehensive contract projects in the private sector; and through it Fairfax Identity Labs (FIL) division, for paternity testing, forensic case-work analysis and Convicted Offender Data Base Index System CODIS work. During 2007, the Company acquired Mimotopes Pty, Ltd. which has developed a number of proprietary and patented technologies and is an industry leader in the synthesis of research grade peptides. Exelgen, formally known as Tripos Discovery Research Ltd was acquired June 2007 and is a leading drug discovery services business that provides pharmaceutical and biotechnology companies with novel approaches to drug discovery.

Consolidation Policy

The consolidated financial statements include the accounts of Commonwealth Biotechnologies, Inc. and its wholly owned subsidiaries Mimotopes Pty, Ltd, Australia and Exelgen, England. All inter-company accounts and transactions have been eliminated in consolidation.

Estimates

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent asset and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Revenue Recognition

The Company recognizes revenue upon the completion of laboratory service projects, or upon the delivery of biologically relevant materials that have been synthesized in accordance with project terms. Laboratory service projects are generally administered under fee-for-service contracts or purchase orders. Any revenues from research and development arrangements, including corporate contracts and research grants, are recognized pursuant to the terms of the related agreements as work is performed, or as scientific milestones, if any, are achieved. Product sales are recognized when shipped. Amounts received in advance of the performance of services or acceptance of a milestone, are recorded as deferred revenue and recognized when completed.

Foreign Currency Translation

The Companys consolidated financial statements are reported in U.S. dollars. Assets and liabilities of foreign subsidiaries are translated using rates of exchange as of the balance sheet date, and related revenues and expenses are translated at average rates of exchange in effect during the period. Cumulative translation adjustments have been recorded as a separate component within other comprehensive income (loss) of stockholders equity. Realized gains and losses from foreign currency translations are included in other income (expense).

20

Commonwealth Biotechnologies, Inc.

Long-Lived Assets

Long-lived assets, such as property, plant, and equipment, are evaluated for impairment when events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable through the estimated undiscounted future cash flows from the use of those assets. When any such impairment exists, the related assets will be written down to fair value. No impairment losses have been recorded through December 31, 2007.

Cash and Cash Equivalents

The Company considers all highly liquid debt instruments purchased with an original maturity of three months or less to be cash equivalents. At times, the Company maintains cash balances in excess of FDIC insured amounts. The excess over the FDIC amount was approximately $2,450,000 and $1,800,000 at December 31, 2007 and 2006, respectively.

Accounts Receivable

The majority of our accounts receivable are due from trade customers. Credit is extended based on evaluation of our customers financial condition and collateral is not required. Accounts receivable payment terms vary and are stated in the financial statements at amounts due from customers net of an allowance for doubtful accounts. Accounts outstanding longer than the payment terms are considered past due. We determine our allowance by considering a number of factors, including the length of time trade accounts receivable are past due, our previous loss history, customers current ability to pay their obligations to us, and the condition of the general economy and the industry as a whole. We write off accounts receivable when they become uncollectible, and payments subsequently received on such receivables are credited to the allowance for doubtful accounts.

Inventory

Inventories consists of raw materials, work-in-process and finished goods and are stated at the lower of FIFO cost (first-in, first-out method) or market. The Company reviews its recorded inventory periodically and estimates on allowance for obsolete, excess, or slow moving items as necessary.

Property and Equipment

Property and equipment are recorded at cost. Depreciation is computed principally by the straight-line method over their estimated useful lives providing depreciation and amortization for financial reporting purposes. The cost of repairs and maintenance is expensed as incurred. The estimated useful lives of the assets are as follows:

| Years | ||

| Buildings |

39.5 | |

| Laboratory and computer equipment |

3 - 10 | |

| Furniture and fixtures and office equipment |

7 |

21

Commonwealth Biotechnologies, Inc.

Assets under capital lease obligations are recorded at the lesser of the present value of the minimum lease payments or the fair market value of the leased asset, at inception of the lease.

Intangible Assets

Intangible assets consist of a covenant not to compete, commercial contracts, listing of draw sites, listing of providers to assist in paternity testing and other related intangibles acquired in the purchase of Fairfax Identity Labs which are being amortized over 2 to 3 years. Amounts are fully amortized at December 31, 2007.

Deferred Financing Fees

Loan costs are being amortized on a straight-line basis, which approximates the interest method, over the expected term of the related obligations.

Goodwill

Goodwill, which represents the excess of purchase price over fair value of net assets acquired, is evaluated at least annually for impairment by comparing its fair value with its recorded amount and is written down when appropriate. Projected net operating cash flows are compared to the carrying amount of the goodwill recorded and if the estimated net operating cash flows are less than the carrying amount, a loss is recognized to reduce the carrying amount to fair value. Goodwill as of December 31, 2007 and December 31, 2006 is a result of the acquisition by the Company of Mimotopes during 2007 and Fairfax Identity Labs during 2004. There was no impairment of goodwill at December 31, 2007 or December 31, 2006.

Income Taxes

Deferred taxes are provided on the asset and liability method whereby deferred tax assets are recognized for deductible temporary differences and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Income (Loss) Per Common Share

Basic income (loss) per share has been computed on the basis of the weighted-average number of common shares outstanding. Common shares which can be issued upon exercise of stock options and warrants have not been included in the computation for the years December 31, 2007 and 2006 because their inclusion would have been anti-dilutive. Weighted average shares outstanding for basic and diluted loss per common share were 5,135,951 and 3,281,360 for the years ended December 31, 2007 and 2006, respectively.

22

Commonwealth Biotechnologies, Inc.

Employee Stock Plans

The Company adopted a Stock Incentive Plan on June 24, 1997. The Plan provides for granting to employees, officers, directors, consultants and certain other non-employees of the Company options to purchase shares of common stock. A maximum of 410,000 shares of common stock may be issued pursuant to the Plan. Of the maximum number of shares to be issued under the Plan, 270,000 have been reserved for incentive awards to be granted to the founders of the Company, and 140,000 are reserved for incentive awards to be granted to others.

A 2000 Stock Incentive Plan was adopted by the Board of Directors and approved by the shareholders. The Plan makes up to 300,000 shares of common stock available for grants of restricted stock awards and stock options in the form of incentive stock options and non-qualified options to employees, directors and consultants of the Company.

A 2002 Stock Incentive Plan was adopted by the Board of Directors and approved by the shareholders. The Plan makes up to 600,000 shares of common stock available for grants of restricted stock awards and stock options in the form of incentive stock options and non-qualified options to employees, directors and consultants of the Company.

A 2007 Stock Incentive Plan was adopted by the Board of Directors and approved by the shareholders. The Plan makes up to 1,000,000 shares of common stock available for grants of restricted stock awards and stock options in the form of incentive stock options and non-qualified options to employees, directors and consultants of the Company.

Incentive awards may be in the form of stock options, restricted stock, incentive stock or tax offset rights. In the case of incentive stock options (within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended), the exercise price will not be less than 100% of the fair market value of shares covered at the time of the grant, or 110% for incentive stock options granted to persons who own more than 10% of the Companys voting stock. Options granted under the Plans generally vest over a five-year period from the date of grant and are exercisable for ten years, except that the term may not exceed five years for incentive stock options granted to persons who own more than 10% of the Companys outstanding common stock.

Stock Based Compensation Plans

Beginning January 1, 2006, the Company adopted SFAS 123R, which recognizes share-based compensation expense for stock option grants. Prior to 2006, the Company applied Accounting Principles Bulletin (APB) Opinion 25, Accounting for Stock Issued to Employees, and related Interpretations to account for employee stock compensation plans, and accordingly did not recognize compensation expense for stock options granted when the option price is greater than or equal to the underlying stock price at the date of grant.

23

Commonwealth Biotechnologies, Inc.

Fair Value of Financial Instruments

The Company has determined, based on available market information and appropriate valuation methodologies, that the fair value of its financial instruments approximates carrying value. The carrying amounts of cash and cash equivalents, accounts receivable and accounts payable approximate fair value due to the short-term maturity of the instruments. The carrying amount of debt approximates fair value because of the short term maturities or the interest rates under the credit agreements are predominantly variable, based on current market conditions.

Derivative Instruments and Hedging Activities

The Company uses interest rate swap agreements to manage variable interest rate exposure on the majority of its long-term debt. The Companys objective for holding these derivatives is to decrease the volatility of future cash flows associated with interest payments on its variable rate debt. The Company does not issue derivative instruments for trading purposes. For derivatives designated as cash flow hedges, the effective portion of changes in the fair value of the derivative is initially reported in other comprehensive income or loss on the consolidated balance sheets and subsequently reclassified to interest expense when the hedged exposure affects income (i.e. as interest expense accrues on the related outstanding debt). Differences between the amounts paid and amounts received under the swap agreements are recognized in interest expense.

Changes in the ineffective portion of the fair value of the derivative are accounted for through interest expense. The notional principal value of the Companys swap agreement outstanding as of December 31, 2007 is equal to the outstanding principal balance of the corresponding debt instrument.

New Accounting Pronouncements

In July 2006, the FASB issued FASB Interpretation No. 48 (FIN 48), Accounting for Uncertainty in Income Taxesan interpretation of FASB Statement 109, which provides guidance on the measurement, recognition, and disclosure of tax positions taken or expected to be taken in a tax return. The interpretation also provides guidance on de-recognition, classification, interest and penalties, and disclosure. FIN 48 prescribes that a tax position should only be recognized if it is more-likely-than-not that the position will be sustained upon examination by the appropriate taxing authority. A tax position that meets this threshold is measured as the largest amount of benefit that is more likely than not (greater than 50 percent) realized upon ultimate settlement. The cumulative effect of applying FIN 48 is to be reported as an adjustment to the beginning balance of retained earnings in the period of adoption. FIN 48 is effective for fiscal years beginning after December 15, 2006. The adoption of this standard did not have an impact on the Companys financial condition or results of operations.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements. This Statement defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. SFAS No. 157 applies to other accounting pronouncements that require or permit fair value measurements, the Board having previously concluded in those accounting pronouncements that fair value is the relevant measurement attribute. The Statement does not require any new fair value measurements and was initially effective for the Company beginning January 1, 2008. In February 2008, the FASB approved the issuance of FASB Staff Position (FSP) FAS 157-2. FSP FAS 157-2 defers the effective date of SFAS No. 157 until January 1, 2009

24

Commonwealth Biotechnologies, Inc.

for nonfinancial assets and nonfinancial liabilities except those items recognized or disclosed at fair value on an annual or more frequently recurring basis. Management has not completed its review of the new guidance; however, the effect of the Statements implementation is not expected to be material to the Companys results of operations or financial position.

In December 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No. 141(R), Business Combinations, to further enhance the accounting and financial reporting related to business combinations. SFAS No. 141(R) establishes principles and requirements for how the acquirer in a business combination (1) recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any non controlling interest in the acquire, (2) recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase, and (3) determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination. SFAS No. 141(R) applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. Therefore, the effects of the Companys adoption of SFAS No. 141(R) will depend upon the extent and magnitude of acquisitions after December 31, 2008.

In December 2007, the FASB issued SFAS No. 160, No controlling Interests in Consolidated Financial Statements an amendment of ARB No. 51, to create accounting and reporting standards for the no controlling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS No. 160 establishes accounting and reporting standards that require (1) the ownership interest in subsidiaries held by parties other than the parent to be clearly identified and presented in the consolidated balance sheet within equity, but separate from the parents equity, (2) the amount of consolidated net income attributable to the parent and the no controlling interest to be clearly identified and presented on the face of the consolidated statement of income, (3) changes in a parents ownership interest while the parent retains its controlling financial interest in its subsidiary to be accounted for consistently, (4) when a subsidiary is deconsolidated, any retained noncontrolling equity investment in the former subsidiary to be initially measured at fair value, and (5) entities to provide sufficient disclosures that clearly identify and distinguish between the interests of the parent and the interests of the noncontrolling owners. SFAS No. 160 applies to fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008, and prohibits early adoption. Management has not completed its review of the new guidance; however, the effect of the Statements implementation is not expected to be material to the Companys results of operations or financial position.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities. This Statement permits entities to choose to measure eligible items at fair value at specified election dates. For items for which the fair value option has been elected, unrealized gains and losses are to be reported in earnings at each subsequent reporting date. The fair value option is irrevocable unless a new election date occurs, may be applied instrument by instrument, with a few exceptions, and applies only to entire instruments and not to portions of instruments. SFAS No. 159 provides an opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting. SFAS No. 159 is effective for the Company beginning January 1, 2008. Management has not completed its review of the new guidance; however, the effect of the Statements implementation is not expected to be material to the Companys results of operations or financial position.

25

Commonwealth Biotechnologies, Inc.

In March, 2008, the FASB issued FASB Statement No. 161, Disclosures about Derivative Instruments and Hedging Activities-an Amendment of FASB Statement 133. Statement 161 enhances required disclosures regarding derivatives and hedging activities, including enhanced disclosures regarding how: (a) an entity uses derivative instruments; (b) derivative instruments and related hedged items are accounted for under FASB Statement No. 133, Accounting for Derivative Instruments and Hedging Activities; and (c) derivative instruments and related hedged items affect an entitys financial position, financial performance, and cash flows. Specifically, Statement 161 requires:

| | Disclosure of the objectives for using derivative instruments be disclosed in terms of underlying risk and accounting designation; |

| | Disclosure of the fair values of derivative instruments and their gains and losses in a tabular format; |

| | Disclosure of information about credit-risk-related contingent features; and |

| | Cross-reference from the derivative footnote to other footnotes in which derivative-related information is disclosed. |

26

Commonwealth Biotechnologies, Inc.

Notes to Consolidated Financial Statements

1. Property and Equipment

Property and equipment consisted of the following:

| December 31, | ||||||

| 2007 | 2006 | |||||

| Land |

$ | 404,269 | $ | 403,919 | ||

| Building |

6,722,042 | 5,206,637 | ||||

| Laboratory equipment |

5,865,599 | 5,136,424 | ||||

| Furniture, fixtures and office and computer equipment |

1,129,673 | 663,123 | ||||

| 14,121,583 | 11,410,103 | |||||

| Less accumulated depreciation and amortization |

6,604,868 | 5,797,958 | ||||

| $ | 7,516,715 | $ | 5,612,145 | |||

Depreciation expense was $828,676 and $595,289 for the years ended December 31, 2007 and 2006, respectively. The increase in property plant and equipment resulted primarily from the acquisitions of Mimotopes and Exelgen. One of our buildings is subject to a land lease. Lease payments associated with this land lease amounted to $96,732 in 2007.

2. Inventory

Inventory consisted of the following:

| December 31, | ||||||

| 2007 | 2006 | |||||

| Raw materials |

$ | 1,794,320 | $ | | ||

| Work in process |

136,608 | | ||||

| Finished Goods |

233,536 | 44,343 | ||||

| $ | 2,164,464 | $ | 44,343 | |||

27

Commonwealth Biotechnologies, Inc.

Notes to Consolidated Financial Statements

(continued)

3. Long-Term Debt

Long-term debt consists of:

| December 31, | ||||||

| 2007 | 2006 | |||||

| Mortgage payable to BB&T due in monthly installments of approximately $36,000 with an interest rate of 8.75% as of December 31, 2007. The loan will mature in November 2009 and is collateralized by the corporate offices and laboratory facilities located in Richmond, Virginia, as well as all assets of the Company. The Company also entered into a interest rate agreement essentially locking the interest rate paid by the Company to 7.975%. | $ | 3,634,362 | $ | 3,740,890 | ||

| In January 2005, the Company entered into a capitalized leasing agreement with Technology Leasing Concepts for two pieces of laboratory equipment. The monthly principal and interest payments are $11,378 with an interest rate of 7.5%. Both leases are for a forty-eight month period. | 147,686 | 273,724 | ||||

| In February 2007, the Company entered into a thirty-six month capitalized leasing agreement with Technology Leasing Concepts for several pieces of computer equipment. The monthly principal and interest payments are $898. | 20,188 | | ||||

| Capitalized lease agreement with Bank of America which matures in April 2008. The lease is collateralized by laboratory equipment located in Bude, Cornwall England. The quarterly principal and interest payments are approximately $218,000 with an interest rate of 6.91%. | 419,611 | | ||||

| Capitalized lease agreement with Lombard North Central which matures in December 2008. The lease is collateralized by laboratory equipment located in Bude, Cornwall England. The quarterly principal and interest payments are approximately $298,000 with an interest rate of 7.41%. | 1,088,133 | | ||||